Experian 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83Experian Annual Report 2008

Introduction

2 – 5

Business review

6 – 37

Governance

38 – 64

Financial statements

Group financial statements

Financial statements

Group financial statements

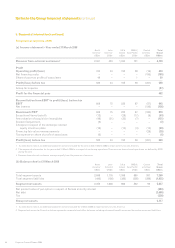

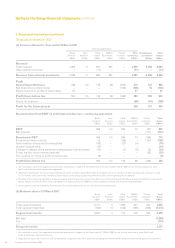

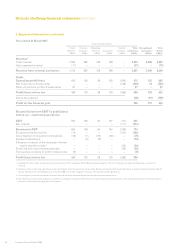

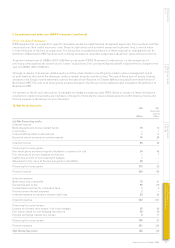

5. Segmental information (continued)

Total segment assets consist primarily of property, plant and equipment, intangible assets including goodwill, inventories,

derivatives designated as hedges of future commercial transactions, and receivables. They exclude tax assets, cash,

investments and derivatives designated as hedges of borrowings which are reported at a Group level only.

Total segment liabilities comprise operating liabilities, including derivatives designated as hedges of future commercial

transactions. They exclude tax liabilities, borrowings and related hedging derivatives and the net present value of the put option in

respect of the Serasa minority which are reported at a Group level only.

Capital expenditure comprises additions to property, plant and equipment and intangible assets, excluding additions

resulting from acquisitions through business combinations.

The primary and secondary segmental reporting formats for Experian are outlined below. In addition the segmental

information in respect of the year ended 31 March 2007 included Home Retail Group as a discontinued operation.

Additional information in respect of discontinued operations is shown in note 12.

Primary reporting format for Experian – geographical segments

At 31 March 2008, Experian is organised on a worldwide basis into four core geographies:

North America;

l

Latin America; l

UK & Ireland; and l

Europe, Middle East and Africa (‘EMEA’)/Asia Pacific. l

In addition unallocated corporate head office costs, which include costs arising from finance, treasury and other global

functions, are reported as Central activities.

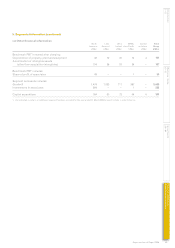

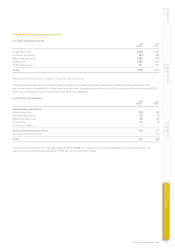

Secondary reporting format for Experian – business segments

Experian operates across four key business segments:

Credit Services;

l

Decision Analytics; l

Marketing Services; and l

Interactive. l

Credit Services acquires, processes and manages large and complex databases containing the credit histories of consumers

and businesses and also operates business processing outsourcing services, mainly in France, helping banks and other

clients with back office functions.

Decision Analytics builds on the Credit Services database information and helps clients by applying analytical tools and

software to convert data held internally and other data into usable business information.

Marketing Services helps clients to acquire new customers and to manage their relationships with existing customers. By

appending hundreds of characteristics to the credit and marketing data held in databases, Marketing Services provides clients

with information designed to assist them in matching the right offer or product to the relevant customer using the most appropriate

communication channels.

Interactive helps customers to understand and manage their own financial information and assets as well as to make

more informed purchasing decisions in areas such as financial services, shopping and education and to connect them with

companies over the Internet.