Experian 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54 Experian Annual Report 2008

Fixed remuneration

Base salary and benefits

To ascertain a job’s market value, external remuneration consultants annually review and provide data on market salary

levels and advise the remuneration committee. Executive directors’ salaries are benchmarked against a mid-market level

of main board executive directors from the comparator companies in the FTSE 100 Index and other global comparators

which reflects the market in which Experian recruits talent. Before making a final decision on individual salary awards,

the committee assesses each director’s contribution to the business, to reflect individual performance and experience.

When setting base salary levels for executive directors, the committee considers pay levels and increases throughout the

organisation.

In addition to base salary, executive directors receive certain benefits in kind including a car or car allowance, private

health cover and life assurance.

Pensions

The retirement age for directors is 60 under arrangements which broadly provide a pension of two thirds of final

salary, life assurance and ill health and dependants’ pensions. Incentive payments (such as annual bonuses) are not

pensionable.

The Company has had arrangements in place for a number of years which were designed to ensure that UK directors

who were affected by the 1989 HM Revenue and Customs earnings cap were placed in broadly the same position as those

who were not. With the agreement of the trustees of the scheme, the Company decided to retain a notional earnings cap

for its existing and future employees, with the exception of new senior executives who are pensioned on full base salary

up to the Lifetime Allowance.

The Company has put security in place for the unfunded pension entitlements of UK executives affected by the earnings

cap, by establishing Secured Unfunded Retirement Benefits Schemes (‘SURBS’). Further details are provided under

the disclosure of the arrangements for each director.

Variable remuneration

Annual Bonus Plan and Co-investment Plan

Annual bonuses are awarded for achieving profit growth targets. The committee believes that linking incentives to profit

growth helps to reinforce Experian’s growth objectives. Targets are calibrated by Kepler using benchmarks that reflect

stretching internal and external expectations. Benchmarks include: broker earnings estimates; earnings estimates for

competitors; straight-line profit growth consistent with median/upper quartile shareholder returns over the next three to

five years; latest projections for the current year; budget; strategic plan; and long-term financial goals

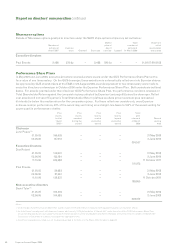

2007/08 bonus

As disclosed at the time of the GUS demerger, it was agreed that for annual bonuses paid in respect of the year

ending 31 March 2008 and subsequently, the maximum bonus opportunity for executive directors would be 200% of

base salary. This level of annual bonus would only be paid if Experian’s financial performance surpassed stretching

financial targets and hence would only be payable if exceptional results were delivered to shareholders. The

enhancement to the bonus opportunity for the executive directors was intended to recognise the global market

in which Experian operates and accompanied the reduction of the matching opportunity under the Experian Co-

investment Plan to 1:1 (previously 2:1 under the GUS Co-investment Plan). Executive directors will not participate

in the Experian Co-investment Plan in respect of the 2007/08 fiscal year and bonus payments will be made in cash.

Experian performed strongly in 2007/08 in a particularly difficult trading environment and the bonuses payable to

executive directors in respect of this financial year disclosed on page 58 are representative of this strong performance

in uncertain market conditions in which global targets were met and annual bonuses were paid at target levels.

Report on directors’ remuneration continued