Experian 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100 Experian Annual Report 2008

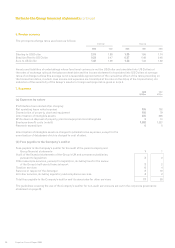

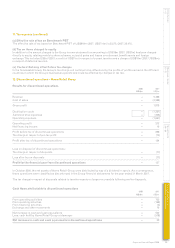

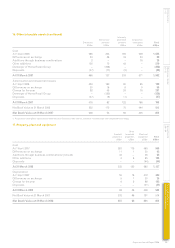

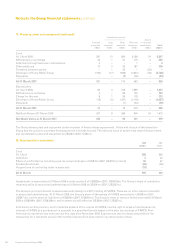

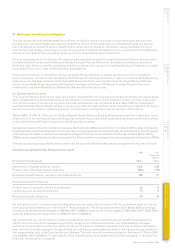

17. Property, plant and equipment (continued)

Leasehold properties

Assets

Freehold Long Short Plant and in course of

properties leasehold leasehold equipment construction To t a l

US$m US$m US$m US$m US$m US$m

Cost

At 1 April 2006 397 13 684 2,159 54 3,307

Differences on exchange 34 1 51 175 4 265

Additions through business combinations 3 – – 1 – 4

Other additions 13 3 32 181 – 229

Transfers between assets – – 22 – (22) –

Demerger of Home Retail Group (160) (17) (666) (1,907) (36) (2,786)

Disposals – – (8) (46) – (54)

At 31 March 2007 287 – 115 563 – 965

Depreciation

At 1 April 2006 60 4 318 1,255 – 1,637

Differences on exchange 3 – 29 100 – 132

Charge for the year 8 1 26 178 – 213

Demerger of Home Retail Group (16) (5) (347) (1,119) – (1,487)

Disposals – – (7) (42) – (49)

At 31 March 2007 55 – 19 372 – 446

Net Book Value at 31 March 2006 337 9 366 904 54 1,670

Net Book Value at 31 March 2007 232 – 96 191 – 519

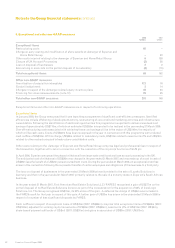

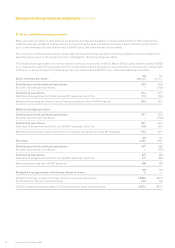

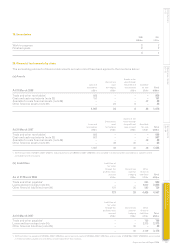

The Group leases plant and equipment under a number of finance lease agreements. At the end of each of the leases the

Group has the option to purchase the equipment at a beneficial price. The net book value of assets held under finance leases

and capitalised in plant and equipment is US$18m (2007: US$nil).

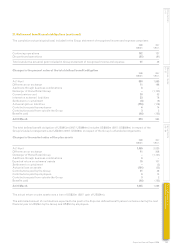

18. Investments in associates

2008 2007

US$m US$m

Cost

At 1 April 286 225

Additions 5 33

Share of profit after tax including a pre-tax exceptional gain of US$3m (2007: US$15m) (note 9) 50 67

Dividends received (36) (39)

Acquisitions of controlling stake in associate (10) –

At 31 March 295 286

Investments in associates at 31 March 2008 include goodwill of US$228m (2007: US$219m). The Group’s share of cumulative

retained profits of associated undertakings at 31 March 2008 is US$141m (2007: US$127m).

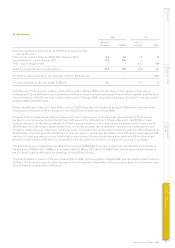

The Group’s principal interest in associated undertakings is a 20% holding of FARES. There are no other material interests

in associated undertakings. At 31 March 2008, the Group’s share of the assets of FARES amounted to US$497m (2007:

US$477m), and its share of liabilities is US$202m (2007: US$200m). The Group’s share of revenue for the year ended 31 March

2008 is US$249m (2007: US$249m), and its share of profit after tax US$50m (2007: US$67m).

First American Corporation, which holds the balance of the capital of FARES, has the right to acquire from Experian its

interest in FARES at a purchase price pursuant to a specified formula based on the after tax earnings of FARES. First

American Corporation may only exercise this right after November 2008. Experian can elect to delay completion of the

transaction for a maximum period of 24 months following First American Corporation giving notice.

Notes to the Group financial statements continued