Experian 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.72 Experian Annual Report 2008

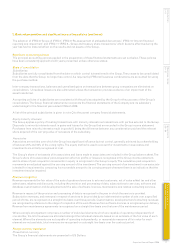

2. Basis of preparation and significant accounting policies (continued)

Transactions and balances

Transactions in foreign currencies are recorded in the functional currency of the relevant Group entity at the exchange rate

prevailing on the date of the transaction. At each balance sheet date, monetary assets and liabilities denominated in foreign

currencies are retranslated at the exchange rate prevailing at the balance sheet date. Translation differences on monetary items

are taken to net financing costs in the Group income statement except when deferred in equity, as qualifying net investment hedges

or cash flow hedges.

Translation differences on non-monetary available for sale financial assets are reported as part of the fair value gain or

loss in equity.

Group undertakings

The results and financial position of Group undertakings whose functional currencies are not US Dollars are translated into

US Dollars as follows:

Assets and liabilities are translated at the closing rate at the balance sheet date;

l

Income and expenses are translated at the average exchange rate for the year (unless this average is not a reasonable l

approximation of the cumulative effect of the rates prevailing on the transaction dates, in which case income and expenses

are translated at the rate on the dates of the transactions); and

All resulting exchange differences are recognised as a separate component of equity.

l

On consolidation, exchange differences arising from the translation of the net investment in entities whose functional

currency is not the US Dollar, and of borrowings and other currency instruments, primarily foreign exchange contracts,

designated as hedges of such investments, are taken to equity. Tax charges and credits attributable to those exchange

differences are taken directly to equity. When such an entity is sold, such exchange differences are recognised in the Group

income statement as part of the gain or loss on sale. Goodwill and fair value adjustments arising on the acquisition of such

entities are treated as assets and liabilities of the entities and are translated at the closing rate.

Share-based payments

IFRS 2 ‘Share-based Payment’ applies to equity instruments, such as share options, granted since 7 November 2002. The

Group elected to adopt full retrospective application of the standard on all share options and awards granted to employees

before 7 November 2002 but not vested at the date of transition to IFRS (1 April 2004).

The Group has a number of equity settled, share-based compensation plans. These include awards in respect of shares in the

Company made at or after demerger together with awards previously made in respect of shares in GUS plc which were rolled

over into awards in respect of shares in the Company at demerger. The fair value of options and shares granted is recognised

as an expense in the Group income statement on a straight line basis over the vesting period after taking into account the

Group’s best estimate of the number of awards expected to vest. The Group revises the vesting estimate at each balance

sheet date. Non-market performance conditions are included in the vesting estimates. Expenses are incurred over the vesting

period. Fair value is measured at the date of grant using whichever of the Black-Scholes model, Monte Carlo model and

closing market price is most appropriate to the award. Market based performance conditions are included in the fair value

measurement on grant date and are not revised for actual performance.

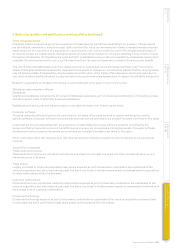

Goodwill

Goodwill is the excess of the fair value of the consideration payable for an acquisition over the fair value of the Group’s share

of identifiable net assets of a subsidiary or associate acquired at the date of acquisition. Fair values are attributed to the

identifiable assets, liabilities and contingent liabilities that existed at the date of acquisition, reflecting their condition at that

date. Adjustments are made where necessary to bring the accounting policies of acquired businesses into alignment with those

of the Group.

Goodwill on acquisitions of subsidiaries is separately recognised in the balance sheet. Goodwill on acquisitions of

associates is included in the carrying amount of the investment. Goodwill is stated at cost less any impairment. Goodwill

is not amortised but is tested annually for impairment. An impairment charge is recognised for any amount by which the

carrying value of goodwill exceeds its recoverable amount.

Goodwill is allocated to cash generating units (‘CGUs’) and monitored for internal management purposes by geographical

segment. The allocation is made to those CGUs or groups of CGUs that are expected to benefit from the business

combination in which the goodwill arose. Where the recoverable amount of the CGU is less than its carrying amount,

including goodwill, an impairment loss is recognised in the Group income statement.

Gains and losses on the disposal of an entity include the carrying amount of goodwill relating to the entity sold, allocated

where necessary on the basis of relative fair value.

Notes to the Group financial statements continued