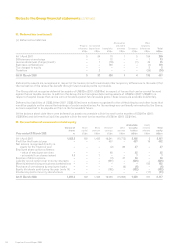

Experian 2008 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119Experian Annual Report 2008

Introduction

2 – 5

Business review

6 – 37

Governance

38 – 64

Financial statements

Group financial statements

Financial statements

Group financial statements

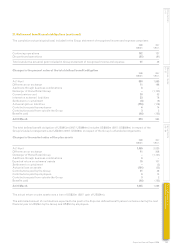

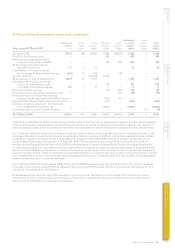

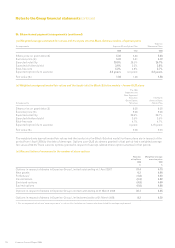

33. Notes to the Group cash flow statement

2008 2007

US$m US$m

(a) Cash generated from operations

Profit after tax 452 326

Adjustments for:

Tax expense 97 68

Share of post-tax profits of associates (50) (67)

Net financing costs 155 146

Operating profit 654 473

Loss on sale of property, plant and equipment 3 10

Depreciation and amortisation 422 303

Goodwill adjustment 2 14

Charge in respect of equity incentive plans 66 91

Exceptional items included in working capital 9 46

Increase in inventories – (1)

Increase in receivables (73) (72)

Increase in payables 87 82

Difference between pension contributions paid and amounts recognised in Group income statement (5) (4)

Cash generated from operations 1,165 942

(b) Interest paid

Interest paid on bonds, bank loans and overdrafts 167 133

Interest element of finance lease rental payments 2 –

Total interest paid 169 133

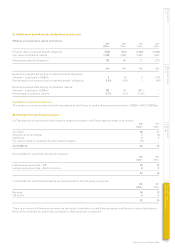

(c) Acquisition of subsidiaries

Purchase of subsidiary undertakings (including acquisition expenses) (note 34) (1,726) (82)

Net cash acquired with subsidiary undertakings (note 34) 60 8

Deferred consideration settled on acquisitions made in previous years (54) (44)

Net cash outflow for acquisition of subsidiaries (1,720) (118)

(d) Disposal of subsidiaries

Receipt of deferred consideration in respect of home shopping and Reality – 258

Sale of other businesses 6 –

Cash inflow from disposal of subsidiaries 6 258

(e) Financing

Debt due within one year:

Repayment of borrowings (746) (42)

New borrowings 29 –

Debt due after more than one year:

Repayment of borrowings – (1,381)

New borrowings 1,409 –

Net cash flow from debt financing 692 (1,423)

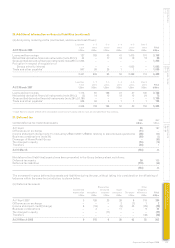

(f) Analysis of cash and cash equivalents

Cash at bank and in hand 148 364

Short-term investments 3 543

Cash and cash equivalents per Group balance sheet 151 907

Overdrafts (4) (273)

Cash and cash equivalents per Group cash flow statement 147 634

(g) Major non-cash transactions

Other than those obligations acquired in connection with the purchase of Serasa, the Group did not enter into any new finance lease

arrangements during the year (2007: US$nil). Finance lease obligations of Serasa at the date of acquisition in June 2007 were US$19m.