Experian 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 Experian Annual Report 2008

Financial risk management

The Group seeks to reduce its

exposures to foreign exchange,

interest rate and other financial risks.

Full disclosures in respect of financial

risks, as required by IFRS 7 ‘Financial

Instruments: Disclosures’ which

became effective from 1 April 2007,

are included within the notes to the

financial statements.

Foreign exchange risk

The Group’s reported profit can be

significantly affected by currency

movements. In the year ended 31

March 2008 approximately 36% of

the Group’s EBIT from continuing

operations was earned in currencies

other than the US Dollar.

The Group operates internationally

and is exposed to foreign exchange risk

from future commercial transactions,

recognised assets and liabilities and

investments in, and loans between,

entities with different functional

currencies. The Group manages such

risk, primarily within entities whose

functional currencies are Sterling,

by borrowing in the relevant foreign

currencies and using forward foreign

exchange contracts. The principal

transaction exposures are to the US

Dollar and the Euro.

The Group has investments in entities

with other functional currencies,

whose net assets are exposed to

foreign exchange translation risk. In

order to reduce the impact of currency

fluctuations on the value of such

entities, the Group has a policy of

borrowing in US Dollars and Euros, as

well as in Sterling and of entering into

forward foreign exchange contracts in

the relevant currencies.

Interest rate risk

The Group’s interest rate exposure

is managed by the use of fixed and

floating rate borrowings and by the

use of interest rate swaps to adjust

the balance of fixed and floating rate

liabilities. The Group also mixes

the duration of its borrowings to

smooth the impact of interest rate

fluctuations.

Credit risk

The Group’s exposure to credit risk is

managed by dealing only with banks

and financial institutions with strong

credit ratings, within limits set for

each organisation. Dealing activity is

closely controlled and counterparty

positions are monitored regularly.

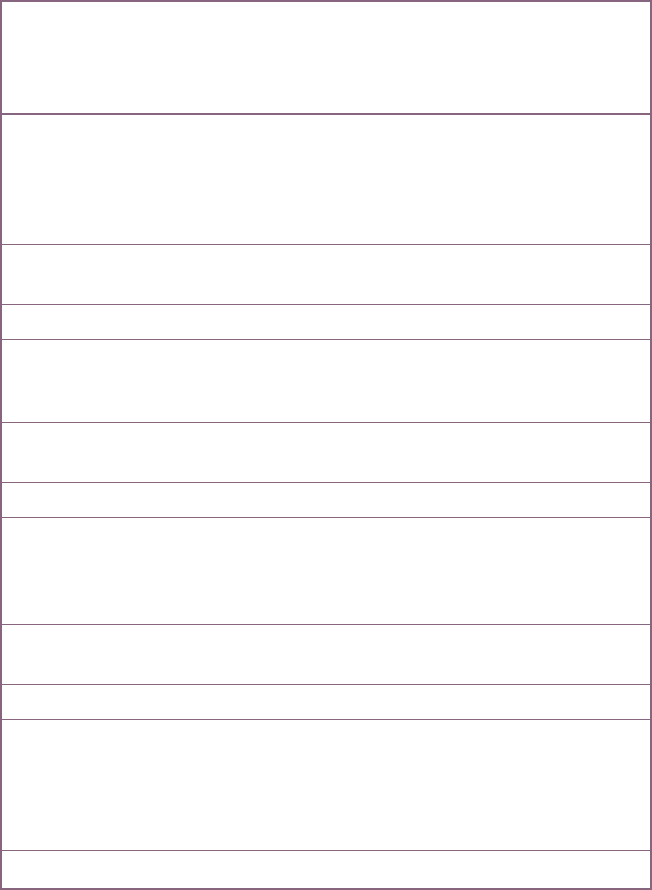

1 Growth at constant exchange rates

2 Discontinuing activities include MetaReward, UK account processing and Loyalty Solutions

3 EBIT margin is for continuing direct business only, excluding FARES

Reconciliation of revenue and EBIT by principal activity

Organic

2008 2007 Growth1 growth1

12 months to 31 March US$m US$m % %

Revenue

Credit Services 1,901 1,503 19 1

Decision Analytics 469 392 13 7

Marketing Services 830 728 10 1

Interactive 859 784 9 9

Total – continuing activities 4,059 3,407 14 4

Discontinuing activities2 71 85 n/a

Total 4,130 3,492 14

EBIT

Credit Services – direct business 531 419 21

Serasa integration charge (11) – n/a

Total Credit Services – direct business 520 419 19

FARES 54 61 (11)

Total Credit Services 574 481 15

Decision Analytics 154 136 7

Marketing Services 78 65 18

Interactive 189 173 9

Central activities (57) (47) (15)

Total – continuing activities 938 808 13

Discontinuing activities2 7 18 n/a

Total 945 825 11

EBIT margin

Credit Services – direct business 27.4% 27.9%

Decision Analytics 32.8% 34.7%

Marketing Services 9.4% 8.9%

Interactive 22.0% 22.1%

Total EBIT margin3 21.8% 21.9%

Financial review continued