Experian 2008 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23Experian Annual Report 2008

Financial statements

65 – 144

Governance

38 – 64

Introduction

2 – 5

Business review

Financial review

Business review

Financial review

Business review

Financial review

The basic earnings per share for

the prior year of 49.9 US cents

included 14.8 US cents in respect of

discontinued operations. Benchmark

earnings per share increased to 60.3

US cents from 59.7 US cents last year.

The board has announced a dividend

of 12.0 US cents per ordinary share,

giving a dividend per share of 18.5 US

cents for the full year which is covered

3.5 times by benchmark earnings.

Share price and total equity

The share price of Experian ranged

from a low of 358p to a high of 633.5p

during the year. On 31 March 2008, the

mid market price was 367p, giving a

market capitalisation of US$7.4bn at

that date.

Total equity at 31 March 2008

amounted to US$2,117m, equivalent

to US$2.09 per share, an increase of

US$10m in the year.

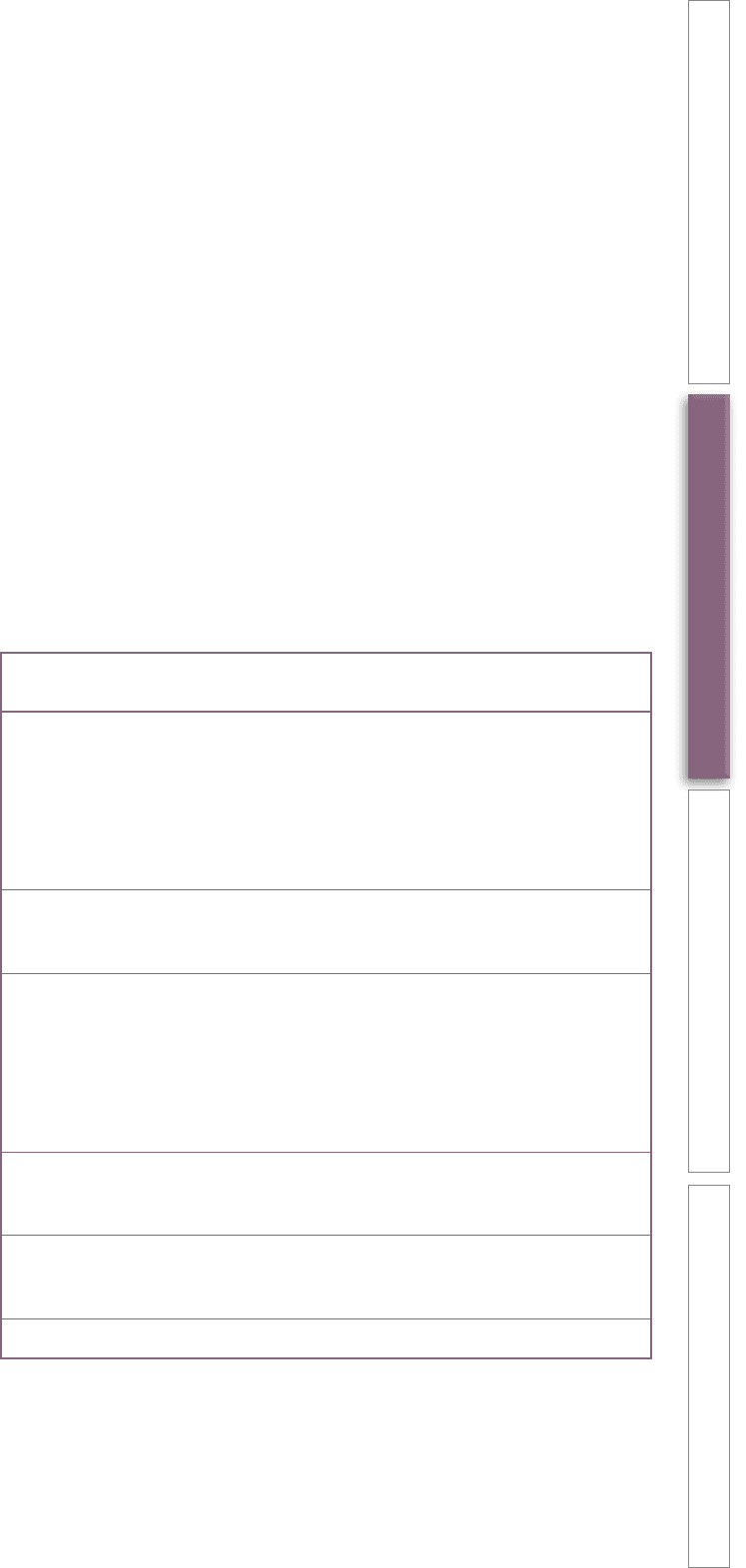

Cash flow and net debt

As indicated in the table opposite,

the Group’s free cash flow in the year

ended 31 March 2008 was US$679m

compared with US$577m in 2007.

Capital expenditure in 2008 was

US$344m, US$69m higher than last

year as a result of capital expenditure

in newly acquired businesses. Such

expenditure was equivalent to 118% of

the depreciation charge in 2008.

Free cash flow, together with existing

cash resources and draw downs from

borrowing facilities, was used to

fund acquisitions of US$1,720m and

dividends of US$193m. Cash outflow

from exceptional items amounted to

US$45m. The net cash outflow for the

year was US$1,282m.

Net debt at 31 March 2008 increased

by US$1,291m to US$2,699m, up from

US$1,408m at 31 March 2007.

Acquisitions

Acquisition expenditure amounted to

US$1,720m (2007: US$118m), including

deferred and contingent consideration

on prior year acquisitions. During the

year ended 31 March 2008, acquisition

expenditure was principally in

connection with the purchase of

Hitwise and the majority stake in Serasa.

Liquidity and funding

The Group seeks to ensure that

sufficient liquidity is available to meet

foreseeable needs and to invest its

cash assets safely and profitably.

The maturity, currency and interest

rate profiles of the Group’s borrowings

are shown in note 30 to the financial

statements. The maturity profile is

spread over the next six years, to avoid

excessive concentration of refinancing

needs. At 31 March 2008 undrawn

committed borrowing facilities totalled

US$1,121m.

During the year, the Group redeemed

the whole of the outstanding balance

of the 4.125% Euronotes 2007 at their

par value of €548m.

Group cash flow 2008 2007

12 months to 31 March US$m US$m

EBIT from continuing operations 945 825

Depreciation and amortisation 291 237

Capital expenditure (344) (275)

Change in working capital 5 5

Retained in associate (17) (22)

Charge in respect of equity incentive plans

within Benchmark PBT 22 34

Operating cash flow1 902 804

Net interest paid (132) (106)

Tax paid (91) (121)

Free cash flow 679 577

Net cash outflow from exceptional items (45) (98)

Acquisitions (1,720) (118)

Purchase of available for sale financial assets and

investments in associates (9) (42)

Disposal of subsidiaries 6 258

Dividends paid (193) (401)

Net cash flow (1,282) 176

Foreign exchange movements 19 166

Other financing related cash flows 776 121

Movement in cash and cash equivalents (continuing) (487) 463

Movement in cash and cash equivalents

– discontinued operations – 32

Movement in cash and cash equivalents (487) 495

1 Operating cash flow of US$902m (2007: US$804m) is derived from cash generated from operations in the Group cash flow

statement of US$1,165m (2007: US$942m) after adjusting for the outflow for capital expenditure of US$344m (2007: US$275m)

and adding US$36m (2007: US$39m) in respect of dividends from associates and US$45m (2007: US$98m) in respect of the

cash outflow from exceptional items