BMW 2013 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

18 COMBINED MANAGEMENT REPORT

18

General Information on the

BMW

Group

18 Business Model

20 Management System

23 Research and Development

24 Report on Economic Position

24

Overall Assessment by Management

24 General and Sector-specific

Environment

27

Financial and Non-financial

Performance Indicators

29 Review of Operations

47 Results of Operations, Financial

Position and Net Assets

62 Events after the End of the

Reporting Period

63 Report on Outlook, Risks and

Opportunities

63 Outlook

68 Risks Report

77 Report on Opportunities

81 Internal Control System and Risk

Management System Relevant for

the

Consolidated Financial Reporting Process

82 Disclosures Relevant for Takeovers

and Explanatory Comments

85

BMW Stock and Capital Markets

Overall assessment by management

The BMW Group’s performance in 2013 was positive

overall and fully in line with our expectations. Good

progress was made in terms of results of operations,

financial position and net assets. This statement also

takes into account events after the end of the reporting

period.

General and sector-specific environment

General economic environment

After the downturn in the two preceding years, the

global economy stabilised over the course of 2013,

ending

with a moderate growth rate of approximately

2.4 %. Once again, the USA and China were the main-

stays of growth during the period under report. After

s

ix consecutive quarters of recession, the eurozone

finally managed to register its first minor positive

growth rates in the second half of 2013. Surprisingly

strong upturns in Japan and the United Kingdom

helped to stabilise the world economy. By contrast,

growth

in some of the major emerging economies,

such as India, Brazil and Russia, slowed significantly.

Speculation that the US Reserve Bank is likely to put a

brake on its expansionary monetary policy caused inter-

est rate expectations to rise on the world’s capital mar-

kets. As a consequence, some international investors

withdrew capital from emerging economies, reduced

in-

vestments in commodities and reallocated funds, pri-

marily in stock markets in the USA, Europe and Japan.

Practically all emerging economies registered

drops in

growth rates, sometimes significant, as a result.

High sovereign debt levels again exerted an influence

on economic developments, particularly in Europe. The

eurozone’s economy contracted overall by 0.4 % in 2013.

With the exception of Germany, where the growth rate

edged up to 0.4 %, economic growth remained weak in

the remainder of the region. France’s gross domestic

product (GDP) practically stagnated at a rate of 0.2 %,

while Italy (– 1.8 %) and Spain (– 1.3 %) both suffered an-

other year of recession. Whereas positive data coming

from Spain towards the end of 2013 suggest the re-

cessionary phase may be coming to an end, the eco-

nomic position in Italy and France remained tense to

the end.

The UK economy – Europe’s largest outside the euro-

zone which had been flat in the

previous year – re-

ported an upturn of 1.9 % in 2013, partly benefiting

from support for the property market in the form of

monetary and fiscal policies.

The economy in the USA grew surprisingly well in 2013,

registering a growth rate of 1.9 %. This positive

perfor-

mance was attributable entirely to the private sector,

with consumer spending and investments up again,

thanks to sharp improvements in the employment and

property markets. The public sector, by contrast, had

a negative impact on growth, owing firstly to further

spending consolidation and secondly to political dis-

agreement regarding the federal budget and debt ceiling.

Japan’s new government managed to keep the country

out of renewed recession by employing heavily

expan-

sionary monetary and fiscal policies, culminating in GDP

growth of 1.7 % for the full year 2013.

Despite a small decline in the growth rate, which stood

at 7.7 % in 2013, China nevertheless asserted its role

as the most dynamic of the world’s major economies.

Other emerging economies grew considerably more

slowly than expected. India’s growth rate of 4.7 % was

only about one half of the long-term prediction. Brazil

(2.3 %) and Russia (1.5 %) also fell well short of the growth

rates recorded one year earlier.

Report on Economic Position

Overall Assessment by Management

General and Sector-specific Environment

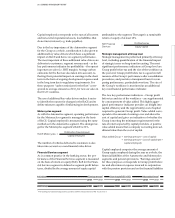

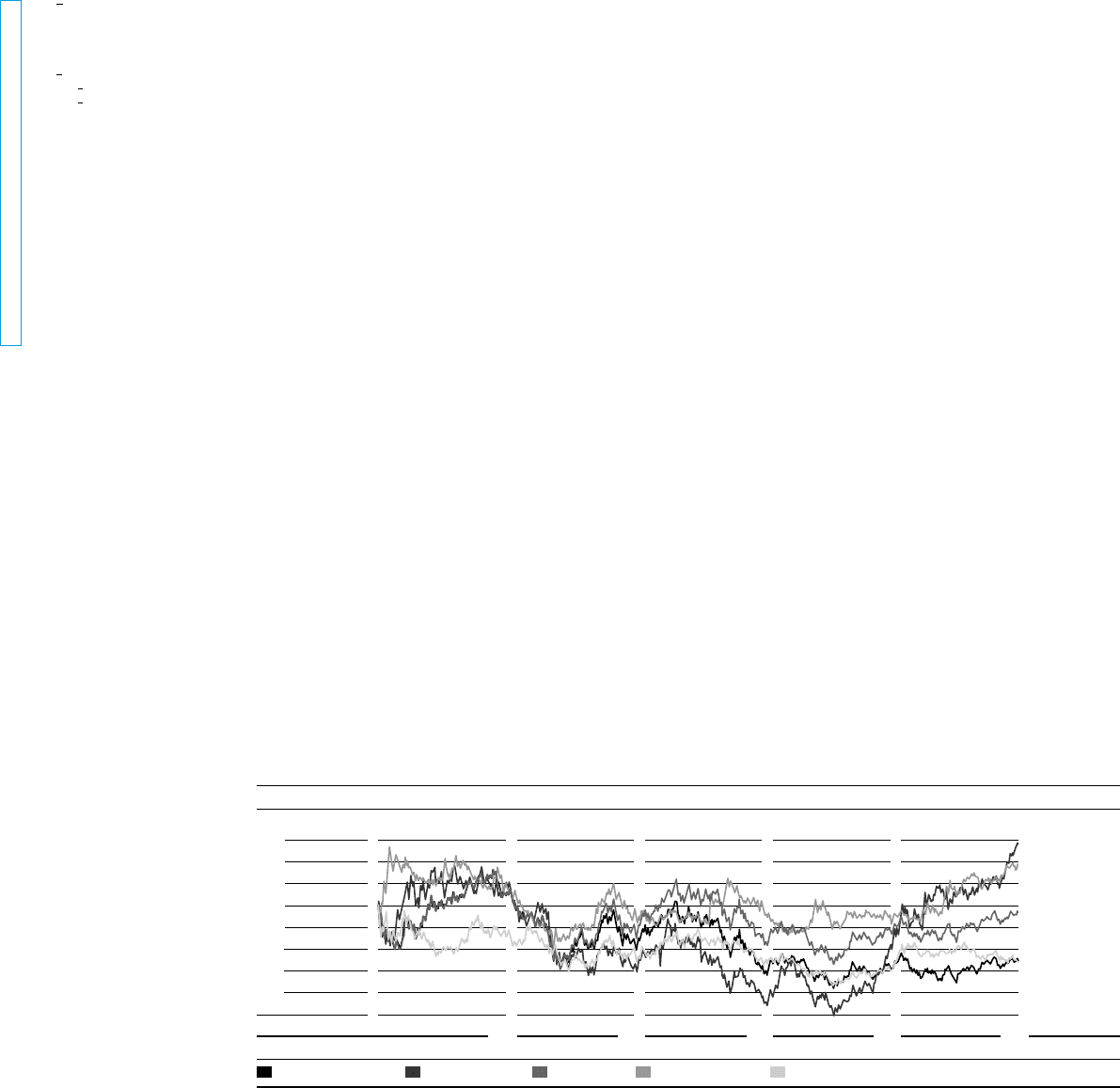

Exchange rates compared to the euro

(Index: 31 December 2008 = 100)

120

115

110

105

100

95

90

85

09 10 11 12 13

Source: Reuters.

British Pound

Russian Rouble

Chinese

Renminbi

Japanese Yen

US Dollar

Japanese Yen Russian RoubleUS DollarChinese Renminbi British Pound