BMW 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

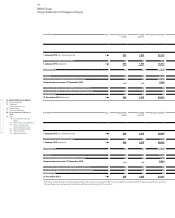

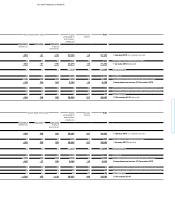

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

Investments in non-consolidated Group companies and

interests in associated companies not accounted for

using the equity method are reported as Other invest-

ments and measured at cost or, if lower, at their fair

value.

Participations are measured at their fair value. If this

value is not available or cannot be determined reliably,

participations are measured at cost.

Non-current marketable securities are measured ac-

cording

to the category of financial asset to which they

are classified. No held-for-trading financial assets are

included under this heading.

A financial instrument is a contract that gives rise to a

financial asset of one entity and a financial liability or

equity instrument of another entity. Once the BMW

Group

becomes party to such to a contract, the finan-

cial instrument is recognised either as a financial asset

or as a financial liability.

Financial assets are accounted for on the basis of the

settlement date. On initial recognition, they are meas-

ured

at their fair value. Transaction costs are included

in the fair value unless the financial assets are allocated

to the category “financial assets measured at fair value

through profit or loss”.

Subsequent to initial recognition, available-for-sale and

held-for-trading financial assets are measured at their

fair value. When market prices are not available, the fair

value of available-for-sale financial assets is measured

using appropriate valuation techniques e. g. discounted

cash flow analysis based on market information available

at the balance sheet date.

Available-for-sale assets include non-current investments,

securities and investment fund shares. This category

includes all non-derivative financial assets which are not

classified as “loans and receivables” or “held-to-maturity

investments” or as items measured “at fair value through

profit and loss”.

Loans and receivables which are not held for trading

and held-to-maturity financial investments with a fixed

term are measured at amortised cost using the effective

interest method. All financial assets for which published

price quotations in an active market are not available

and whose fair value cannot be determined reliably are

required to be measured at cost.

In accordance with IAS 39 (Financial Instruments:

Recognition and Measurement), assessments are made

regularly as to whether there is any objective evidence

that a financial asset or group of assets may be impaired.

Impairment losses identified after carrying out an im-

pairment test are recognised as an expense. Gains and

losses on available-for-sale financial assets are recog-

nised directly in equity until the financial asset is

dis-

posed of or is determined to be impaired, at which time

the cumulative loss previously recognised in equity is

reclassified to profit or loss for the period.

With the exception of derivative financial instruments,

all receivables and other current assets relate to loans

and receivables which are not held for trading. All such

items are measured at amortised cost. Receivables with

maturities of over one year which bear no or a lower-

than-market interest rate are discounted. Appropriate

impairment losses are recognised to take account of all

identifiable risks.

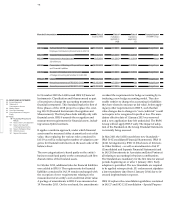

Receivables from sales financing comprise receivables

from retail customer, dealer and lease financing.

Impairment losses on receivables relating to financial

services business are recognised using a uniform method-

ology

that is applied throughout the Group and meets

the requirements of IAS 39. This methodology results

in the recognition of impairment losses both on indi-

vidual assets and on groups of assets. If there is objec-

tive

evidence of impairment, the BMW Group recog-

nises impairment losses on the basis of individual

assets. Within the retail customer business, the existence

of overdue balances or the incidence of similar events

in the past are examples of such objective evidence. In

the event of overdue receivables, impairment losses are

always recognised individually based on the length

of period of the arrears. In the case of dealer financing

receivables, the allocation of the dealer to a correspond-

ing rating category is also deemed to represent objec-