BMW 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77 COMBINED MANAGEMENT REPORT

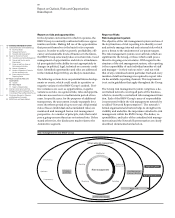

Report on Outlook, Risks and Opportunities

Report on Opportunities

Management and identification of opportunities

New opportunities regularly present themselves in

the dynamic business environment in which the BMW

Group operates. General economic trends and sector-

specific

developments – including external regulations,

suppliers, customers and competitors – are monitored

continuously. Identifying opportunities is an integral

part of the process of developing strategies and drawing

up forecasts for the BMW Group. The significance of

opportunities for the BMW Group is classified in the

categories “material” or “not material”.

Market, competition and scenario analyses are con-

ducted and evaluated and forecasts are drawn up

as part of the process of identifying opportunities. The

Group’s product portfolio is permanently reviewed in

the light of these analyses and, as appropriate, new

product projects are presented to the Board of Manage-

ment for consideration.

Opportunities management also covers regular reviews

of cost drivers and other factors critical for success.

One of the key areas in this context is to ensure optimal

operations within the production and supplier network,

which are therefore subject to regular review. Potential

areas of improvement can be quickly realised after ap-

proval by the Board of Management and the benefits

factored into earnings forecasts. The forecasts drawn up

by the BMW Group reflect the expected impact of tar-

geted efficiency improvements on variable and fixed

costs. Efficiency improvement targets take account of

past experience as well as the current composition of

the product portfolio.

Business process optimisation and strict cost control are

essential to ensure good profitability and a high return

on capital employed. The outlook is drawn up on the

assumption that profitability improvement measures

will be achieved. One good example of this is the rigor-

ous implementation of the so-called “architectural

ap-

proach”. The new MINI presented in November is

the first vehicle to be built on the basis of this

approach.

Greater communality of features between different

models and product lines, made possible by a modular

and architectural approach to building vehicles, helps

to improve profitability by reducing development

costs

and investment on the series development of new

vehicles, by generating benefits of scale at the level of

production cost and by increasing flexibility in produc-

tion.

The improved cost basis achieved opens up op-

portunities

to move into additional market segments

which would have otherwise been unprofitable. The

new generation of engines allows a high degree of

flexi-

bility in production in terms of the number of cylinders

and the choice between diesel and petrol engines, thus

maximising market potential.

Identified opportunities can be incorporated at short

notice into the opportunities management and re-

porting

system. The implementation of identified op-

portunities is undertaken on a decentralised basis and

monitored using a variety of suitable instruments.

The quarterly forecast report presented to the Board of

Management highlights the impact of opportunities

that have been realised.

Opportunities

Political and global economic opportunities

Economic conditions influence the operations, financial

position, earnings performance and cash flows of the

BMW Group. Should the global economy develop sig-

nificantly better than reflected in the outlook, revenues

and earnings of the BMW Group could be significantly

higher than originally predicted. Economic

opportuni-

ties present themselves in particular from the fact that

the BMW Group is fully committed to expanding busi-

ness volumes in the world’s growth markets. The BMW

Group sees an opportunity for above-average growth in

the Chinese market. Potential for recovery is also seen

elsewhere, particularly in southern European countries.

The outcome could be a sharp increase in sales volumes

as well as reduced competitive pressure and improved

selling prices. The BMW Group reviews its market

fore-

casts at frequent intervals, adjusting them when

neces-

sary to accommodate changed market conditions and

make full use of available market potential.

In addition to the impact from economic developments,

the BMW Group’s earnings can also be positively af-

fected

in the short to medium term by changes in the

le-

gal environment. A possible reduction in tariff barriers,

in import restrictions or direct excise duties could lower

the cost of materials for the BMW Group and also en-

able products and services to be offered to the customer

at lower prices. Another factor to consider is that regu-

latory support for forward-looking technologies, such as

electromobility – in the form of incentives – help to

make the total cost of ownership more attractive for the

customer, thus opening up opportunities for faster mar-

ket penetration by means of these technologies. Oppor-

tunities of this nature could result in higher sales vol-

umes and, all other things being equal, to an improved