Experian 2008 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.16 Experian Annual Report 2008

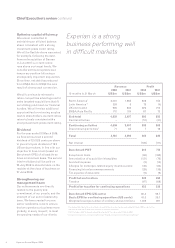

UK and Ireland

UK and Ireland performed well despite a difficult

market environment for the financial services sector.

This reflected the balance and diversity of the

Experian portfolio. There was significant investment

in new products, both organically and via acquisition,

and a focus on enhancing operational efficiency.

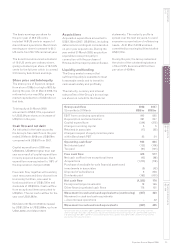

Credit Services

Includes consumer credit and

business information bureaux and

automotive and insurance services

Total revenue for Credit Services

increased by 4% at constant exchange

rates, with organic revenue growth

of 1%. Acquisitions contributed 3%

to revenue growth, primarily The pH

Group. There was good progress in

business information over the year,

which offset weakness in consumer

information. This weakness was

attributable to the unprecedented

market conditions that affected the

financial services sector and which

led to lower transaction volumes

on consumer credit information

products. Elsewhere, there were

good performances in new vertical

markets; in telecommunications

Experian continues to gain share, and

there has been significant progress

in the UK public sector with four

substantial multi-year contract wins.

There was also good progress with

large financial services customers,

including a significant multi-year

renewal with HBOS at increased

contract value.

Strategically, Experian maintains its

focus on product innovation and a

strong new product pipeline has been

built which will support both business

and consumer information activities,

including new services in the trade

credit sector, as well as in account

management and collections. During

the year, there was also further focus

on enhancing operational efficiency

with new investment in low-cost

delivery centres.

Decision Analytics

Includes credit analytics, decision

support software and fraud solutions

Total revenue at Decision Analytics

increased by 8% at constant

exchange rates, flat on an organic

basis. Acquisitions contributed

the growth, namely Tallyman and

N4 Solutions. Performance was

affected by the challenging market

environment for financial services.

Lower credit origination volumes

impacted revenue from application

processing, while capital expenditure

cutbacks by lenders gave rise to

delays in pipeline conversion. These

factors were counterbalanced by

good growth in fraud prevention

software where new client wins were

secured for Experian’s Hunter and

Probe solutions.

During the year, Experian

acquired the Tallyman collections

management software business and

N4 Solutions, a mortgage sector and

financial services software provider.

Both acquisitions have performed

very well, benefiting from their

integration into Experian. Tallyman

has generated multiple new business

wins in the financial services,

telecommunications and utilities

sectors, while N4 Solutions secured

new contracts with Norwich Union

and Nationwide. There was also

significant organic investment in new

products to help lenders with default

and insolvency consultancy, public

sector scoring, plus further initiatives

in fraud solutions.

• Revenue from continuing

activities up 8% at constant

exchange rates; 3% organic

• EBIT flat year-on-year at

constant exchange rates

• Portfolio balance offset

challenging market

environment for financial

services sector activities

• Considerable progress in

new vertical markets

• Significant new product

investment, both organically

and via acquisition

• Interactive performed

strongly, nearly doubling

revenue year-on-year at

constant exchange rates