BMW 2013 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

150

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

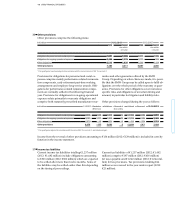

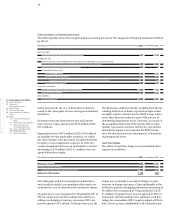

Fair value measurement of financial instruments

The fair values shown are computed using market in-

formation

available at the balance sheet date, on the

basis of prices quoted by the contract partners or using

appropriate measurement methods, e. g. discounted cash

flow models. In the latter case, amounts were discounted

at 31 December 2013 on the basis of the following

in-

terest rates:

Interest rates taken from interest rate curves were ad-

justed,

where necessary, to take account of the credit

quality and risk of the underlying financial instrument.

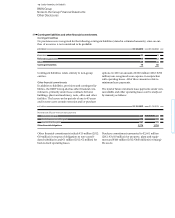

Derivative financial instruments are measured at their

fair value. The fair values of derivative financial instru-

ments

are determined using measurement models, as

a consequence of which there is a risk that the amounts

calculated could differ from realisable market prices on

disposal. Observable financial market price spreads

are taken into account in the measurement of derivative

financial instruments. The methodology for collating

data used in the fair values computation model was re-

fined during the second quarter of 2013, particularly

with respect to the way interest rate curves are employed

and the use of additional market data (tenor and cur-

rency basis spreads), thus helping to minimise differ-

ences between the carrying amounts of the instruments

and the amounts that can be realised on the financial

markets on their disposal. In addition, the Group’s own

default risk and that of counterparties is taken into

account in the form of credit default swap (CDS) con-

tracts

which have matching terms and which can be

observed on the market.

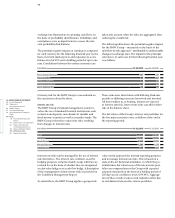

Financial instruments measured at fair value are allo-

cated to different measurement levels in accordance with

IFRS 13. This includes financial instruments that are

1.

measured at their fair values in an active market for

identical financial instruments (Level 1),

2. measured at their fair values in an active market for

comparable financial instruments or using measure-

ment models whose main input factors are based on

observable market data (Level 2) or

3. using input factors not based on observable market

data (Level 3).

The following table shows the amounts allocated to

each measurement level at the end of the reporting

period:

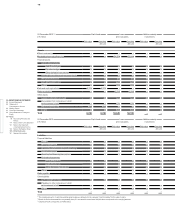

31 December 2013 Level hierarchy in accordance with IFRS 13

in € million Level 1 Level 2 Level 3

Marketable securities, investment fund shares and collateral assets – available-for-sale 3,134 – –

Other investments – available-for-sale 379 – –

Derivative instruments (assets)

Cash flow hedges – 1,914 –

Fair value hedges – 1,050 –

Other derivative instruments – 1,049 –

Derivative instruments (liabilities)

Cash flow hedges – 317 –

Fair value hedges – 321 –

Other derivative instruments – 465 –

ISO Code EUR USD GBP JPY CNY

in %

Interest rate for six months 0.28 0.26 0.54 0.20 5.66

Interest rate for one year 0.40 0.31 0.71 0.21 5.80

Interest rate for five years 1.27 1.77 2.17 0.40 5.80

Interest rate for ten years 2.22 3.17 3.09 0.95 5.86