Experian 2008 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 Experian Annual Report 2008

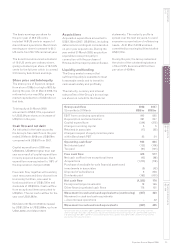

Revenue

Group revenue from continuing

operations grew by 18.6% from

US$3,481m to US$4,130m.

Benchmark profit before tax

(‘Benchmark PBT’)

Benchmark PBT for continuing

operations rose by US$105m to

US$819m, principally as a result of

the increase in revenue from

continuing operations including the

benefit of acquisitions.

Taxation

The Group’s effective rate of tax for

the year based on Benchmark PBT

was 23.2% (2007: 22.4%). The Group’s

cash tax rate (based on tax paid in the

year and Benchmark PBT) was 11.1%

(2007: 16.9%).

Earnings and dividends

per share

Basic earnings per share were 43.3 US

cents in the year ended 31 March 2008.

Bringing new confidence to the buying

of used cars

Experian’s vehicle history information is a

vital component in the used car buying and

selling process. It reveals if a vehicle has

been stolen or previously salvaged, whether

it has been water damaged or involved in an

accident, whether the mileage is correct and

other valuable insights.

Interpreting all this information can be time

consuming though, particularly for people

wanting to compare different vehicles

quickly and easily. That’s why Experian has

developed the AutoCheck Score in the US,

a world first for the vehicle industry. The

AutoCheck Score distills all the history

information Experian holds on a vehicle into

a single, numeric score and then compares

it to vehicles of similar age and type. The

AutoCheck Score is a valuable tool for

used car buyers and sellers, and has been

proven to increase confidence in the vehicle

purchase decision.

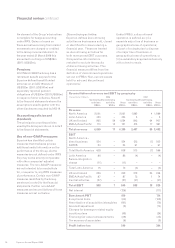

Financial review

The Group made sound financial progress in the year

with good revenue, profit and cash performance.