BMW 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111 GROUP FINANCIAL STATEMENTS

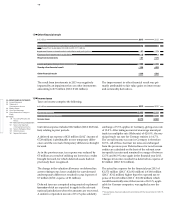

IFRS 13 (Fair Value Measurement) provides a uniform

definition of fair value which applies across all Stand-

ards. The uniform requirements set out in IFRS 13

must now be applied to all fair value measurements re-

quired in other Standards. The only Standards to

which IFRS 13 does not apply are IFRS 2 (Share-based

Payment) and IAS 17 (Leases). The Standard also re-

places and supplements disclosures about fair value

measurement.

Fair value is defined in IFRS 13 as an exit price, in other

words as the price that would be received to sell an as-

set or paid to transfer a liability. Fair value measurement

must take account of the characteristics of the asset or

liability and be based on a market perspective. Similar

to the approach already taken to the fair value measure-

ment of financial instruments, a fair value hierarchy

has

been introduced that categorises into three levels the

inputs to valuation techniques used to measure fair

value. Categorisation is determined on the basis of how

near the inputs are to the market. The Standard also

sets out the rules for selecting appropriate valuation

techniques to measure fair value.

In accordance with the transition requirements of

IFRS 13, the BMW Group has applied the new rules for

fair value measurement prospectively in the financial

year 2013 and has not disclosed comparative figures for

the previous year. Apart from the adjustments made in

conjunction with amended IAS 19, as described in note

7 above, the introduction of IFRS 13 did not have any

further material impact on the measurements of assets

and liabilities within the BMW Group.

The Amendment to IAS 1 changes the presentation of

other comprehensive income in the statement of total

comprehensive income. Items reported in other com-

prehensive income which will subsequently be reclassi-

fied to the income statement (“recycling”) are now re-

ported separately from those that will never be recycled.

If items are presented gross (i. e. without offset of the

deferred tax impact), deferred taxes are also allocated to

the two groups of items (and not shown as a single

amount).

The BMW Group has complied with the new disclo-

sure requirements and amended comparative figures

accordingly.

The Amendment to IAS 36 has been applied early,

with-

out having any impact on the results of operations, finan-

cial

position and net assets of the BMW Group.

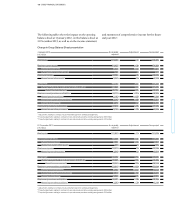

(b) Financial reporting pronouncements issued by the

IASB, but not yet applied

The following Standards, Revised Standards,

Amend-

ments and Interpretations issued by the IASB during

previous accounting periods, were not mandatory

for the period under report and were not applied in the

financial year 2013:

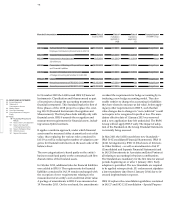

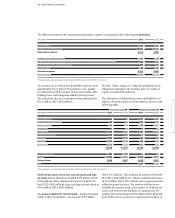

Standard / Interpretation

Date of Date of Date of Expected impact

issue by IASB mandatory mandatory on BMW Group

application application

IASB EU

IFRS 9 Financial Instruments 12. 11. 2009 /

28. 10. 2010 /

16. 12. 2011 /

19. 11. 2013

Open No Significant in principle

IFRS 10

Consolidated Financial Statements

12. 5. 2011 1. 1. 2013 1. 1. 2014 Significant in principle

IFRS 11

Joint Arrangements

12. 5. 2011 1. 1. 2013 1. 1. 2014 Significant in principle

IFRS 12

Disclosure of Interests in

Other Entities

12. 5. 2011 1. 1. 2013 1. 1. 2014 Significant in principle

Changes in Transitional Regulations

(IFRS 10, IFRS 11 and IFRS 12)

28. 6. 2012 1. 1. 2013 1. 1. 2014 Significant in principle

Investment Entities (Amendments to

IFRS 10, IFRS 12 and IAS 27)

31. 10. 2012 1. 1. 2014 1. 1. 2014 Insignificant

IFRS 14

Regulatory Deferral Accounts

30. 1. 2014 1. 1. 2016 No

Insignificant