Experian 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117Experian Annual Report 2008

Introduction

2 – 5

Business review

6 – 37

Governance

38 – 64

Financial statements

Group financial statements

Financial statements

Group financial statements

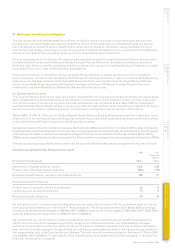

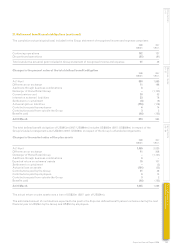

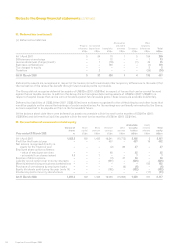

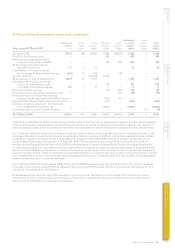

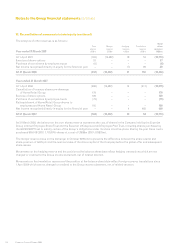

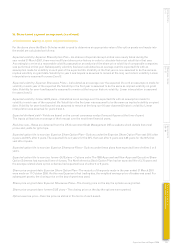

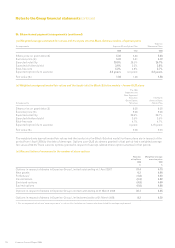

32. Reconciliation of movements in total equity (continued)

Attributable Equity

Number of Share Share Retained Other to equity minority To t a l

shares capital premium earnings reserves holders interests equity

Year ended 31 March 2007 m US$m US$m US$m US$m US$m US$m US$m

At 1 April 2006 879.2 88 16,256 5,683 (16,575) 5,452 2 5,454

Profit for the financial year – – – 462 – 462 1 463

Net income recognised directly

in equity for the financial year – – – 132 469 601 – 601

Share issues pre demerger of

Home Retail Group 7.1 1 75 – – 76 – 76

Cancellation of treasury shares

pre demerger of Home Retail Group (8.9) (1) (178) – 179 – – –

Capital reduction – – (16,153) 16,153 – – – –

Share issues by way of Global Offer 142.9 14 1,427 – – 1,441 – 1,441

Employee share option schemes:

– value of employee services – – – 109 – 109 – 109

– proceeds from shares issued 2.0 – 8 – – 8 – 8

Exercise of share options – – – (70) 129 59 – 59

Purchase of own shares by employee trusts – – – – (75) (75) – (75)

Relinquishment of Home Retail Group

shares to employees and Home Retail Group – – – (100) 100 – – –

Equity dividends paid during the year (note 14) – – – (401) – (401) – (401)

Dividend in specie relating to the demerger

of Home Retail Group (note 14) – – – (5,627) – (5,627) – (5,627)

Dividends paid to minority shareholders – – – – – – (1) (1)

At 31 March 2007 1,022.3 102 1,435 16,341 (15,773) 2,105 2 2,107

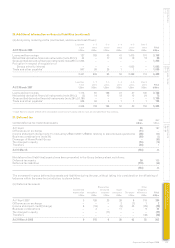

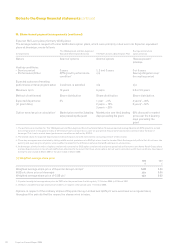

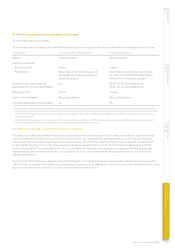

The balance classified as share capital is the nominal value of the Company’s issued share capital. Further details relating

to the authorised and issued share capital of Experian Group Limited at the balance sheet dates, together with details of

ordinary shares issued since the balance sheet date, are contained in note K to the parent company financial statements.

On 10 October 2006, the separation of Experian and Home Retail Group was completed by way of demerger. As part of the

demerger, Experian Group Limited became the ultimate holding company of GUS plc and related subsidiaries and shares

in GUS plc ceased to be listed on the London Stock Exchange on 6 October 2006. Trading of shares in Experian on the

London Stock Exchange commenced on 11 October 2006. This transaction was accounted for using the principles of

merger accounting and the distribution to GUS plc shareholders of shares in Home Retail Group plc was accounted for

as a dividend in specie. In accordance with the requirements of merger accounting, the nominal values of the issued share

capital at 1 April 2005 and subsequent movements to the date of demerger were amended to reflect the capital structure of

Experian Group Limited. These movements included the recognition of a share premium balance in Experian Group Limited

on a reorganisation prior to the demerger and the subsequent reduction of share capital and the transfer of the associated

share premium account to retained earnings.

On 11 October 2006, the Group raised US$1,441m, net of US$43m expenses, by way of a share offer. The amount received

in excess of the nominal value of shares issued is reported as part of the share premium account and the balance on this

account is not available for distribution.

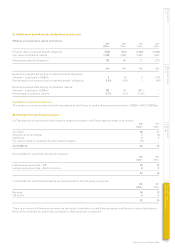

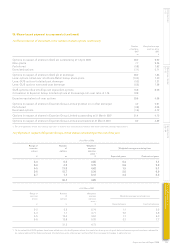

Retained earnings comprise net profits retained in the Group after the payment of dividends. The composition of and

movements on other reserves are explained below. There are no significant statutory, contractual or exchange control

restrictions on distributions by Group undertakings.