Experian 2008 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116 Experian Annual Report 2008

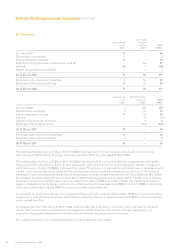

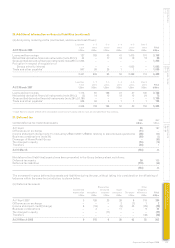

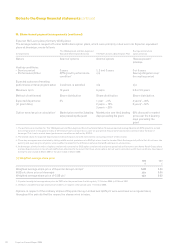

31. Deferred tax (continued)

(c) Deferred tax liabilities

Share option Other

Property Accelerated and award temporary

valuations depreciation Intangibles schemes Tax losses differences To t a l

US$m US$m US$m US$m US$m US$m US$m

At 1 April 2007 5 34 70 1 5 154 269

Differences on exchange – – 12 – – 1 13

Income statement charge/(credit) – 1 (18) – (1) 43 25

Business combinations – – 120 – – (1) 119

Tax charged to equity – – – – – 5 5

Transfers – 2 – – – (26) (24)

At 31 March 2008 5 37 184 1 4 176 407

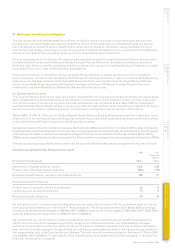

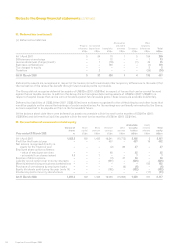

Deferred tax assets are recognised in respect of tax losses carried forward and other temporary differences to the extent that

the realisation of the related tax benefit through future taxable profits is probable.

The Group did not recognise deferred tax assets of US$32m (2007: US$19m) in respect of losses that can be carried forward

against future taxable income. In addition the Group did not recognise deferred tax assets of US$25m (2007: US$22m) in

respect of capital losses that can be carried forward against future taxable gains. These losses are available indefinitely.

Deferred tax liabilities of US$2,004m (2007: US$2,187m) have not been recognised for the withholding tax and other taxes that

would be payable on the unremitted earnings of certain subsidiaries. As the earnings are continually reinvested by the Group,

no tax is expected to be payable on them in the foreseeable future.

At the balance sheet date there were deferred tax assets recoverable within the next twelve months of US$47m (2007:

US$120m) and deferred tax liabilities payable within the next twelve months of US$1m (2007: US$10m).

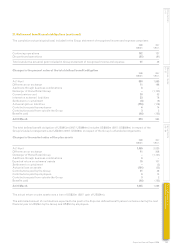

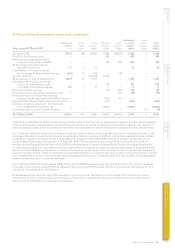

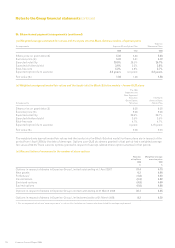

32. Reconciliation of movements in total equity

Attributable Equity

Number of Share Share Retained Other to equity minority To t a l

shares capital premium earnings reserves holders interests equity

Year ended 31 March 2008 m US$m US$m US$m US$m US$m US$m US$m

At 1 April 2007 1,022.3 102 1,435 16,341 (15,773) 2,105 2 2,107

Profit for the financial year – – – 437 – 437 15 452

Net income recognised directly in

equity for the financial year – – – (2) 89 87 – 87

Employee share option schemes:

– value of employee services – – – 65 – 65 – 65

– proceeds from shares issued 1.1 – 7 – – 7 – 7

Exercise of share options – – – (3) 37 34 – 34

Liability on put option over minority interests – – – (591) – (591) – (591)

Minority interest arising on business combinations – – – – – – 155 155

Purchase of own shares by employee trusts – – – – (6) (6) – (6)

Equity dividends paid during the year (note 14) – – – (182) – (182) – (182)

Dividends paid to minority shareholders – – – – – – (11) (11)

At 31 March 2008 1,023.4 102 1,442 16,065 (15,653) 1,956 161 2,117

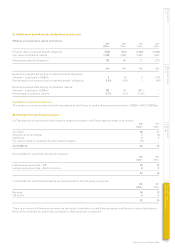

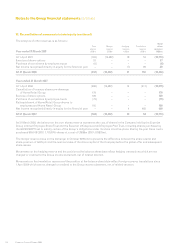

Notes to the Group financial statements continued