BMW 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

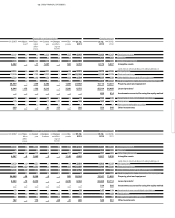

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

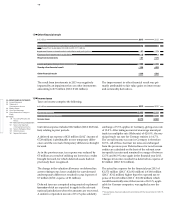

Changes in deferred taxes include changes relating to

items recognised either through the income statement

or directly in equity as well as the impact of exchange

rate and first-time consolidations. Deferred taxes recog-

nised

directly in equity increased in total by € 770 mil-

lion (2012*: decrease of € 30 million). Of this amount,

€ 421 million (2012: € 498 million) related to the fair value

measurement of derivative financial instruments and

marketable securities (recognised directly in equity),

shown in the summary above in the line items “Other

assets” and “Liabilities”. A further € 349 million (2012*:

decrease of € 528 million) related to the remeasurements of

the net defined benefit liability for pension plans, shown

in the summary above in the line item “Provisions”.

Deferred taxes are not recognised on retained profits of

€ 28.0 billion (2012: € 24.8 billion) of foreign subsidiaries,

as it is intended to invest these profits to maintain and

expand the business volume of the relevant companies.

A computation was not made of the potential impact

of income taxes on the grounds of disproportionate

expense.

The tax returns of BMW Group entities are checked

regularly by German and foreign tax authorities. Taking

account of a variety of factors – including existing in-

terpretations,

commentaries and legal decisions taken

relating to the various tax jurisdictions and the BMW

Group’s past experience – adequate provision has, as

far as identifiable, been made for potential future tax

obligations.

management’s assessment of whether it is probable

that the relevant entities will generate sufficient future

taxable profits, against which deductible temporary

differences can be offset.

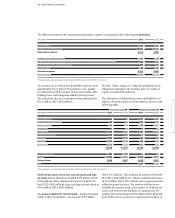

Capital losses available for carryforward in the United

Kingdom which do not relate to ongoing operations

amounted to € 2.0 billion at the end of the reporting pe-

riod, unchanged from one year earlier. As in previous

years, deferred tax assets recognised on these tax losses

– amounting to € 395 million at the end of the reporting

period after tax rate changes in 2013 (2012: € 465 mil-

lion) – were fully written down since they can only be

utilised against future capital gains.

Netting relates to the offset of deferred tax assets and lia-

bilities within individual separate entities or tax groups

to the extent that they relate to the same tax authorities.

Deferred taxes recognised directly in equity amounted

to € 451 million (2012: € 1,222 million), a decrease of

€ 771 million (2012*: increase of € 27 million) compared

to the previous year. The change includes a reduction

in deferred taxes recognised in conjunction with cur-

rency translation amounting to € 1 million (2012: reduc-

tion of € 3 million).

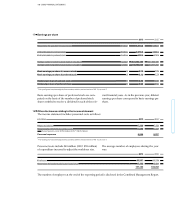

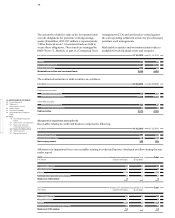

Changes in deferred tax assets and liabilities during the

reporting period can be summarised as follows:

in € million 2 013 2012*

Deferred taxes at 1 January 1,114 1,347

Deferred tax expense / income recognised through income statement 138 – 216

Change in deferred taxes recognised directly in equity 770 – 30

Exchange rate impact and other changes – 88 13

Deferred taxes at 31 December 1,934 1,114

* Prior year figures have been adjusted in accordance with the revised version of IAS 19,

see note 7.