Experian 2008 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 Experian Annual Report 2008

Interactive

Includes Consumer Direct (online credit

reports, scores and monitoring services

sold direct to consumers) and lead

generation businesses (LowerMyBills,

online education and PriceGrabber)

Revenue at Interactive grew by 5%

in the year.

Consumer Direct continued to

build strongly on its market-leading

position, delivering growth in excess

of 20%. This was driven by further

growth in subscription revenue and

good progress in development of the

affinity channel, for example from the

partnership with American Express.

Experian also continues to invest in

new products with broad market appeal

and which focus on new demographic

opportunities, for example in the

area of fraud prevention and identity

protection.

In lead generation, PriceGrabber

performed well with growth fuelled by

higher referral revenue, good growth in

co-brand partnerships and increased

media revenue. LowerMyBills was

impacted by the severe downturn in

sub-prime mortgage lending, which

led to a significant decline in revenue,

as previously disclosed. Strategically,

the emphasis has been on leveraging

the LowerMyBills platform, integrating

it with the education vertical and

diversifying into new verticals such

as credit card and insurance. The new

platform is now referred to as Experian

Interactive Media and positions

Experian to expand across multiple

vertical markets quickly and efficiently.

Financial review

Revenue from continuing activities

was US$2,061m, up 4%, with organic

revenue growth of 3%. The acquisition

of Hitwise contributed 1% to revenue

growth.

EBIT from direct businesses was

US$554m (2007: US$512m), an

increase of 8% in the year, giving an

EBIT margin of 26.9% (2007: 25.8%).

Margins improved in all four areas,

notwithstanding the difficult market

environment and while funding

investment in the Canadian credit

bureau build.

EBIT from FARES, the 20%-owned

real estate information associate,

was US$54m (2007: US$61m). This

reflected continued cost action,

which helped offset the very weak

environment for mortgage origination.

North America continued

Organic

2008 2007 Growth growth

12 months to 31 March US$m US$m % %

Revenue

– Credit Services 807 804 – –

– Decision Analytics 82 77 7 7

– Marketing Services 380 353 8 2

– Interactive 791 751 5 5

Total – continuing activities 2,061 1,985 4 3

Discontinuing activities1 - 4 n/a

Total North America 2,061 1,989 4

EBIT

– Direct business 554 512 8

– FARES 54 61 (11)

Total – continuing activities 608 573 6

Discontinuing activities1 – (7) n/a

Total North America 608 566 8

EBIT margin2 26.9% 25.8%

1 Discontinuing activities include MetaReward

2 EBIT margin is for continuing direct business only and excludes FARES

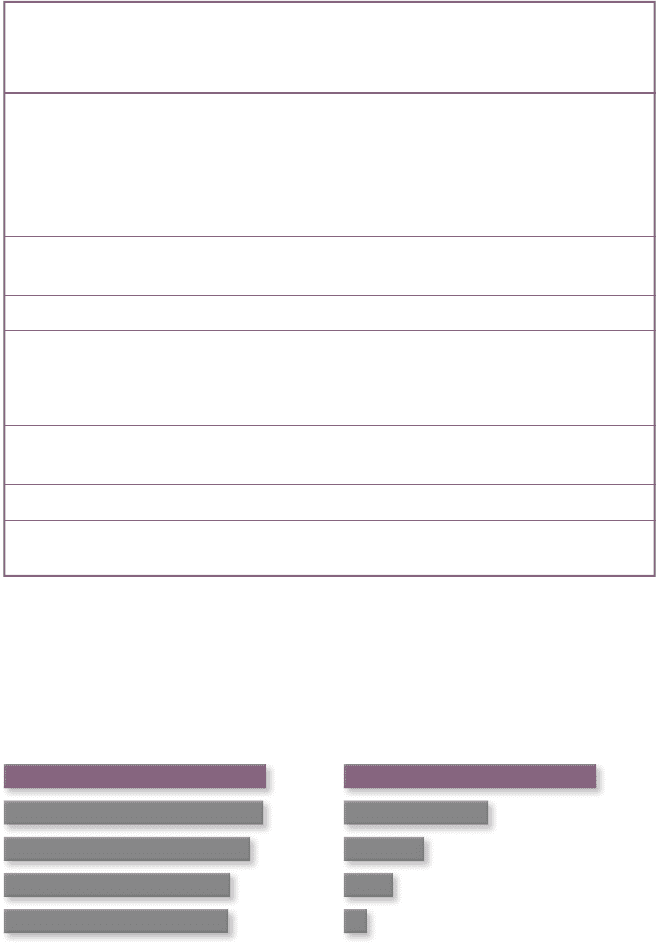

Volume of consumer credit reports

(indexed)

115

109

101

100

08

07

06

05

04

117

Volume of emails delivered (indexed)

637

359

212

100

08

07

06

05

04

1,127

08

07

06

05

04