Experian 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.82 Experian Annual Report 2008

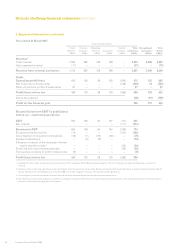

3. Financial risk management (continued)

Price risk

The Group is exposed to price risk in connection with investments classified on the balance sheet as available for sale financial

assets. Such investments are primarily held to provide security in connection with unfunded pension obligations and are

managed by independent fund managers who seek to mitigate such risk by diversification of the portfolio.

At 31 March 2008, if the relevant stock market and other indices had been 10% higher/lower with all other variables held

constant, no further gains/losses would have been recognised in the Group statement of recognised income and expense.

Credit risk

In the case of derivative financial instruments, deposits and trade receivables, the Group is exposed to credit risk, which

results from the non-performance of contractual agreements on the part of the contract party.

This credit risk is minimised by a policy under which the Group only enters into such contracts with banks and financial

institutions with strong credit ratings, within limits set for each organisation. Dealing activity is closely controlled and

counterparty positions are monitored regularly. The general credit risk on derivative financial instruments utilised by the

Group is therefore not considered to be significant. No credit limits were exceeded during the year and the Group does not

anticipate that any losses will arise from non-performance by these counterparties.

At the balance sheet date trade receivables with financial institutions accounted for some 41% (2007: 40%) of total trade

receivables in the UK and some 38% (2007: 39%) of total trade receivables in the US. The remaining balances are distributed

across multiple industries and geographies. The Group has implemented policies that require appropriate credit checks on

potential customers before granting credit. The maximum credit risk of such financial assets is represented by the carrying

value of the asset net of any applicable provision for impairment.

Liquidity risk

The Group maintains long-term committed facilities that are managed to ensure it has sufficient available funds for

operations and planned expansions. The Group monitors rolling forecasts of the Group’s net debt including projected cash

flows and the level of committed facilities necessary to meet these.

Details of the facilities available to the Group and their utilisation at the balance sheet date are given in note 24. Maturity

analyses for financial liabilities are given in note 30.

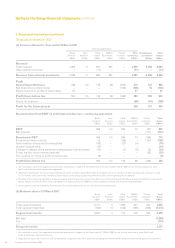

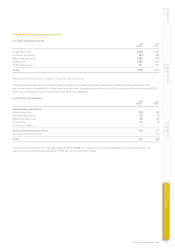

4. Capital risk management

The Group’s objectives in managing capital are to safeguard its ability to continue as a going concern in order to provide

returns for shareholders and benefits for other stakeholders and to maintain an optimal capital structure and cost of capital.

In order to maintain or adjust the capital structure, the Group may adjust the amount of dividends paid to shareholders,

return capital to shareholders, issue new shares or sell assets to reduce net debt. As part of its internal reporting processes

the Group monitors capital employed by geographical segment. For this purpose, capital employed excludes net debt and

taxation balances. The Group manages its working capital in order to meet its target for the conversion of EBIT into operating

cash flow.

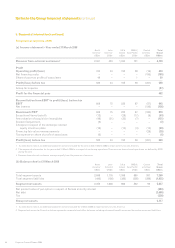

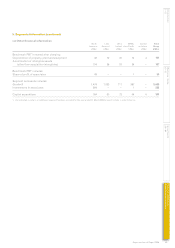

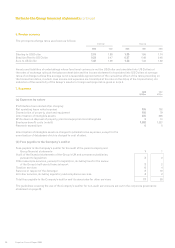

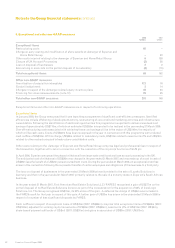

5. Segmental information

A business segment is a group of assets and operations engaged in providing products or services that are subject to risks

and returns that are different from those of other business segments. A geographical segment is engaged in providing

products or services within a particular economic environment and is subject to risks and returns that are different from

those of segments operating in other economic environments.

Inter-segment transactions are entered into under the normal commercial terms and conditions that would also be available

to unrelated third parties. There is no material impact from inter-segment transactions on the Group’s results.

Notes to the Group financial statements continued