Experian 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73Experian Annual Report 2008

Introduction

2 – 5

Business review

6 – 37

Governance

38 – 64

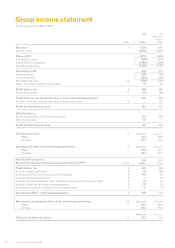

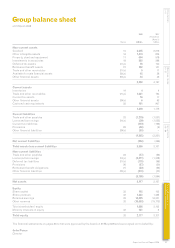

Financial statements

Group financial statements

Financial statements

Group financial statements

2. Basis of preparation and significant accounting policies (continued)

Other intangible assets

Intangible assets acquired as part of an acquisition of a business are capitalised separately from goodwill, if those assets

are identifiable, separable or arise from legal rights and their fair value can be measured reliably. Intangible assets acquired

separately from the acquisition of a business are capitalised at cost. Certain costs incurred in the developmental phase of

an internal project are capitalised as intangible assets provided that a number of criteria are satisfied. These criteria include

the technical feasibility of completing the asset so that it is available for use or sale, the availability of adequate resources to

complete the development and to use or sell the asset and how the asset will generate probable future economic benefit.

The cost of other intangible assets with finite useful economic or contractual lives is amortised over those lives. The carrying

values of intangible assets are reviewed for impairment when events or changes in circumstances indicate that the carrying values

may not be recoverable. If impaired the carrying values are written down to the higher of fair value less costs to sell, and value-in-

use, which is determined by reference to projected future income streams using assumptions in respect of profitability and growth.

Research expenditure is charged in the Group income statement in the year in which it is incurred.

Databases and computer software

Databases

Capitalised databases comprise the fair value of databases acquired as part of a business combination or the data purchase

and data capture costs of internally developed databases.

Databases are held at cost and are amortised on a straight line basis over three to seven years.

Computer software

Acquired computer software licences are capitalised on the basis of the costs incurred to acquire and bring into use the

specific software. Computer software licences are held at cost and are amortised on a straight line basis over three to five years.

Costs that are directly associated with the production of identifiable and unique software products controlled by the

Group, and that will generate economic benefits beyond one year, are recognised as intangible assets. Computer software

development costs recognised as assets are amortised on a straight line basis over three to five years.

Other costs associated with developing or maintaining computer software programmes are recognised as an expense as

incurred.

Acquisition intangibles

Trademarks and licences

Trademarks and licences are carried at cost and are amortised on a straight line basis over their contractual lives, up to a

maximum period of 20 years.

Trade names

Legally protected or otherwise separable trade names acquired as part of a business combination are capitalised at fair

value on acquisition and amortised on a straight line basis over three to fourteen years based on management’s expectations

to retain trade names within the business.

Customer relationships

Contractual and non-contractual customer relationships acquired as part of a business combination are capitalised at fair

value on acquisition and amortised on a straight line basis over three to eighteen years based on management’s estimates of

the average lives of customer relationships.

Completed technology

Completed technology acquired as part of a business combination is capitalised at fair value on acquisition and amortised

on a straight line basis over three to eight years based on the expected life of the asset.