BMW 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

18 COMBINED MANAGEMENT REPORT

18

General Information on the

BMW

Group

18 Business Model

20 Management System

23 Research and Development

24 Report on Economic Position

24 Overall Assessment by Management

24 General and Sector-specific

Environment

27

Financial and Non-financial

Performance Indicators

29 Review of Operations

47 Results of Operations, Financial

Position and Net Assets

62 Events after the End of the

Reporting Period

63 Report on Outlook, Risks and

Opportunities

63 Outlook

68 Risks Report

77 Report on Opportunities

81 Internal Control System and Risk

Management System Relevant for

the

Consolidated Financial Reporting Process

82 Disclosures Relevant for Takeovers

and Explanatory Comments

85

BMW Stock and Capital Markets

nounced. Registration figures in Spain (+ 3.3 %) stabilised

at a very low level following the slump experienced in

previous years. The UK, by contrast, turned out to be in

good shape: boosted by a surprisingly strong economic

recovery, the UK car market grew by approximately 10.8 %

to 2.3 million units.

Japan’s car market consolidated somewhat in 2013

to

approximately 5.2 million units. In the previous year,

demand had still been exceptionally high, owing to the

backlog caused by the natural disaster.

Car markets in the major emerging economies felt the

effect of the economic slowdown, with the Russian mar-

ket

contracting by approximately 5.3 % to 2.6 million

units and the Brazilian market, at 3.6 million units,

also

falling slightly short of the previous year (– 1.2 %).

The decrease in India was more pronounced, with new

registrations down by 7.0 % to 2.5 million units.

Despite the continuing weakness of markets in Europe,

we came close to achieving the previous year’s sales

volume level and were thus able to buck the general

trend. Positive market developments in Asia and the

Americas also had a positive impact on unit sales of the

BMW Group in these regions.

Motorcycle markets

The world’s 500 cc plus class motorcycle markets were

3.0 % down worldwide on the previous year. Motorcycle

registrations in Europe fell by 9.1 %. Germany (– 0.7 %)

recorded a relatively moderate decline, in contrast to

France (– 11.2 %) and Italy (– 20.1 %), where the drops

were again on a double-digit scale. The US motorcycle

market remained roughly at the previous year’s level

(– 0.2 %).

Within this difficult market environment, the BMW

Group’s motorcycles business performed significantly

better than the general trend.

Financial Services

The situation on international financial markets seemed

to stabilise during the year under report. Lifting the

public debt ceiling in the USA helped to calm capital

markets. The Japanese Reserve Bank continued its

ex-

pansionary monetary policy and kept the economy

propped up with massive support. The situation in the

eurozone also became more settled in 2013. The Euro-

pean Central Bank felt compelled to reduce its reference

interest rate to 0.25 % in an endeavour to maintain eco-

nomic momentum.

Greater worldwide economic stability also had a positive

effect on credit losses, with bad debt levels continuing

to fall in both the USA and Asia. Some signs of improve-

ment were also noticeable in southern Europe.

Price levels on international used car markets in 2013

remained more or less stable across all regions, including

southern European markets, where prices stabilised at

a low level.

The BMW Group’s Financial Services business also

profited from the general stabilisation of the world’s car

and financial markets.

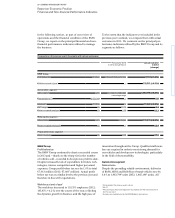

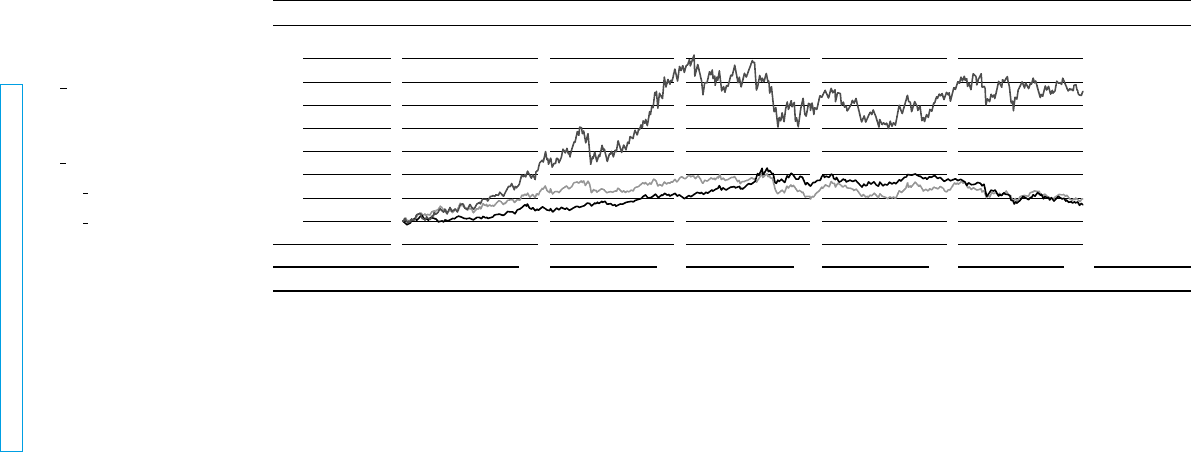

Precious metals price trend

(Index: 31 December 2008 = 100)

450

400

350

300

250

200

150

100

09 10 11 12 13

Source: Reuters.

Palladium

Gold

Platinum