Experian 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70 Experian Annual Report 2008

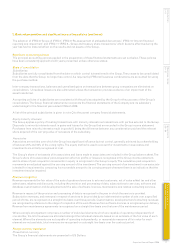

1. Corporate information

Experian Group Limited (the ‘Company’), which is the ultimate parent company of the Experian Group, is incorporated and

registered in Jersey under Jersey Companies Law as a public company limited by shares. The Company’s shares are listed on

the London Stock Exchange. Experian is a business services group.

The consolidated financial statements of Experian Group Limited and its subsidiary undertakings (‘Experian’ or ‘the Group’)

were approved by the Board on 20 May 2008.

2. Basis of preparation and significant accounting policies

Basis of preparation

The Group financial statements are presented in US Dollars as this is the most representative currency of the Group’s

operations. The financial statements are rounded to the nearest million. They are prepared on the historical cost basis

modified for the revaluation of certain financial instruments. The principal exchange rates used in preparing the Group

financial statements are set out in note 6.

In compliance with the requirements for companies whose shares are listed on the London Stock Exchange, the financial

statements of the Company are included within the Group annual report and they are set out on pages 132 to 141. These

are presented in Sterling as that is the functional currency of the Company. In determining its functional currency, the

directors have taken account of the fact that the assets and liabilities and cash flows of Experian Group Limited are primarily

denominated in Sterling. The Company has elected to prepare its financial statements under UK accounting standards.

The Group financial statements are prepared in accordance with International Financial Reporting Standards (‘IFRS’) as adopted

for use in the European Union (the ‘EU’) and as issued by the International Accounting Standards Board (‘IASB’). These are those

standards, subsequent amendments and related interpretations issued and adopted by the IASB that have been endorsed by the

EU. Although the Company is incorporated and registered in Jersey, the Group financial statements include disclosures sufficient

to comply with those parts of the UK Companies Act 1985 applicable to companies reporting under IFRS.

As indicated below, during the year ended 31 March 2008, there have been a number of new accounting standards, amendments

and interpretations effective for accounting periods beginning on or after 1 April 2007. None of these has had a material impact

on the results or financial position of the Group for the year under review although, in accordance with the requirement of

IFRS 7 ‘Financial Instruments: Disclosures’, gains and losses on fair value hedges are now reported on a gross basis in the

Group income statement. Comparative figures have been restated and the effect is to increase financing income and financing

expense for the year ended 31 March 2007 by US$55m. In addition pension assets and liabilities are now reported separately in

the Group balance sheet where there is no right of offset and accordingly liabilities of US$50m are now reported as retirement

benefit obligations at 31 March 2008. Comparative figures have been restated and the effect is to increase non-current assets

and non-current liabilities at 31 March 2007 by US$56m. With these exceptions, the financial information has accordingly been

prepared on a consistent basis with that reported for the year ended 31 March 2007 although, following the acquisition of a

70% stake in Serasa during the year, the segmental information presented in respect of the Americas in note 5 is now further

analysed to show North and Latin America as separate segments.

In connection with the acquisition of the 70% stake in Serasa, the Group entered into a put/call option agreement over the

remaining shares held by the minority shareholders. In accordance with IAS 39 ‘Financial Instruments: Recognition and

Measurement’ the put element is shown as a liability stated at the net present value of the expected future payments and in

accordance with IAS 1 ‘Presentation of Financial Statements’ this liability is shown as a non-current financial liability. The

net present value of the put option was reassessed at 31 March 2008 and the change since the date of acquisition has been

recognised in the Group income statement within finance income.

On 10 October 2006, the separation of Experian and Home Retail Group was completed by way of demerger. As part of the

demerger, the Company became the ultimate holding company of GUS plc (now Experian Finance plc) and related subsidiaries

and shares in GUS plc ceased to be listed on the London Stock Exchange on 6 October 2006. Trading of shares in the Company on

the London Stock Exchange commenced on 11 October 2006. As reported last year, the demerger transaction was accounted for

using the principles of merger accounting set out in FRS 6 ‘Acquisitions and Mergers’ and UK Generally Accepted Accounting

Principles (‘UK GAAP’). This policy, which does not conflict with IFRS, reflected the economic substance of the transaction.

The distribution to GUS plc shareholders of shares in Home Retail Group plc was accounted for as a dividend in specie.

Recent accounting developments

IFRS 7 ‘Financial Instruments: Disclosures’ and the complementary amendment to IAS 1 ‘Presentation of Financial

Statements – Capital Disclosures’ are effective for accounting periods beginning on or after 1 January 2007 and accordingly

have been adopted by the Group during the year. Their effect is to revise and enhance previous disclosures required by IAS

32 and IAS 30 ‘Disclosures in the Financial Statements of Banks and Similar Financial Institutions’ but they have no material

effect on the results and net assets of the Group. As indicated above, in accordance with the requirements of IFRS 7, gains

and losses on fair value hedges are now reported on a gross basis in the Group income statement and comparative figures

have been restated. Revised and enhanced disclosures have been given in these financial statements in respect of the year

ended 31 March 2008 and comparative information has been restated as appropriate. The qualitative analysis required to be

given in connection with IFRS 7 is set out in note 3 to the financial statements.

Notes to the Group financial statements

for the year ended 31 March 2008