Experian 2008 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105Experian Annual Report 2008

Introduction

2 – 5

Business review

6 – 37

Governance

38 – 64

Financial statements

Group financial statements

Financial statements

Group financial statements

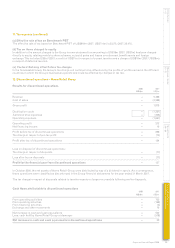

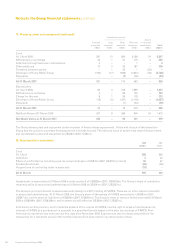

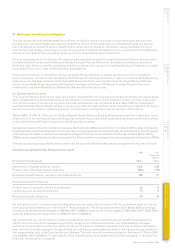

24. Loans and borrowings (continued)

(b) The carrying amounts of the Group’s loans and borrowings are denominated in the following currencies:

Current Non-current Current Non-current

2008 2008 2007 2007

US$m US$m US$m US$m

US Dollar 29 1,409 1 –

Sterling – 1,392 4 1,348

Brazilian Real 6 10 – –

Euro 4 – 1,020 –

39 2,811 1,025 1,348

(c) A comparison of carrying values and fair values of the Group’s loans and borrowings is as follows:

Carrying Fair Carrying Fair

value value value value

2008 2008 2007 2007

US$m US$m US$m US$m

€548m 4.125% Euronotes 2007 – – 751 751

£350m 6.375% Eurobonds 2009 732 732 721 722

£334m 5.625% Euronotes 2013 660 659 627 630

Bank loans 1,438 1,438 – –

Overdrafts 4 4 273 273

Present value of obligations under finance leases 16 16 1 1

2,850 2,849 2,373 2,377

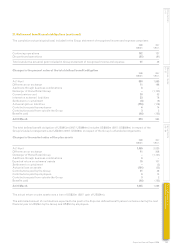

(d) The minimum lease payments payable under finance leases comprise:

2008 2007

US$m US$m

Not later than one year 7 1

Later than one year and not later than five years 15 –

Total minimum lease payments 22 1

Future finance charges on finance leases (6) –

Present value of finance leases 16 1

The present value of finance leases falls due:

Not later than one year 6 1

Later than one year and not later than five years 10 –

Present value of finance leases 16 1

(e) Borrowing facilities

At 31 March 2008, the Group had undrawn committed borrowing facilities of US$1,121m (2007: US$2,450m) which expire

more than two years after the balance sheet date. These facilities are in place for general corporate purposes, including the

financing of acquisitions.

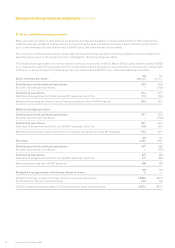

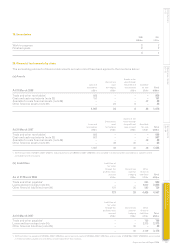

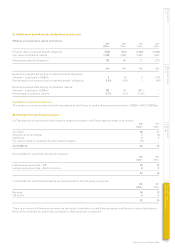

25. Analysis of net debt (non-GAAP measure)

2008 2007

US$m US$m

Cash and cash equivalents (net of overdrafts) 147 634

Derivatives hedging loans and borrowings (43) (6)

Debt due within one year (29) (729)

Finance leases (16) (1)

Debt due after more than one year (2,758) (1,306)

Net debt at the end of the financial year (2,699) (1,408)