BMW 2013 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

164

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

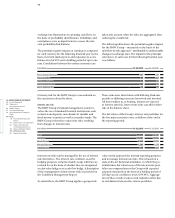

in € million 2013 2012*

Reconciliation of segment result

Total for reportable segments 8,539 9,172

Financial result of Automotive segment and Motorcycles segment – 99 – 432

Elimination of inter-segment items – 527 – 937

Group profit before tax 7,913 7,803

Reconciliation of capital expenditure on non-current assets

Total for reportable segments 24,204 21,438

Elimination of inter-segment items – 4,325 – 2,901

Total Group capital expenditure on non-current assets 19,879 18,537

Reconciliation of depreciation and amortisation on non-current assets

Total for reportable segments 10,741 9,618

Elimination of inter-segment items – 3,787 – 1,838

Total Group depreciation and amortisation on non-current assets 6,954 7,780

in € million 31. 12. 2013 31. 12 . 2 0 12*

Reconciliation of segment assets

Total for reportable segments 73,410 69,714

Non-operating assets – Other Entities segment 5,989 6,065

Operating liabilities – Financial Services segment 83,923 81,064

Interest-bearing assets – Automotive and Motorcycles segments 37,364 36,321

Liabilities of Automotive and Motorcycles segments not subject to interest 24,411 21,943

Elimination of inter-segment items – 86,729 – 83,272

Total Group assets 138,368 131,835

* Prior year figures have been adjusted in accordance with the revised version of IAS 19, see note 7.

The segment result of the Motorcycles segment in the

previous year was negatively impacted by an impair-

ment loss of € 13 million on property, plant and equip-

ment in accordance with IFRS 5 and by an expense of

€ 57 million for an allocation to provisions at 31 Decem-

ber 2012.

Interest and similar income of the Financial Services

segment is included in segment result and totalled

€ 5 million (2012*: € 1 million). Interest and similar

ex-

penses of the Financial Services segment amounted

to

€ 7 million (2012*: € 5 million). Financial Services

segment result was negatively impacted by impair-

ment losses totalling € 139 million recognised on

leased products.

The Other Entities segment result includes interest

and

similar income amounting to € 1,340 million (2012*:

€ 1,542 million) and interest and similar expenses

amounting to € 1,279 million (2012*: € 1,499 million). As

in the previous year, the result from equity accounted

investments did not have any impact on the segment

result of the Other Entities segment. The segment result

is stated after an impairment loss on other investments

amounting to € 7 million (2012: € 7 million).

As in the previous year, segment assets of the Other

Entities segment do not contain any investments ac-

counted

for using the equity method.

The information disclosed for capital expenditure and

depreciation and amortisation relates to non-current

property, plant and equipment, intangible assets and

leased products.

Segment figures can be reconciled to the corresponding

Group figures as follows: