Experian 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93Experian Annual Report 2008

Introduction

2 – 5

Business review

6 – 37

Governance

38 – 64

Financial statements

Group financial statements

Financial statements

Group financial statements

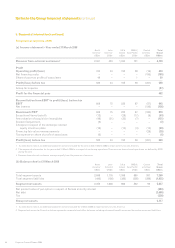

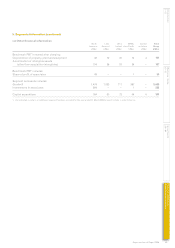

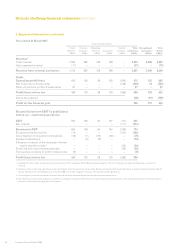

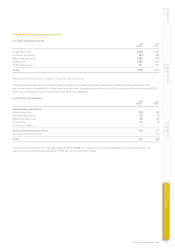

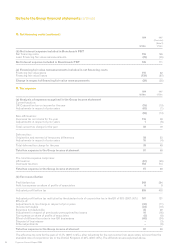

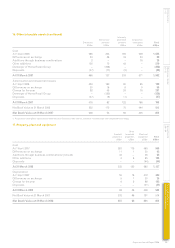

9. Exceptional and other non-GAAP measures (continued)

Other non-GAAP measures

IFRS requires that, on acquisition, specific intangible assets are identified and recognised separately from goodwill and then

amortised over their useful economic lives. These include items such as brand names and customer lists, to which value

is first attributed at the time of acquisition. The Group has excluded amortisation of these acquisition intangibles from its

definition of Benchmark PBT because such a charge is based on uncertain judgements about their value and economic life.

A goodwill adjustment of US$2m (2007: US$14m) arose under IFRS 3 ‘Business Combinations’ on the recognition of

previously unrecognised tax losses on prior years’ acquisitions. The corresponding tax benefit reduced the tax charge for the

year by US$2m (2007: US$14m).

Charges in respect of demerger-related equity incentive plans relate to one-off grants made to senior management and at

all staff levels at the time of the demerger, under a number of equity incentive plans. The cost of these one-off grants is being

charged to the Group income statement over the five years from flotation in October 2006 but excluded from the definition of

Benchmark PBT. The cost of all other grants is being charged to the Group income statement and included in the definition of

Benchmark PBT.

An element of the Group’s derivatives is ineligible for hedge accounting under IFRS. Gains or losses on these derivatives

arising from market movements are credited or charged to financing fair value remeasurements within finance income and

finance expense in the Group income statement.

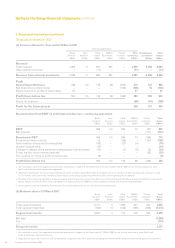

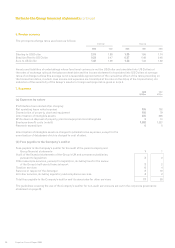

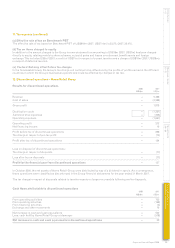

10. Net financing costs

2008 2007

(Restated)

(Note 2)

US$m US$m

(a) Net financing costs

Interest income:

Bank deposits and money market funds 19 10

Loan notes – 1

Interest differentials on derivatives 1 17

Expected return on pension scheme assets 76 68

Interest income 96 96

Financing fair value gains:

Fair value gains on borrowings attributable to interest rate risk 34 55

Fair value gains on non-hedging derivatives – 7

Ineffective portion of net investment hedges 7 –

Movement in fair value of Serasa put option (note 29(d)) 69 –

Financing fair value gains 110 62

Finance income 206 158

Interest expense:

Bank loans and overdrafts 76 41

Eurobonds and notes 90 112

Commitment and facility utilisation fees 1 2

Finance lease interest expense 2 –

Interest expense on pension scheme liabilities 53 52

Interest expense 222 207

Financing fair value losses:

Losses on interest rate swaps – fair value hedges 35 60

Fair value losses on non-hedging derivatives 98 26

Foreign exchange transaction losses 6 11

Financing fair value losses 139 97

Finance expense 361 304

Net financing costs 155 146