BMW 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

18 COMBINED MANAGEMENT REPORT

18

General Information on the BMW Group

18 Business Model

20 Management System

23 Research and Development

24 Report on Economic Position

24 Overall Assessment by Management

24 General and Sector-specific

Environment

27

Financial and Non-financial

Performance Indicators

29 Review of Operations

47 Results of Operations, Financial

Position and Net Assets

62 Events after the End of the

Reporting Period

63 Report on Outlook, Risks and

Opportunities

63 Outlook

68 Risks Report

77 Report on Opportunities

81 Internal Control System and Risk

Management System Relevant for

the

Consolidated Financial Reporting Process

82 Disclosures Relevant for Takeovers

and Explanatory Comments

85

BMW Stock and Capital Markets

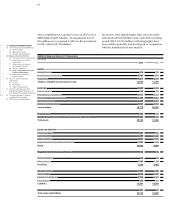

exchange rate factors, both non-current financial liabili-

ties and current financial liabilities increased by 4.4 %.

Overall, the earnings performance, financial position

and net assets position of the BMW Group continued to

develop very positively during the financial year under

report.

Compensation report

The compensation of the Board of Management com-

prises both a fixed and a variable component. Benefits

are also payable – primarily in the form of pension

benefits – at the end of members’ mandates. Further

details, including an analysis of remuneration by each

individual, are disclosed in the Compensation Report,

which can be found in the section “Statement on Cor-

porate Governance”. The Compensation Report is a sub-

section of the Combined Management Report.

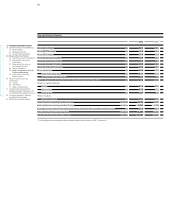

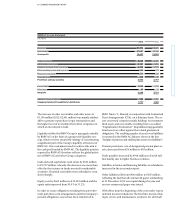

Value added statement*

The value added statement shows the value of work

performed less the value of work bought in by the BMW

Group during the financial year. Depreciation and

amortisation, cost of materials and other expenses are

treated as bought-in costs in the value added calcula-

tion. The allocation statement applies value added to

each of the participants involved in the value added

process. It should be noted that the gross value added

amount treats depreciation as a component of value

added which, in the allocation statement, is treated as

internal financing.

Net valued added by the BMW Group in 2013 increased

by 1.3 % to € 19,215 million and was once again at a high

level.

The bulk of the net value added (46.8 %) is applied to

employees. The proportion applied to providers of finance

fell to 9.3 %, mainly due to the lower refinancing costs

on international capital markets for the financial services

side of the business. The government / public sector (in-

cluding deferred tax expense) accounted for 16.1 %. The

proportion of net value added applied to shareholders,

at 8.9 %, was higher than in the previous year. Minority

interests take a 0.1 % share of net value added. The

re-

maining portion of net value added (18.8%) will be

re-

tained in the Group to finance future operations.

* Prior year figures have been adjusted in accordance with the revised version of

IAS 19, see note 7.