BMW 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

88 GROUP FINANCIAL STATEMENTS

88 Income Statements

88 Statement of

Comprehensive Income

90 Balance Sheets

92 Cash Flow Statements

94 Group Statement of Changes in

Equity

96 Notes

96 Accounting Principles and

Policies

114 Notes to the Income Statement

121 Notes to the Statement

of Comprehensive Income

122

Notes to the Balance Sheet

145 Other Disclosures

161 Segment Information

In November 2009 the IASB issued IFRS 9 (Financial

Instruments: Classification and Measurement) as part

of its project to change the accounting treatment for

financial instruments. This Standard marks the first of

three phases of the IASB project to replace the exist-

ing

IAS 39 (Financial Instruments: Recognition and

Measurement). The first phase deals initially only with

financial assets. IFRS 9 amends the recognition and

measurement requirements for financial assets, includ-

ing various hybrid contracts.

It applies a uniform approach, under which financial

assets must be measured either at amortised cost or fair

value, thus replacing the various rules contained in

IAS 39 as well as reducing the number of valuation cate-

gories for financial instruments on the assets side of the

balance sheet.

The new categorisation is based partly on the entity’s

business model and partly on the contractual cash flow

characteristics of the financial assets.

In October 2010, additional rules for financial liabilities

were added to IFRS 9. The requirements for financial

liabilities contained in IAS 39 remain unchanged with

the exception of new requirements relating to the

measurement of an entity’s own credit risk at fair value.

A package of amendments to IFRS 9 was announced on

19 November 2013. On the one hand, the amendments

overhaul the requirements for hedge accounting by in-

troducing a new hedge accounting model. They also

enable entities to change the accounting for liabilities

they have elected to measure at fair value, before apply-

ing any other requirements in IFRS 9, such that fair

value changes due to changes in “own credit risk” would

not require to be recognised in profit or loss. The man-

datory effective date of 1 January 2015 was removed

and a new application date left undecided. The BMW

Group will not apply IFRS 9 early. The impact of adop-

tion of the Standard on the Group Financial Statements

is currently being assessed.

I

n May 2011 the IASB issued three new Standards –

IFRS 10 (Consolidated Financial Statements), IFRS 11

(Joint Arrangements), IFRS 12 (Disclosure of Interests

in Other Entities) – as well as amendments to IAS 27

(Consolidated and Separate Financial Statements) and

to IAS 28 (Investments in Associates and Joint Ventures)

all relating to accounting for business combinations.

The Standards are mandatory for the first time for annual

periods beginning on or after 1 January 2013. Early

adoption is permitted. The new Standards are required

to be applied retrospectively. EU endorsement stipulates

a later mandatory date (from 1 January 2014) due to in-

creased implementation expense.

IFRS 10 replaces the consolidation guidelines contained

in IAS 27 and SIC-12 (Consolidation – Special Purpose

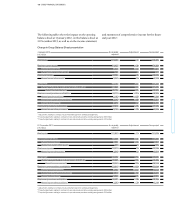

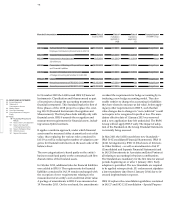

Standard / Interpretation

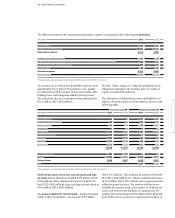

Date of Date of Date of Expected impact

issue by IASB mandatory mandatory on BMW Group

application application

IASB EU

IAS 19

Defined Benefit Plans:

Employee Contributions (Amendments to IAS 19)

21. 11. 2013 1. 7. 2014 No

Insignificant

IAS 27

Separate Financial Statements

12. 5. 2011 1. 1. 2013 1. 1. 2014 None

IAS 28

Investments in Associates and

Joint Ventures

12. 5. 2011 1. 1. 2013 1. 1. 2014 None

IAS 32

Presentation – Offsetting of Financial Assets

and Financial Liabilities

16. 12. 2011 1. 1. 2014 1. 1. 2014 Insignificant

IAS 39

Novation of Derivatives and Continuation

of Hedge Accounting (Amendments to IAS 39)

27. 6. 2013 1. 1. 2014 1. 1. 2014 Insignificant

IFRIC 21 Levies 20. 5. 2013 1. 1. 2014 No Insignificant

Annual Improvements to IFRS 2010 – 2012

12. 12. 2013 1. 7. 2014 No Insignificant

Annual Improvements to IFRS 2011 – 2013

12. 12. 2013 1. 7. 2014 No Insignificant