BMW 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

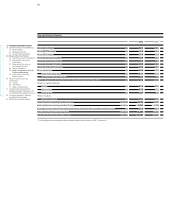

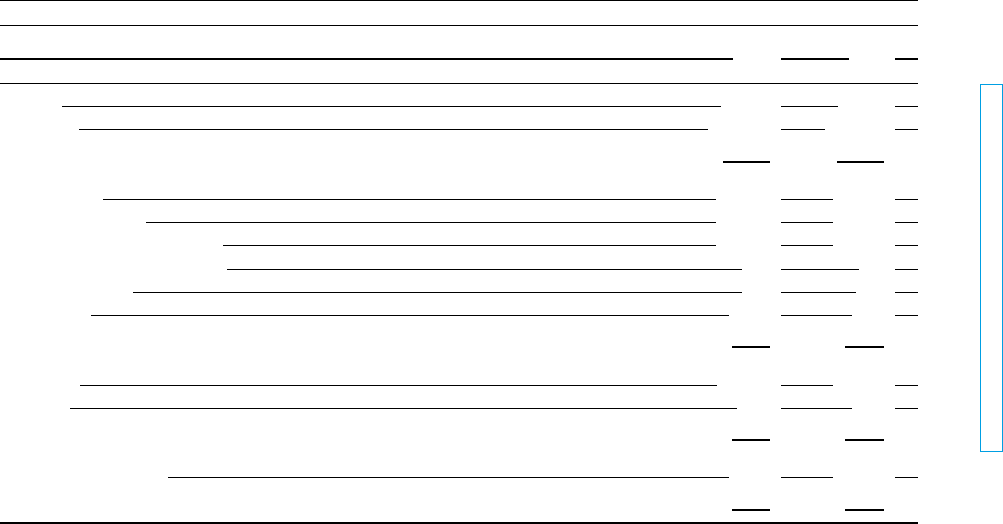

61 COMBINED MANAGEMENT REPORT

BMW AG Income Statement

in € million

2013 2012

Revenues 60,474 58,805

Cost of sales – 47,067 – 46,252

Gross profit 13,407 12,553

Selling expenses – 3,528 – 3,684

Administrative expenses – 2,141 – 1,701

Research and development expenses – 4,362 – 3,573

Other operating income and expenses 542 703

Result on investments 373 598

Financial result – 328 – 99

Profit from ordinary activities 3,963 4,797

Income taxes – 1,629 – 1,635

Other taxes – 45 – 31

Net profit 2,289 3,131

Transfer to revenue reserves – 582 – 1,491

Unappropriated profit available for distribution 1,707 1,640

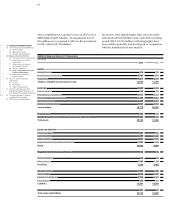

The increase of other receivables and other assets to

€ 3,194 million (2012: € 2,061 million) was mainly attribut-

able

to genuine repurchase (repo) transactions and

the higher level of receivables from other companies in

which an investment is held.

Liquidity within the BMW Group is managed centrally

by BMW AG on the

basis of a group-wide liquidity con-

cept, which revolves around the strategy of concentrating

a significant part of the Group’s liquidity at the level of

BMW AG. One instrument used to achieve this aim is

the cash pool headed by BMW AG. The liquidity position

reported by BMW AG therefore reflects the global activi-

ties of BMW AG and other Group companies.

Cash and cash equivalents went down by € 861 million

to € 3,757 million, whereby the decrease was more than

offset by the increase in funds invested in marketable

securities. Financial receivables from subsidiaries went

down sharply.

Equity rose by € 665 million to € 10,529 million and the

equity ratio improved from 30.9 % to 31.2 %.

In order to secure obligations resulting from pre-retire-

ment part-time work arrangements and the Company’s

pension obligations, assets have been transferred to

BMW Trust e. V., Munich, in conjunction with Contractual

Trust Arrangements (CTA), on a fiduciary basis. The as-

sets concerned comprise mainly holdings in investment

fund assets and a receivable resulting from a so-called

“Capitalisation Transaction” (Kapitalisierungsgeschäft).

Fund assets are offset against the related guaranteed

obligations. The resulting surplus of assets over liabilities

is reported in the BMW AG balance sheet on the line

“Surplus of pension and similar plan assets over liabilities”.

Pension provisions, net of designated pension plan as-

sets, decreased

from € 56 million to € 43 million.

Trade payables increased by € 918 million to € 4,818 mil-

lion mainly due to higher business volumes.

Liabilities to banks and financing liabilities to subsidiaries

increased in the year under report.

Other liabilities fell from € 800 million to € 285 million,

reflecting the fact that all commercial paper outstanding

at 31 December 2012 was repaid during the year and

no new commercial paper was issued .

With effect from the beginning of the year under report,

deferred income includes for the first time income relat-

ing to service and maintenance contracts, for which all