Experian 2008 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120 Experian Annual Report 2008

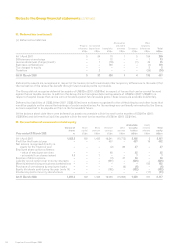

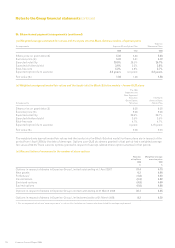

34. Acquisitions

On 28 June 2007, the Group acquired an initial 65% stake in Serasa, the market-leading credit bureau in Brazil, from a consortium of

Brazilian banks for US$1.2bn inclusive of transaction costs and net of cash and cash equivalents held by that business. Under the

terms of the purchase agreement a further 5% of Serasa has been acquired since the date of the acquisition and, at 31 March 2008,

the Group’s interest in Serasa was 70%. There are put and call options associated with the shares held by the remaining principal

shareholders of Serasa and these are exercisable for a period of five years from June 2012. As indicated in note 2, the net present

value of the put option has been recognised as a non-current financial liability. At 31 March 2008 this liability was US$583m.

In addition the Group acquired the whole of the issued share capital of Hitwise, a leading internet market intelligence company,

for US$260m on 8 June 2007 and made a number of other acquisitions, none of which is considered individually material. The

other acquisitions comprise the purchase of an additional interest in an entity previously classified as an associate together with

purchases of 100% interests in a number of other entities.

In aggregate, the acquired businesses contributed revenues of US$411m to the Group, consisting of revenues from Serasa

US$305m, Hitwise US$45m and other acquisitions US$61m, from the date of their acquisition to 31 March 2008. The acquisitions

contributed aggregate profit after tax of US$54m to the Group, consisting of the profit after tax of Serasa US$44m, Hitwise US$4m

and other acquisitions US$6m, for the periods from their respective acquisition dates to 31 March 2008. If these acquisitions had

been completed on 1 April 2007, further revenues of US$132m would have been reported. It has been impracticable to estimate

the impact on Group profit after tax had the acquired entities been owned from 1 April 2007, due to the acquired entities having

different accounting policies prior to acquisition, previously reporting to different period ends and, in the case of certain of the

individually immaterial acquisitions, preparing financial information on a cash basis prior to acquisition.

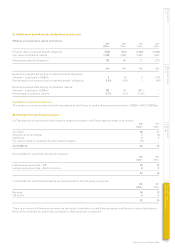

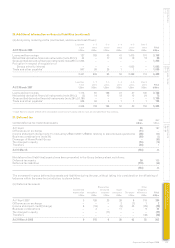

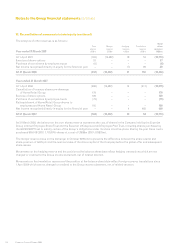

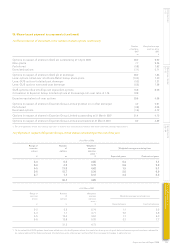

Details of the net assets acquired at provisional fair values are as follows:

Serasa Hitwise Other acquisitions To t a l

Book value Fair value Book value Fair value Book value Fair value Book value Fair value

US$m US$m US$m US$m US$m US$m US$m US$m

Intangible assets 96 531 4 76 - 79 100 686

Property, plant and equipment 61 64 2 2 3 3 66 69

Deferred tax assets 8 25 – 3 1 1 9 29

Trade and other receivables 57 53 12 9 38 38 107 100

Cash and cash equivalents 22 22 21 21 17 17 60 60

Trade and other payables (66) (65) (34) (34) (25) (26) (125) (125)

Provisions (5) (54) – – – – (5) (54)

Current tax liabilities (3) (3) – – – – (3) (3)

Deferred tax liabilities (32) (79) – (16) – (24) (32) (119)

138 494 5 61 34 88 177 643

Goodwill 911 201 169 1,281

1,405 262 257 1,924

Satisfied by:

Cash 1,231 260 181 1,672

Acquisition expenses 46 2 6 54

Deferred consideration (19) – 52 33

Acquisition of controlling stake in associate – – 10 10

Recognition of minority interest 147 – 8 155

1,405 262 257 1,924

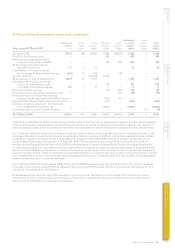

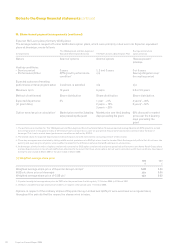

The book values above are the carrying amounts of each class of asset and liability, determined in accordance with IFRS,

immediately before the acquisition.

The fair values set out above contain certain provisional amounts which will be finalised no later than one year after the date

of acquisition. Provisional amounts have been included at 31 March 2008 as a consequence of the timing and complexity of the

acquisitions. Fair value adjustments in respect of acquisitions made during the year resulted in an increase in book value of

US$466m and arose principally in respect of acquisition intangibles. Goodwill represents the synergies, assembled workforce

and future growth potential of the businesses acquired.

Deferred consideration is primarily payable in cash up to three years after the date of acquisition and in some cases is

contingent on the businesses acquired achieving revenue and profit targets. The deferred consideration settled during the

year on acquisitions made in previous years was US$53m.

There have been no material gains, losses, error corrections or other adjustments recognised in the year ended 31 March

2008, that relate to acquisitions that were effected in the current or previous years.

Notes to the Group financial statements continued