BMW 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

18 COMBINED MANAGEMENT REPORT

18

General Information on the BMW Group

18 Business Model

20 Management System

23 Research and Development

24 Report on Economic Position

24 Overall Assessment by Management

24 General and Sector-specific

Environment

27

Financial and Non-financial

Performance Indicators

29 Review of Operations

47 Results of Operations, Financial

Position and Net Assets

62 Events after the End of the

Reporting Period

63 Report on Outlook, Risks and

Opportunities

63 Outlook

68 Risks Report

77 Report on Opportunities

81 Internal Control System and Risk

Management System Relevant for

the

Consolidated Financial Reporting Process

82 Disclosures Relevant for Takeovers

and Explanatory Comments

85

BMW Stock and Capital Markets

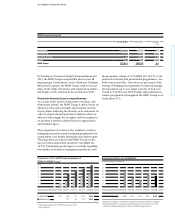

A profit before tax of € 164 million (2012: € 3 million) was

recorded for the Other Entities segment. The positive

impact of market value changes of interest rate deriva-

tives,

recorded in other financial result, was the main

reason for the improvement.

The negative impact on earnings at the level of profit be-

fore tax reported in the Eliminations column decreased

from € 937 million in 2012 to € 527 million in 2013,

mainly due to lower inter-segment eliminations. This

line item in the Eliminations column also includes a

positive exceptional impact of € 129 million, resulting

from fine-tuning the methodology used to measure

leased products.

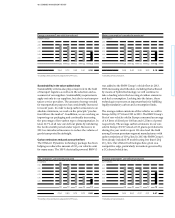

Financial position

The consolidated cash flow statements for the Group

and the Automotive and Financial Services segments

show the sources and applications of cash flows for the

financial years 2013 and 2012, classified into cash

flows

from operating, investing and financing activities.

Cash and cash equivalents in the cash flow statements

correspond to the amount disclosed in the balance

sheet.

Cash flows from operating activities are determined

indirectly, starting with Group and segment net profit.

By contrast, cash flows from investing and financial

activities are based on actual payments and receipts.

The cash inflow from operating activities in 2013

decreased by € 1,462 million to € 3,614 million (2012:

€ 5,076 million), mainly due to rises in leased prod-

ucts

and receivables from sales financing totalling

€ 6,549 million (2012: € 5,409 million) brought about

by sales volume factors.

The cash outflow for investing activities amounted to

€ 6,981 million (2012: € 5,433 million) and was thus

28.5 % higher than in the previous year. The increase

primarily reflects investments in property, plant and

equipment and intangible assets which went up by

€ 1,433 million to € 6,669 million. Net investments in

marketable securities resulted in a cash outflow of

€ 381 million (2012: € 175 million).

Further information on investments is provided in the

section on the net assets position.

Cash inflow from financing activities totalled € 2,703 mil-

lion

(2012: € 952 million). Proceeds from the issue of

bonds amounted to € 8,982 million (2012: € 7,977

mil-

lion), compared with an outflow of € 7,242 million (2012:

€ 6,727 million) for the repayment of bonds. Non-cur-

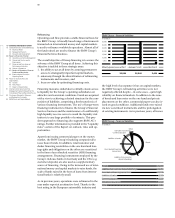

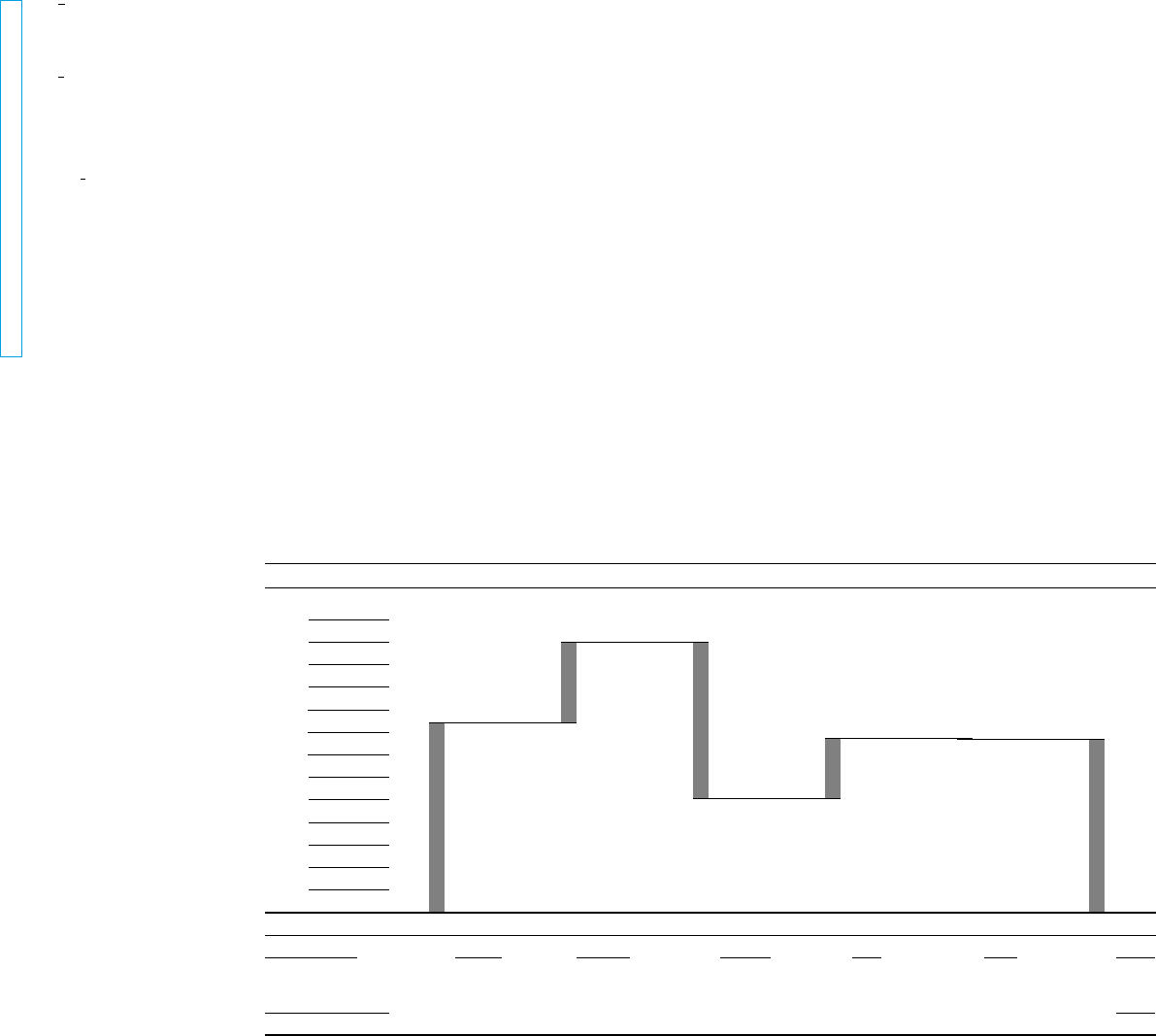

Change in cash and cash equivalents

in € million

13,000

12,000

11,000

10,000

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

Cash and cash Cash inflow Cash outflow Cash inflow Currency trans- Cash and cash

equivalents from operating from investing from financing lation, changes in equivalents

31.12. 2012 activities activities activities Group composition 31.12. 2013

8,370 + 3,614 – 6,981 + 2,703 – 42 7,664