Experian 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79Experian Annual Report 2008

Introduction

2 – 5

Business review

6 – 37

Governance

38 – 64

Financial statements

Group financial statements

Financial statements

Group financial statements

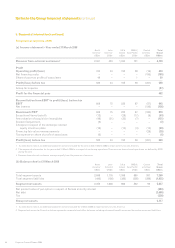

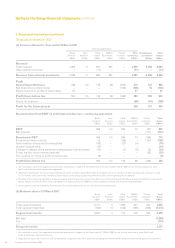

2. Basis of preparation and significant accounting policies (continued)

The expected return on plan assets is calculated by reference to the plan investments at the balance sheet date and is a

weighted average of the expected returns on each main asset type based on market yields available on these asset types at

the balance sheet date.

The Group determines the appropriate discount rate at the end of each year. This is the interest rate used to calculate

the present value of estimated future cash outflows expected to be required to settle the defined benefit obligations. In

determining the discount rate, the Group has considered the prevailing market yields of high-quality corporate bonds that are

denominated in the currency in which the benefits will be paid, and that have terms to maturity consistent with the estimated

average term of the related pension liability.

Other key assumptions for defined benefit obligations and pension costs are based in part on market conditions at the

relevant balance sheet dates and additional information is disclosed in note 27.

Fair value of derivatives and other financial instruments

The fair value of financial instruments that are not traded in an active market (for example, over-the-counter derivatives) is

determined using valuation techniques. The Group uses its judgement to select a variety of methods and makes assumptions

that are mainly based on market conditions existing at each balance sheet date.

The assumptions in respect of the valuation of the put option associated with the remaining 30% stake of Serasa are set out

in note 29(d).

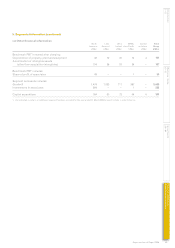

Goodwill

Goodwill is allocated to CGUs and monitored for internal management purposes by geographical segment. The allocation is made

to those CGUs or groups of CGUs that are expected to benefit from the business combination in which the goodwill arose.

The Group tests goodwill for impairment annually or more frequently if events or changes in circumstances indicate that the

goodwill may be impaired. The recoverable amount of each CGU is generally determined based on value-in-use calculations,

which require the use of cash flow projections based on financial budgets approved by management, looking forward up to

five years. Cash flows are extrapolated using estimated growth rates beyond a five year period. The growth rates used do not

exceed the long-term average growth rate for the businesses in which the segment operates.

In view of the significance of the Serasa acquisition on the Latin American segment goodwill, the impairment review was

based on the fair value evidenced by that transaction. Key assumptions used for value-in-use calculations for all other

CGUs are:

Budgeted gross margin;

l

Weighted average real growth rate of 2.25% used to extrapolate cash flows beyond the budget period; and l

Pre-tax discount rate of 11.4% applied to the pre-tax cash flow projections. l

Management determines budgeted gross margin based on past performance and its expectations for the market

development. The weighted average growth rates used are consistent with the forecasts included in industry reports. The

discount rates used reflect the Group’s post-tax weighted average cost of capital of 8%.

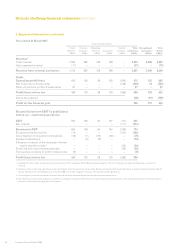

Share-based payments

The Group has a number of equity settled share-based payment arrangements in existence. The assumptions used in

determining the amounts charged in the Group income statement include judgements in respect of performance conditions

and length of service together with future share prices, dividend and interest yields and exercise patterns.

Critical judgements

Management has made certain judgements in the process of applying the Group’s accounting policies set out above that

have a significant effect on the amounts recognised in the Group financial statements. These include the classification of

transactions between the Group income statement and the Group balance sheet. These accounting policy descriptions

indicate where judgement needs exercising.

The most significant of these judgements is in respect of intangible assets where certain costs incurred in the developmental

phase of an internal project are capitalised if a number of criteria are met. Management has made certain judgements and

assumptions when assessing whether a project meets these criteria, and on measuring the costs and the economic life

attributed to such projects. On acquisition, specific intangible assets are identified and recognised separately from goodwill

and then amortised over their estimated useful lives. These include such items as brand names and customer lists, to which

value is first attributed at the time of acquisition. The capitalisation of these assets and the related amortisation charges are

based on uncertain judgements about the value and economic life of such items. The economic lives for intangible assets

are estimated at between three and seven years for internal projects, which include databases, internal use software and

internally generated software, and between two and 20 years for acquisition intangibles.