BMW 2013 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

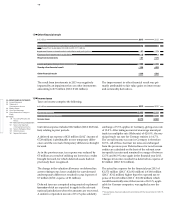

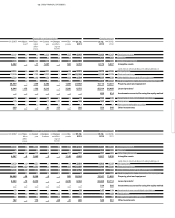

in € million 31. 12. 2013 31. 12. 2012

Gross investment in finance leases

due within one year 4,816 4,580

due between one and five years 9,748 8,938

due later than five years 98 118

14,662 13,636

Present value of future minimum lease payments

due within one year 4,378 4,094

due between one and five years 8,813 8,060

due later than five years 85 110

13,276 12,264

Unrealised interest income 1,386 1,372

26

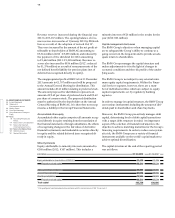

Receivables from sales financing

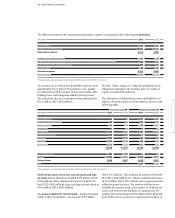

Receivables from sales financing, totalling € 54,117 mil-

lion (

2012: € 52,914 million), comprise € 40,841 million

(2012: € 40,650 million) for credit financing for retail

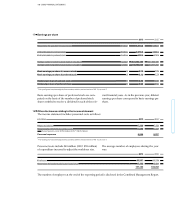

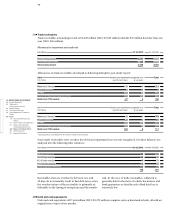

Additions to investments in non-consolidated sub-

sidiaries

relate primarily to capital increases at the level

of BMW Milano S.r.l., Milan, BMW Retail Nederland

B.V., Haaglanden, and BMW i Ventures B.V., Rijswijk.

Additions to participations relate primarily to the pur-

chase of available-for-sale marketable securities.

The impairment loss of € 16 million on investments in

non-consolidated subsidiaries relates mainly to invest-

ments in dealerships.

Disposals of investments in subsidiaries result primarily

from the deconsolidation of the Husqvarna Group.

customers and dealers and € 13,276 million (2012:

€ 12,264 million) for finance leases. Finance leases are

analysed as follows:

Impairment losses on participations – recognised with

income statement effect – related mainly to the invest-

ment in SGL Carbon SE, Wiesbaden, which was written

down on the basis of objective criteria.

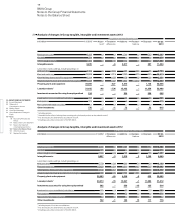

A break-down of the different classes of other investments

disclosed in the balance sheet and changes during the

year are shown in the analysis of changes in Group tan-

gible, intangible and investment assets in note 21.

If the Group’s share of the at-equity result of BMW

Brilliance Automotive Ltd., Shenyang, were reported as

part of the Automotive segment’s EBIT, the EBIT mar-

gin would increase by 0.6 percentage points to 10.0 %.

in € million 31. 12. 2013 31. 12. 2012

Gross carrying amount 55,697 54,593

Allowance for impairment – 1,580 – 1,679

Net carrying amount 54,117 52,914

Contingent rents recognised as income (generally

relating to the distance driven) amounted to € 3 million

(2012: € 3 million). Write-downs on finance leases

amounting to € 159 million (2012: € 149 million) were

measured and recognised on the basis of specific credit

risks. Non-guaranteed residual values that fall to the

benefit of the lessor amounted to € 120 million (2012:

€ 85 million).

Receivables from sales financing include € 32,616

mil-

lion (2012: € 32,309 million) with a remaining term of

more than one year.

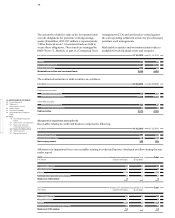

Allowance for impairment and credit risk