Experian 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 Experian Annual Report 2008

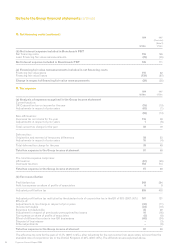

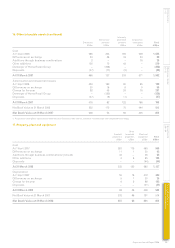

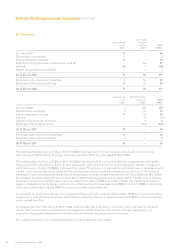

22. Cash and cash equivalents (continued)

(b) Cash at bank and short-term investments of US$151m (2007: US$907m) are further analysed by external credit rating

where a balance with the counterparty is greater than US$2m:

2008 2007

US$m US$m

A rated 44 852

B rated 58 6

Counterparty holding of less than US$2m 49 49

151 907

23. Trade and other payables

Current Non-current Current Non-current

2008 2008 2007 2007

US$m US$m US$m US$m

Trade creditors 214 – 193 –

VAT and other taxes payable 52 – 42 –

Social security costs 95 – 75 –

Accruals and deferred income 818 24 653 17

Other creditors 100 33 68 35

1,279 57 1,031 52

There is no material difference between the fair value of trade and other payables and the book value stated above. Non-

current trade and other payables of US$nil (2007: US$1m) are due after more than five years from the balance sheet date.

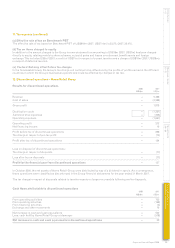

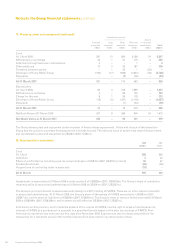

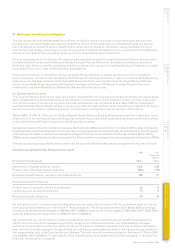

24. Loans and borrowings

(a) The analysis of loans and borrowings disclosed in the Group balance sheet is as follows:

Current Non-current Current Non-current

2008 2008 2007 2007

US$m US$m US$m US$m

€548m 4.125% Euronotes 2007 – – 751 –

£350m 6.375% Eurobonds 2009 – 732 – 721

£334m 5.625% Euronotes 2013 – 660 – 627

Bank loans 29 1,409 – –

Overdrafts 4 – 273 –

Present value of obligations under finance leases (note (d)) 6 10 1 –

39 2,811 1,025 1,348

During the year ended 31 March 2008, the whole of the outstanding balance of the 4.125% Euronotes 2007 was repaid on its

maturity at the par value of €548m. This repayment was financed from bank facilities that were in place at 31 March 2007.

During the year ended 31 March 2007, 4.125% Euronotes 2007 with a par value of €20m and 5.625% Euronotes 2013 with a par

value of £16m were redeemed.

The effective interest rate of Euronotes and Eurobonds approximates to the nominal rate indicated above. The effective

interest rate for overdrafts at 31 March 2008 is 4.6% (2007: 4.3%).

Other than finance lease obligations, all the borrowings of the Group shown above are unsecured. Finance lease obligations

are effectively secured as the rights to the leased assets revert to the lessor in the event of default.

Notes to the Group financial statements continued