BMW 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37 COMBINED MANAGEMENT REPORT

Dealer financing up on previous year

In addition to retail customer financing, the Financial

Services segment also provides financing products

for

the dealer organisation. The total volume of dealer

financing at 31 December 2013 was € 13,110 million,

an increase of 3.5 % compared to one year earlier (2012:

€ 12,669 million).

Deposit business decreased

Deposit-taking represents an important source of re-

financing for the BMW Group. The volume of customer

deposits went down by 4.3 % during the twelve-month

period to € 12,457 million (2012: € 13,018 million).

Insurance business continues to grow

In addition to its financing and leasing products, the

Financial Services segment also offers a wide range of

individually packaged insurance services to customers

in 30 countries. There was no let-up in demand for

insurance products in 2013. The number of new con-

tracts

rose worldwide by 6.3 % to 1,041,530 contracts

(2012: 979,776 contracts). The insurance contract port-

folio expanded by 18.9 % to 2,567,168 contracts (2012:

2,158,892 contracts).

Stable risk profile

Helped by the positive trend in the global economy and

an easing of the euro crisis, the segment’s well-estab-

lished risk management procedures again proved their

worth. The credit risk situation in southern Europe was

also more stable. The loss ratio incurred on the segment’s

total credit portfolio was reduced by 2 basis points to

0.46 % (2012: 0.48 %).

Reflecting developments on international used car mar-

kets,

our vehicles’ residual values also improved slightly

worldwide over the course of the year. The only excep-

tion was in the countries of southern Europe, where,

although there was no improvement, prices at least sta-

bilised at a low level. Average losses on residual value

risks also decreased.

Further information with respect to risks and opportuni-

ties related to Financial Services can be found in the

section “Report on risks and opportunities”.

With the new structure in place, BMW Bank has its

headquarters in Germany, branches in Italy, Spain and

Portugal and a subsidiary in France.

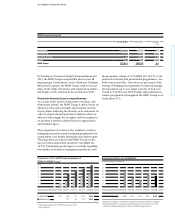

Fleet business remains on growth course

As a fleet management specialist offering a full range

of

services including leasing and funding, Alphabet

is the fourth-largest provider in the European market.

The total portfolio of fleet-related contracts climbed

by 6.6 % to stand at 535,528 contracts at the end of the

reporting period (2012: 502,397 contracts).

Multi-brand financing on the rise

Demand for multi-brand financing increased again in

2013. In total, 181,605 new contracts were signed in

2013, surpassing the previous year’s equivalent figure

by 10.8 % (2012: 163,945 contracts). A portfolio of

452,009 contracts was in place at the end of the reporting

period (2012: 417,408 contracts; + 8.3 %).

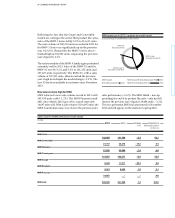

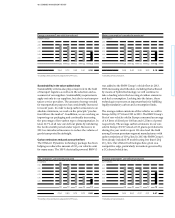

Contract portfolio retail customer financing of

Financial Services segment 2013

as a percentage by region

EU Bank 31.3 Europe / Middle East / Africa 24.9

Americas 30.9 Asia / Pacific 12.9

EU Bank

Americas

Asia / Pacific

Europe / Middle

East / Africa

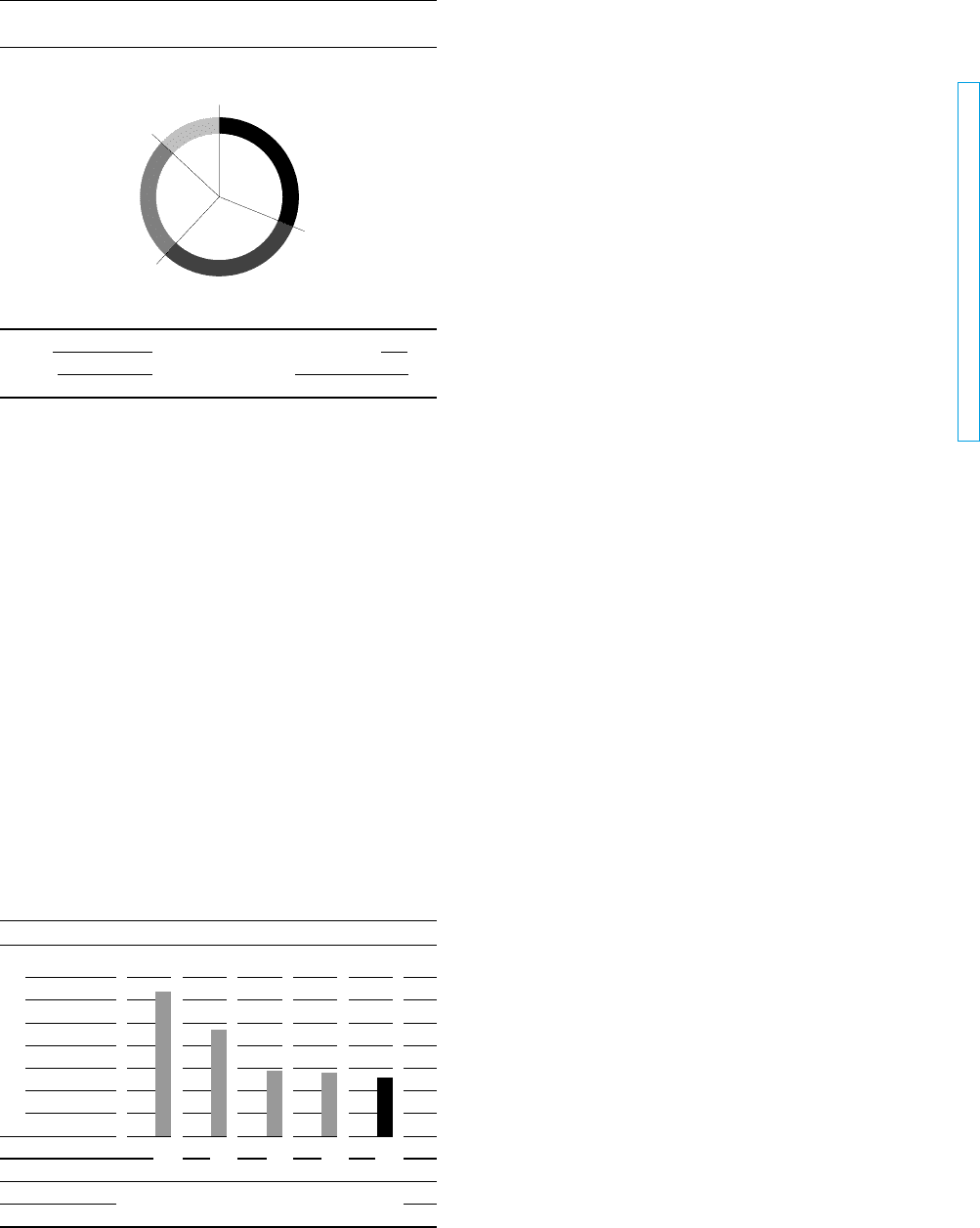

Development of credit loss ratio

in %

0.9

0.8

0.7

0.6

0.5

0.4

0.3

09 10 11 12 13

0.84 0.67 0.49 0.48 0.46