Experian 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61Experian Annual Report 2008

Introduction

2 – 5

Business review

6 – 37

Financial statements

65 – 144

Governance

Report on directors’ remuneration

Governance

Report on directors’ remuneration

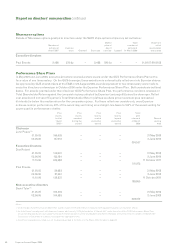

GUS Co-investment Plans and Experian Reinvestment Plans

Awards to directors under the 2004 and 2005 cycles of the GUS Co-investment Plan and North America

Co-investment Plan were reinvested in awards under the Experian Reinvestment Plan and North America Reinvestment

Plan at demerger. Awards under the 2006 cycle were automatically rolled over into equivalent awards over Experian

shares under the rules of the GUS Co-investment Plan. Release of matching shares under the Experian Reinvestment

Plan is subject to the achievement of performance conditions (see note 3 to the table below), the retention of reinvested

awards and continued employment. No further awards will be made under the Reinvestment Plan. Matching shares

awarded under the GUS Co-investment Plans will be released subject to continued employment.

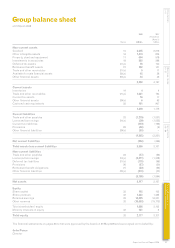

Co-

Co- investment

Reinvestment Special investment Plan Invested Experian Total

Invested Matching Matching Reinvestment Plan Matching and Share share plan

shares at shares at Award at award at invested share matching price on price shares at

1 April 1 April 1 April 1 April shares options shares date of on date 31 March Vesting

2007 2007 2007 2007 awarded awarded released release of award 2008 date

Chairman

John Peace(1)(2)

11.06.04 72,394 295,436 – 370,386 – – – – 560.0p 11 October 2009

13 06.05 75,712 308,976 – 387,361 – – – – 560.0p 11 October 2009

12.06.06 22,124 59,640 – – – – 81,764 600.0p 560.0p 12 June 2009

1,510,265

Executive directors

Don Robert

11.06.04 139,516 279,032 837,096 – – – – – 560.0p 11 October 2011

13.06.05 147,685 295,371 886,112 – – – – – 560.0p 11 October 2011

12.06.06 121,689 243,378 – – – – – – 560.0p 12 June 2009

29.06.07 – – – – 74,340 106,307 – – 630.0p 29 June 2010

3,130,526

Paul Brooks

11.06.04 51,910 103,820 311,460 – – – – – 560.0p 11 October 2011

13 06.05 53,003 106,005 318,016 – – – – – 560.0p 11 October 2011

12.06.06 55,215 110,432 – – – – – – 560.0p 12 June 2009

29.06.07 – – – – 44,544 63,999 – – 630.0p 29 June 2010

1,218,404

Non-executive directors

David Tyler(1) (4)

12.06.06 13,742 37,043 – – – – – – 560.0p 12 June 2009

50,785

Notes:

1. Invested shares for John Peace and David Tyler were purchased with their bonus net of tax. The matching share awards are made on a gross basis and are taxed

at the point of vesting. Invested shares for Don Robert and Paul Brooks were calculated by reference to the bonus gross of tax.

2. John Peace was not eligible to participate in the Reinvestment Plan. He was granted a special reinvestment award over Experian Group Limited shares which will

vest after three years if he continues to be Chairman of Experian Group Limited, subject to the good leaver reasons included in the rules. Details of this award

were disclosed in the circular to GUS shareholders dated 26 July 2006. Invested shares in respect of the 2006 GUS Co-investment Plan award for John Peace

were released following the end of his employment with Experian Finance plc on 31 March 2007 in accordance with the plan rules. The matching share option

in respect of this award also became exercisable in full on this date. Under the Plan rules, participants are entitled to dividend equivalents on exercise of this

matching share option. John Peace received £9,019 in respect of dividend equivalents payable on his matching share options.

3. The first 50% of a matching award under the Experian Reinvestment Plan will vest subject to satisfaction of a performance condition relative to a sliding scale

of growth in Experian Group’s PBT over a three year period. The threshold for vesting will be growth in PBT of 7% per annum at which 30% of this part of the

matching award will vest, rising on a straight-line basis to 100% of this part of the award vesting at growth in PBT of 14% per annum. This part of the matching

award will vest in two equal tranches on the fourth and fifth anniversaries of grant. The remaining 50% of the matching award will be time-based and will vest as

to 50% of this part of the matching award on the third anniversary of grant and as to 25% on each of the fourth and fifth anniversaries of grant.

4. David Tyler’s 2004 and 2005 GUS Co-investment Plan awards vested at the time of the GUS plc demerger, and he did not reinvest these awards. David Tyler’s 2006

GUS Co-investment Plan awards were rolled over on the basis described in footnote 3 to the Share Options table on page 59.