BMW 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

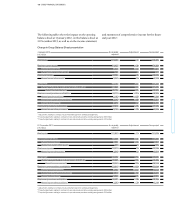

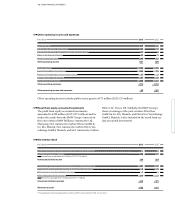

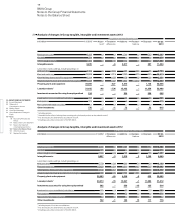

in € million 2 013 2012*

Current tax expense 2,435 2,908

Deferred tax expense / income 138 – 216

Income taxes 2,573 2,692

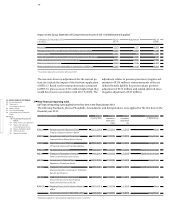

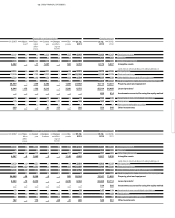

in € million 2 013 2012

Income from investments in subsidiaries and participations 12 5

thereof from subsidiaries: € 8 million (2012: € 1 million)

Impairment losses on investments in subsidiaries and participations – 91 – 175

Expenses from investments in subsidiaries – 2 –

Result on investments – 81 – 170

Losses and gains relating to financial instruments – 125 – 422

Sundry other financial result – 125 – 422

Other financial result – 206 – 592

16

15

Other financial result

Income taxes

Taxes on income comprise the following:

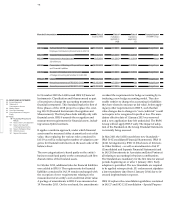

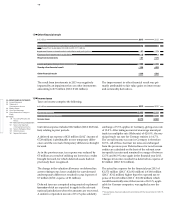

The result from investments in 2013 was negatively

impacted by an impairment loss on other investments

amounting to € 73 million (2012: € 166 million).

Current tax expense includes € 222 million (2012: € 128 mil-

lion)

relating to prior periods.

A deferred tax expense of € 23 million (2012*: income of

€ 729 million) is attributable to new temporary differ-

ences and the reversal of temporary differences brought

forward.

As in the previous year, tax expense was reduced by

€ 5 million as a result of utilising tax losses / tax credits

brought forward, for which deferred assets had not

previously been recognised.

The change in the valuation allowance on deferred tax

assets relating to tax losses available for carryforward

and temporary differences resulted in a tax expense of

€ 7 million (2012: expense of € 3 million).

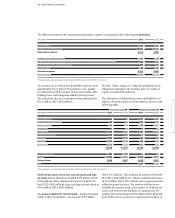

Deferred taxes are computed using enacted or planned

tax rates which are expected to apply in the relevant

national jurisdictions when the amounts are recovered.

A uniform corporation tax rate of 15.0 % plus solidarity

The improvement in other financial result was pri-

marily

attributable to fair value gains on interest rate

and commodity derivatives.

surcharge of 5.5 % applies in Germany, giving a tax rate

of 15.8 %. After taking account of an average municipal

trade tax multiplier rate (Hebesatz) of 420.0 %, the mu-

nicipal trade tax rate for German entities is 14.7 %.

The overall income tax rate in Germany is therefore

30.5 %. All of these German tax rates are unchanged

from the previous year. Deferred taxes for non-German

entities are calculated on the basis of the relevant coun-

try-specific tax rates and remained in a range of between

12.5 % and 46.9 % once again in the financial year 2013.

Changes in tax rates resulted in a deferred tax expense

of

€ 2 million (2012: € 21 million).

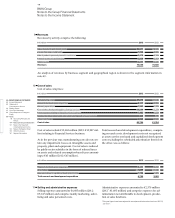

The actual tax expense for the financial year 2013 of

€ 2,573 million (2012*: € 2,692 million) is € 160 million

(2012*: € 312 million) higher than the expected tax ex-

pense of € 2,413 million (2012*: € 2,380 million) which

would theoretically arise if the tax rate of 30.5 %, appli-

cable for German companies, was applied across the

Group.

* Prior year figures have been adjusted in accordance with the revised version of IAS 19,

see note 7.