Experian 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101Experian Annual Report 2008

Introduction

2 – 5

Business review

6 – 37

Governance

38 – 64

Financial statements

Group financial statements

Financial statements

Group financial statements

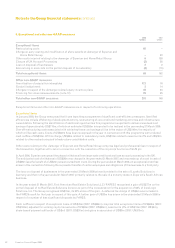

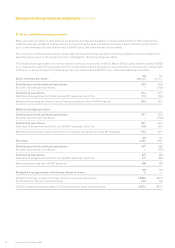

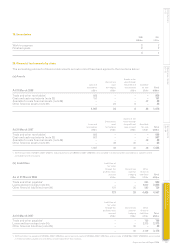

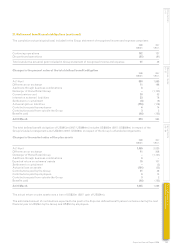

19. Inventories

2008 2007

US$m US$m

Work in progress 2 2

Finished goods 2 2

4 4

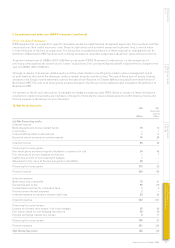

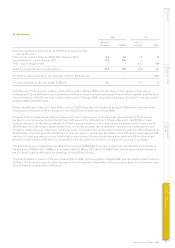

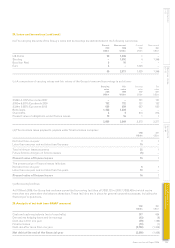

20. Financial instruments by class

The accounting policies for financial instruments set out in note 2 have been applied to the line items below:

(a) Assets

Assets at fair

Derivatives value through

Loan and used the profit and Available

receivables for hedging loss account for sale To t a l

At 31 March 2008 US$m US$m US$m US$m US$m

Trade and other receivables1 856 – – – 856

Cash and cash equivalents (note 22) 151 – – – 151

Available for sale financial assets (note 28) – – – 42 42

Other financial assets (note 29) – 24 6 – 30

1,007 24 6 42 1,079

Assets at fair

Derivatives value through

Loan and used the profit and Available

receivables for hedging loss account for sale To t a l

At 31 March 2007 US$m US$m US$m US$m US$m

Trade and other receivables1 660 – – – 660

Cash and cash equivalents (note 22) 907 – – – 907

Available for sale financial assets (note 28) – – – 38 38

Other financial assets (note 29) – 49 40 – 89

1,567 49 40 38 1,694

1. VAT recoverable of US$1m (2007: US$1m) and prepayments of US$183m (2007: US$144m) are included in trade and other receivables in note 21 but are

excluded from this analysis.

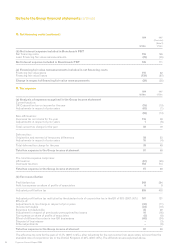

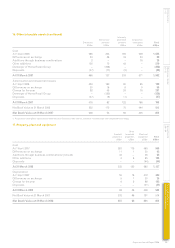

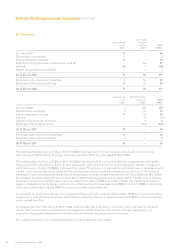

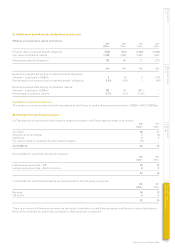

(b) Liabilities Liabilities at

fair value

through the Derivatives Other

profit and loss used for financial

account hedging liabilities To t a l

As at 31 March 2008 US$m US$m US$m US$m

Trade and other payables1 – – 993 993

Loans and borrowings (note 24) – – 2,850 2,850

Other financial liabilities (note 29) 121 20 583 724

121 20 4,426 4,567

Liabilities at

fair value

through the Derivatives Other

profit and loss used for financial

account hedging liabilities To t a l

At 31 March 2007 US$m US$m US$m US$m

Trade and other payables1 – – 766 766

Loans and borrowings (note 24) – – 2,373 2,373

Other financial liabilities (note 29) – 40 – 40

– 40 3,139 3,179

1. VAT and other tax payable of US$52m (2007: US$42m), social security costs of US$95m (2007: US$75m) and accruals of US$196m (2007: US$200m) are included

in trade and other payables in note 23 but are excluded from this analysis.