Experian 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 Experian Annual Report 2008

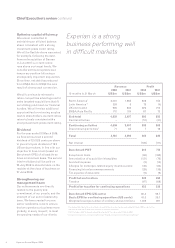

North America

North America performed well despite challenging

market conditions caused by the major disruption

of the US mortgage market and subsequent global

credit liquidity issues. While revenue growth slowed,

there was excellent margin performance as all

businesses benefited from proactive cost control

measures taken over the past 18 months.

Credit Services

Includes consumer credit, business

information and automotive services

Revenue in Credit Services was

flat year-on-year, reflecting an

exceptionally challenging market

for US financial services clients. In

consumer information, disruption

of the mortgage market reduced

demand for credit reports used in

loan origination. Credit liquidity and

capital constraints caused major card

issuers to reduce spend in areas like

credit marketing (pre-screen) as the

year progressed. These factors were

largely balanced by strong demand for

countercyclical products in portfolio

management and collections, which

saw increased volumes and new

business wins. Business information

showed good growth, benefiting from

investment in a new database platform,

and reflected in new contract wins for

business credit reports and portfolio

scoring services. There was also

continued strong growth in automotive

information, driven by market share gains

in the sale of vehicle history reports.

There was good strategic progress

during the year, with a focus on new

product development, enhanced data

quality and increased sales force

productivity. The previously announced

partnership with Visa to create more

predictive bankruptcy scores is in

testing and validation with key card

issuers, while VantageScore continues

to gain traction. Such activities enable

Experian to realise opportunities even

during times of uncertainty, as now,

as well as positioning the business for

eventual market recovery.

Decision Analytics

Includes credit analytics, decision

support software and fraud solutions

Decision Analytics delivered revenue

growth of 7%, which represented a

good performance against a strong

prior year comparable (2007: 29%).

There was good growth in software

products used to support account

management as institutions seek new

ways to improve risk assessment,

as well as good progress in vertical

markets outside financial services,

particularly in the telecommunications

and energy sectors. Fraud prevention

activities also performed well, due to

greater traction from new products

and penetration of new channels. This

offset softness in software products

used in origination of new credit, as

financial services institutions deferred

some spending decisions.

• Revenue from continuing

activities up 4% at

constant exchange rates;

3% organic

• EBIT from continuing

activities up 8% excluding

FARES; up 6% including

FARES

• Proactive cost control

measures resulted

in strong margin

performance - EBIT

margin excluding FARES

up 110 basis points

• Resilient performance

from Credit Services

and Decision Analytics

against unprecedented

market conditions

• New media approaches

50% of Marketing Services

revenue

• Strong performances

at Consumer Direct and

PriceGrabber

2008 Revenue by activity1

Decision Analytics

Credit Services

Marketing Services

Interactive

1 Excludes discontinuing activities