Experian 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95Experian Annual Report 2008

Introduction

2 – 5

Business review

6 – 37

Governance

38 – 64

Financial statements

Group financial statements

Financial statements

Group financial statements

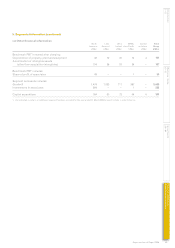

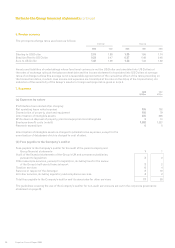

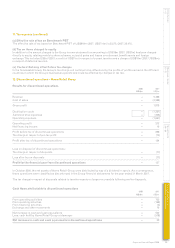

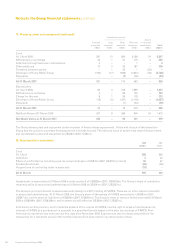

11. Tax expense (continued)

(c) Effective rate of tax on Benchmark PBT

The effective rate of tax based on Benchmark PBT of US$819m (2007: US$714m) is 23.2% (2007: 22.4%).

(d) Tax on items charged to equity

In addition to the amount charged to the Group income statement tax amounting to US$16m (2007: US$7m) has been charged

directly to equity, relating mainly to share schemes, actuarial gains and losses on retirement benefit assets and foreign

exchange. This includes US$nil (2007: a credit of US$11m) in respect of current taxation and a charge of US$16m (2007: US$18m)

in respect of deferred taxation.

(e) Factors that may affect future tax charges

In the foreseeable future, the Group’s tax charge will continue to be influenced by the profile of profits earned in the different

countries in which the Group’s businesses operate and could be affected by changes in tax law.

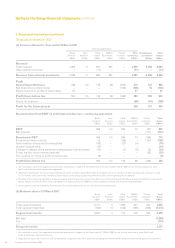

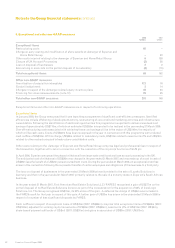

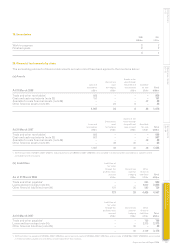

12. Discontinued operations – Home Retail Group

Results for discontinued operations

2008 2007

US$m US$m

Revenue – 5,468

Cost of sales – (3,589)

Gross profit – 1,879

Distribution costs – (1,361)

Administrative expenses – (306)

Operating expenses – (1,667)

Operating profit – 212

Net financing income – 16

Profit before tax of discontinued operations – 228

Tax charge in respect of pre-tax profit – (74)

Profit after tax of discontinued operations – 154

Loss on disposal of discontinued operations:

Tax charge in respect of disposals – (17)

Loss after tax on disposals – (17)

Profit for the financial year from discontinued operations – 137

In October 2006, the net assets of Home Retail Group were distributed by way of a dividend in specie. As a consequence,

these operations were classified as discontinued in the Group financial statements for the year ended 31 March 2007.

The tax charge in respect of disposals related to taxation assets no longer recoverable following earlier disposals.

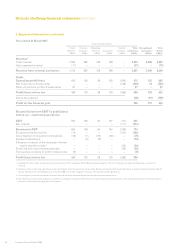

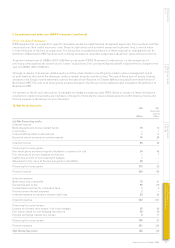

Cash flows attributable to discontinued operations

2008 2007

US$m US$m

From operating activities – 705

From investing activities – (168)

From financing activities – (3)

Exchange and other movements – 16

Net increase in cash and cash equivalents – 550

Less: cash held by Home Retail Group at demerger – (518)

Net increase in cash and cash equivalents in discontinued operations – 32