BMW 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53 COMBINED MANAGEMENT REPORT

were highly sought after by private and institutional

investors.

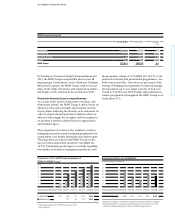

During 2013 the BMW Group issued five euro bench-

mark bonds with a total issue volume of € 4 billion

on European capital markets. Bonds were also issued

in Canadian dollars, British pounds, US dollars, Aus-

tralian dollars and other currencies for a total amount

of € 5.1 billion.

Ten ABS transactions were executed in 2013, including

two public transactions in the USA and one each in

Germany, Switzerland and South Korea with a total

volume equivalent to € 2.5 billion. Further funds were

also raised via new ABS conduit transactions in Japan,

Canada, Australia and South Africa totalling € 1.7 billion.

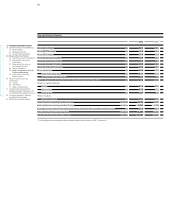

The regular issue of commercial paper also strengthens

the BMW Group’s financial basis. The following table

provides an overview of existing money and capital mar-

ket

programmes of the BMW Group at 31 December

2013:

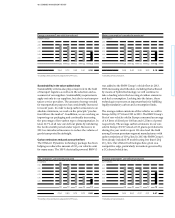

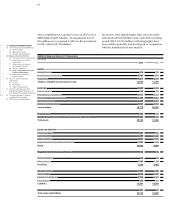

The increase in non-current assets on the assets side of

the balance sheet related primarily to property, plant

and equipment (13.3 %), leased products (5.9 %), intangible

assets (18.7 %) and receivables from sales financing

(1.0 %). At the same time, deferred tax assets decreased

by 17.6 %.

Within current assets, increases were registered in par-

ticular for financial assets (20.5 %), receivables from

sales financing (4.3 %) and other assets (16.4 %). By con-

trast, decreases were recorded for inventories (1.4 %),

cash and cash equivalents (8.4 %) and trade receivables

(3.7 %).

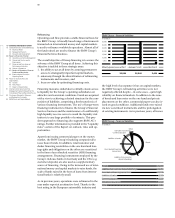

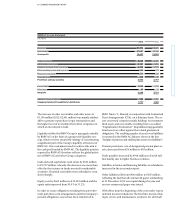

Property, plant and equipment increased by € 1,772 mil-

lion compared to the previous year. The main focus in

2013 was on product investments for production start-

ups (including the BMW 2 Series) and infrastructure im-

provements. In total, € 4,470 million was invested, most

of which related to the Automotive segment. Depreciation

on property, plant and equipment totalled € 2,492 mil-

lion (2012: € 2,298 million). At 31 December 2013, prop-

erty, plant and equipment accounted for 10.9 % of total

assets (2012: 10.1 %). Adjusted for exchange rate factors,

property, plant and equipment increased by 14.5 %. Capi-

tal

commitments for the acquisition of items of property,

plant and equipment totalled € 2,661 million at the end

of the reporting period.

At € 6,179 million, the carrying amount of intangible

assets was € 972 million higher than at 31 December

2012. Within intangible assets, capitalised development

costs rose by € 675 million. Investments in capitalised

development costs totalled € 1,744 million in the year

under report and were thus significantly up on the pre-

vious year’s figure (€ 1,089 million). Intangible assets

also include the acquisition of licences amounting to

€ 379 million, which are being amortised on a straight-

line basis over a period of six years. The proportion

of development costs recognised as assets was 36.4 %

(2012: 27.6 %). Adjusted for exchange rate factors, in-

tangible assets increased by 18.8 %. In total, € 2,217 mil-

lion was invested, most of which related to the Auto-

motive segment.

The BMW Group’s liquidity position is extremely robust,

with liquid funds totalling € 10.7 billion on hand at 31 De-

cember 2013. The BMW Group also has access to a syndi-

cated

credit line of € 6 billion, with a term up to October

2018. This credit line, which is being provided on attrac-

tive conditions by a consortium of 38 international banks,

was not utilised at the end of the reporting period.

Further information with respect to financial liabilities

is provided in notes 34 and 38 to the Group Financial

Statements.

Net assets position*

The Group balance sheet total increased by € 6,533 mil-

lion (+5.0 %) to stand at € 138,368 million at 31 Decem-

ber 2013. Adjusted for exchange rate factors, the bal-

ance sheet total increased by 8.8 %.

Programme Amount utilised

Euro Medium Term Notes €27.6 billion

Commercial paper €6.3 billion

* Prior year figures have been adjusted in accordance with the revised version of

IAS 19, see note 7.