Experian 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57Experian Annual Report 2008

Introduction

2 – 5

Business review

6 – 37

Financial statements

65 – 144

Governance

Report on directors’ remuneration

Governance

Report on directors’ remuneration

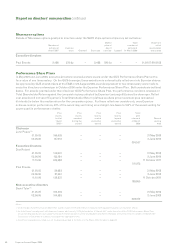

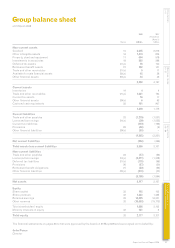

Performance graph

The committee has chosen to illustrate TSR for GUS plc until demerger and Experian Group Limited against the

FTSE 100 Index for the period since listing on 11 October 2006 to 31 March 2008. The FTSE 100 Index is the most

appropriate index against which TSR should be measured, as it is a widely used and understood index of leading UK

companies.

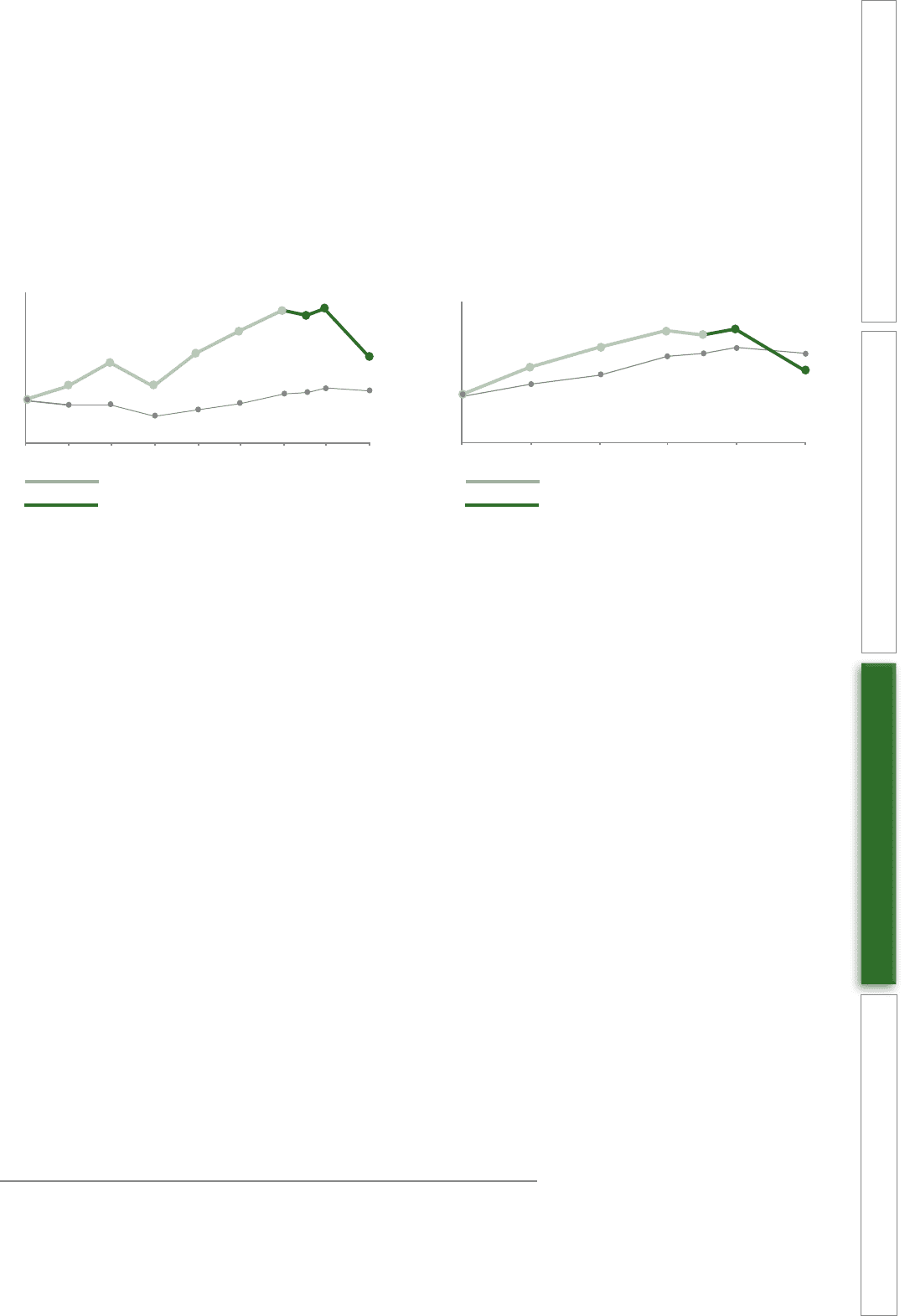

The above graphs show that, at 31 March 2008, a hypothetical £100 invested in GUS and subsequently, Experian would

have generated a total return of £198 compared with a return of £120 if invested in the FTSE 100 Index on 31 March

2000 and a total return of £153 compared with a return of £192 if invested in the FTSE 100 Index on 31 March 2003.

Shareholding guideline

The committee believes that it is important that executives build a significant shareholding to align their interests

with those of shareholders. Therefore the committee has established guidelines under which the Chief Executive

Officer should hold the equivalent of two times his base salary in Experian Group Limited shares and other executive

directors, one times their base salary, including shares held under the Co-investment and Reinvestment plans. Each

of the executive directors meets these guidelines.

Non-executive directors’ remuneration policy

The board’s policy on non-executive directors’ remuneration is that:

Fees should reflect individual responsibilities and membership of board committees.

l

Remuneration should be in line with recognised best practice and sufficient to attract, motivate and retain high calibre non- l

executives.

Remuneration should be a combination of cash fees (paid quarterly) and Experian Group Limited shares (bought annually in

l

the first quarter of the financial year).

Non-executive directors are obliged to comply with a shareholding requirement explained below. Any tax liability connected

l

to these arrangements is the responsibility of the individual director.

The use of Experian Group Limited shares in the package helps align the interests of non-executive directors with those of shareholders.

l

Non-executive directors do not receive any benefits in kind. The Chairman has the use of a company car and private l

healthcare.

The fees of non-executive directors were reviewed in 2008 and will next be reviewed in 2009. Fees are reviewed in the light

of market practice in FTSE 100 companies and anticipated number of days worked, tasks and responsibilities.

Base fee €106,154

Senior independent director €19,437

Chair of audit committee €31,398

Chair of remuneration committee €23,922

Experian requires its non-executive directors to build up a holding in the Company’s shares equal to one times their annual

fee. One quarter of their annual fee is used to purchase shares in the Company each year until they reach this holding.

Such shares are included in the table of directors’ interests on page 63. Non-executive directors do not participate in

executive share schemes or other employee share scheme arrangements. Non-executives do not have service contracts

but each has a letter of appointment. No non-executive director’s letter of appointment provides for any termination

payment. Each appointment is for a renewable three-year term but may be terminated by either party on one month’s

written notice.

Performance as GUS (to 6 October 2006)

Performance as Experian (from 6 October 2006)

March

00

March

01

March

02

March

03

March

04

March

05

March

06

March

07

March

08

£350

£300

£250

£200

£150

£100

£50

£0

Value of £100 invested in GUS/Experian and the FTSE 100

on 31 March 2000

FTSE 100 Index

March

03

March

04

March

05

March

06

March

07

March

08

£300

£250

£200

£150

£100

£50

£0

Value of £100 invested in GUS/Experian and the FTSE 100

on 31 March 2003

FTSE 100 Index

Performance as GUS (to 6 October 2006)

Performance as Experian (from 6 October 2006)