Experian 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111Experian Annual Report 2008

Introduction

2 – 5

Business review

6 – 37

Governance

38 – 64

Financial statements

Group financial statements

Financial statements

Group financial statements

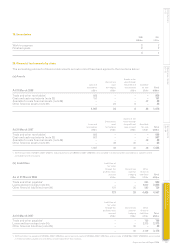

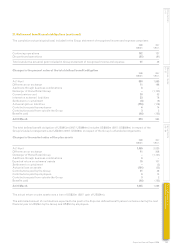

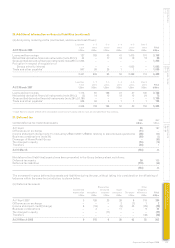

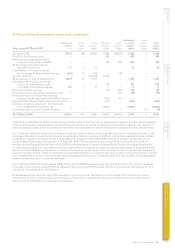

27. Retirement benefit assets/obligations (continued)

History of experience gains and losses

2008 2007 2006 2005

US$m US$m US$m US$m

Present value of defined benefit obligation (913) (984) (1,989) (2,025)

Fair value of schemes’ assets 1,045 1,069 2,020 1,814

Net pension asset/(obligation) 132 85 31 (211)

2008 2007 2006 2005

Experience adjustment arising on defined benefit obligation:

Amount – Loss/(gain) (US$m) 8 (5) 2 (110)

Percentage of the present value of defined benefit obligation 0.9% 0.5% – 5.4%

Experience adjustment arising on schemes’ assets:

Amount – Loss/(gain) (US$m) 101 53 (241) –

Percentage of schemes’ assets 9.7% 5.1% 11.6% –

(b) Defined contribution schemes

The pension cost represents contributions payable by the Group to such schemes and amounted to US$37m (2007: US$33m).

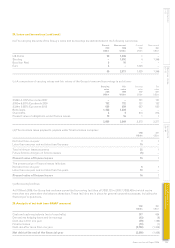

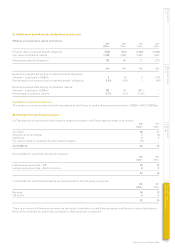

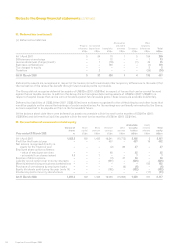

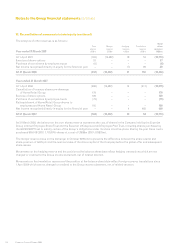

28. Available for sale financial assets

(a) The analysis of available for sale financial assets disclosed in the Group balance sheet is as follows:

2008 2007

US$m US$m

At 1 April 38 37

Differences on exchange 1 (2)

Additions 4 3

Fair value losses on available for sale financial assets (1) –

At 31 March 42 38

(b) Available for sale financial assets comprise:

2008 2007

US$m US$m

Listed equity securities – UK 34 29

Listed equity securities – North America 8 9

42 38

(c) Available for sale financial assets are denominated in the following currencies:

2008 2007

US$m US$m

Sterling 34 29

US Dollar 8 9

42 38

There is no material difference between the fair value of available for sale financial assets and the book value stated above.

None of the available for sale financial assets is either past due or impaired.