BMW 2013 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

138

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

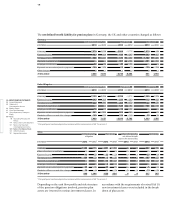

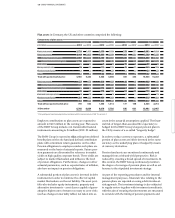

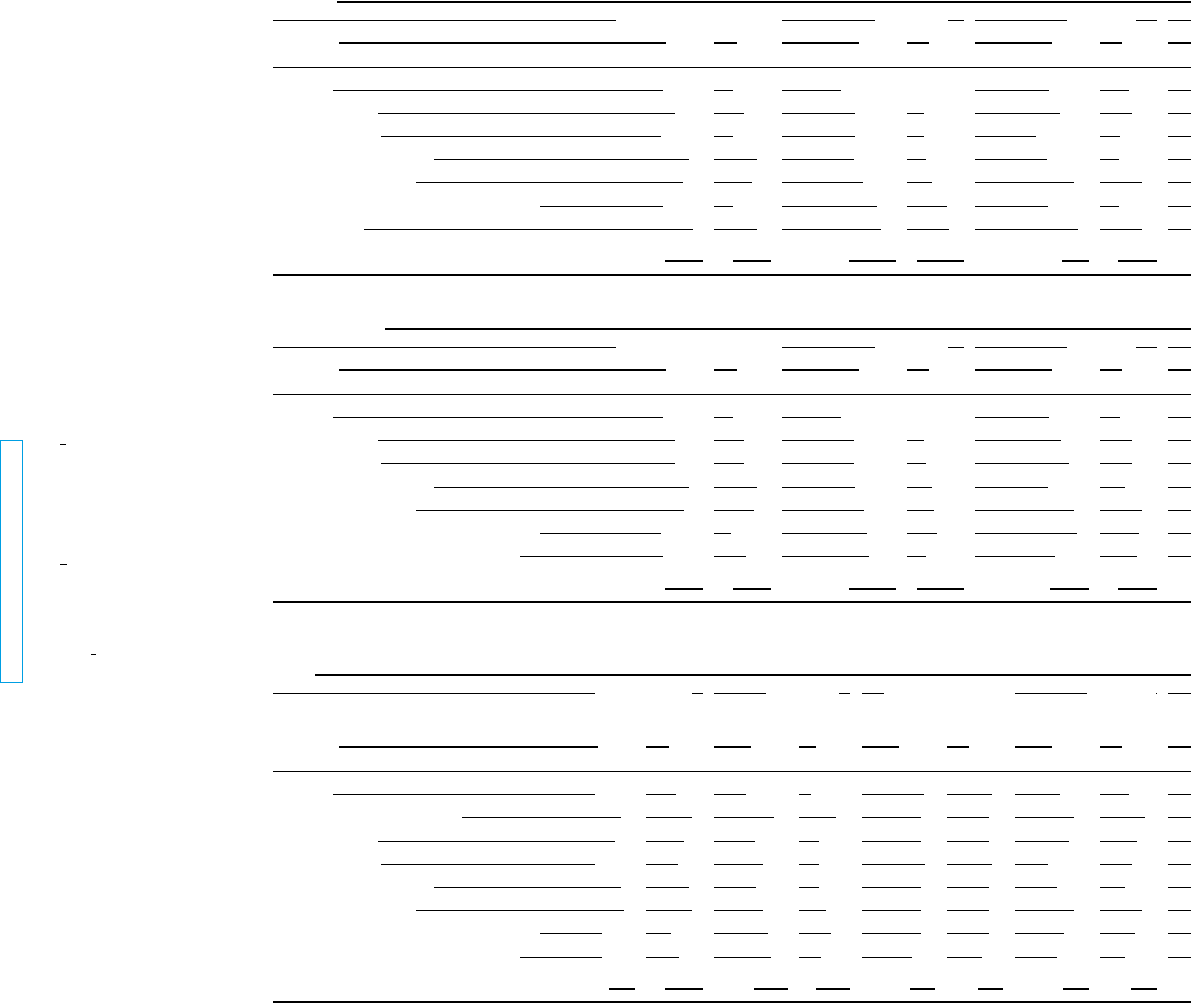

The net defined benefit liability for pension plans in Germany, the UK and other countries changed as follows:

Germany

Defined benefit obligation Plan assets Net liability

in € million 2013 2012 2013 2012 2013 2012

1 January 7,974 5,618 – 6,064 – 5,178 1,910 440

Expense / income 483 414 – 183 – 247 300 167

Remeasurements – 946 2,046 – 174 – 466 – 1,120 1,580

Payments to external funds – – – 301 – 153 – 301 – 153

Employee contributions 42 39 – 42 – 39 – –

Payments on account and pension payments – 154 – 143 15 19 – 139 – 124

Other changes 1 – – – 1 –

31 December 7,400 7,974 – 6,749 – 6,064 651 1,910

United Kingdom

Defined benefit obligation Plan assets Net liability

in € million 2013 2012* 2013 2012 2013 2012*

1 January 7,137 6,499 – 5,782 – 5,376 1,355 1,123

Expense / income 345 368 – 233 – 260 112 108

Remeasurements 330 346 – 305 – 170 25 176

Payments to external funds – – – 135 – 93 – 135 – 93

Employee contributions 18 17 – 18 – 17 – –

Payments on account and pension payments – 261 – 269 269 280 8 11

Translation differences and other changes – 160 176 128 – 146 – 32 30

31 December 7,409 7,137 – 6,076 – 5,782 1,333 1,355

* Prior year figures have been adjusted in accordance with the revised version of IAS 19, see note 7.

Other

Defined benefit Plan assets Effect of limiting the Net liability

obligation net defined benefit

asset to the asset ceiling

in € million 2013 2012* 2013 2012* 2013 2012 2013 2012*

1 January 1,144 913 – 601 – 484 4 3 547 432

Effect of first-time consolidation – 2 – – – – – 2

Expense / income 48 85 – 22 – 21 – – 26 64

Remeasurements – 164 170 – 2 – 35 1 2 – 165 137

Payments to external funds – – – 73 – 67 – – – 73 – 67

Employee contributions 4 4 – 4 – 4 – – – –

Payments on account and pension payments – 45 – 22 40 21 – – – 5 – 1

Translation differences and other changes – 38 – 8 26 – 11 – 1 – 1 – 13 – 20

31 December 949 1.144 – 636 – 601 4 4 317 547

* Prior year figures have been adjusted in accordance with the revised version of IAS 19, see note 7.

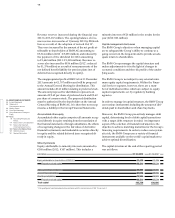

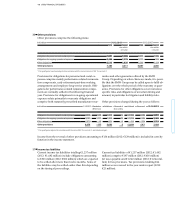

accordance with the requirements of revised IAS 19,

new investment classes were included in the break-

down of plan assets.

Depending on the cash flow profile and risk structure

of the pension obligations involved, pension plan

assets are invested in various investment classes. In