BMW 2013 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

157 GROUP FINANCIAL STATEMENTS

43

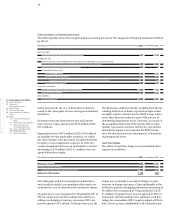

In the next stage, these exposures are compared to all

hedges that are in place. The net cash flow surplus rep-

resents an uncovered risk position. The cash-flow-at-

risk approach involves allocating the impact of potential

raw materials fluctuations to operating cash flows on

the basis of probability distributions. Volatilities and

correlations serve as input factors to assess the relevant

probability distributions.

The potential negative impact on earnings is computed

for each raw material category for the following

finan-

cial year on the basis of current market prices and

ex-

Other risks

A further exposure relates to the residual value risk on

vehicles returned to the BMW Group at the end of lease

contracts. The risk in

this context was not material to

the Group in the past and / or at the end of the reporting

Raw materials price risk

The BMW Group is exposed to the risk of price

fluctua-

tions for raw materials. A description of the management

of these risks is provided in the Combined Management

Report.

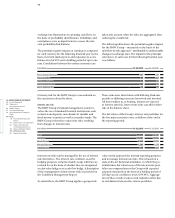

Explanatory notes to the cash flow statements

The cash flow statements show how the cash and cash

equivalents of the BMW Group and of the Automotive

and Financial Services segments have changed in the

course of the year as a result of cash inflows and cash

outflows. In accordance with IAS 7 (Statement of Cash

Flows), cash flows are classified into cash flows from

operating, investing and financing activities.

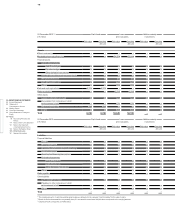

In the following table the potential volumes of fair value

fluctuations – measured on the basis of the value-at-

risk approach – are compared with the expected value for

the interest rate relevant positions of the BMW Group

for the five main currencies:

posure to a confidence level of 95 % and a holding

period of up to one year. Correlations between the

various categories of raw materials are taken into

account when the risks are aggregated, thus reducing

the overall risk.

The following table shows the potential negative impact

for the BMW Group – measured on the basis of the cash-

flow-at-risk approach – attributable to fluctuations in

prices across all categories of raw materials. The risk at

each reporting date for the following financial year was

as follows:

period. A description of the management of this risk is

provided in the

Combined Management Report. Infor-

mation regarding the

residual value risk from operating

leases is provided in the section on accounting policies

in note 5.

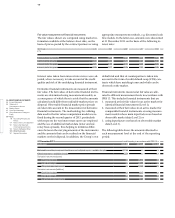

The first step in the analysis of the raw materials price

risk is to determine the volume of planned purchases of

raw materials (and components containing those raw

materials). These amounts, which represent the gross

exposure, were as follows at each reporting date for the

following financial year:

Cash and cash equivalents included in the cash flow

statement comprise cash in hand, cheques, and cash at

bank, to the extent that they are available within three

months from the end of the reporting period and are

subject to an insignificant risk of changes in value.

The cash flows from investing and financing activities

are based on actual payments and receipts. By contrast,

in € million 31. 12. 2013 31. 12. 2012

Euro 214 269

US Dollar 246 271

British Pound 62 44

Chinese Renminbi 11 17

Japanese Yen 6 12

in € million 31. 12. 2013 31. 12. 2012

Raw materials price exposures 4,550 3,370

in € million 31. 12. 2013 31. 12. 2012

Cash flow at risk 405 350