Experian 2008 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

129Experian Annual Report 2008

Introduction

2 – 5

Business review

6 – 37

Governance

38 – 64

Financial statements

Group financial statements

Financial statements

Group financial statements

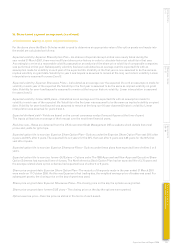

35. Share-based payment arrangements (continued)

(d) Other share awards

During the year ended 31 March 2007, Experian Group Limited issued put options to a small number of employees who

owned an equity interest in a subsidiary. Under the terms of the associated agreement, these options vested on 31 March

2008 assuming the employees remained with the Group and they are exercisable from that date onwards. These options are

accounted for under IFRS 2 as performance conditions are linked to employment with the subsidiary. The options will be

exercisable at a value based on 20% of the prevailing market value of the subsidiary for which these employees work and this

value is capped at US$50m. The options will be settled in Experian Group Limited shares and at the time of the agreement the

expected number of shares was 122,000. The options were purchased for US$0.7m by the employees at fair value as calculated

by third party valuation specialists based on the revenue forecast model of the subsidiary. No cost will arise over the vesting

period as the purchase price of the option was its market value.

During the year ended 31 March 2008 107,000 shares with a fair value of US$1m were released in connection with this

arrangement. At 31 March 2008 the expected number of shares still to be released was 98,000.

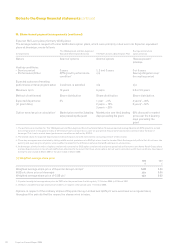

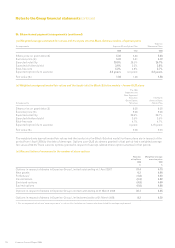

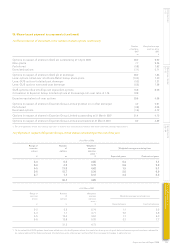

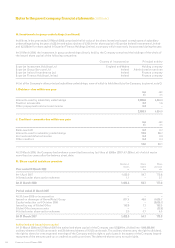

(e) Summary of the total cost of share-based compensation

2008 2007

US$m US$m

Share options 15 30

Share awards 51 72

Total expense recognised (all equity settled) 66 102

Cost of associated social security obligations1 10 4

Total expense recognised in Group income statement 76 106

The expense is reported as follows:

Employee cost included in Benchmark PBT 22 34

Charge in respect of demerger-related equity incentive plans (excluded from Benchmark PBT) 43 23

Exceptional item – charge on early vesting and modification of share awards at demerger of

Experian and Home Retail Group 2 – 23

Exceptional item – other costs incurred relating to the demerger of Experian and Home Retail Group 1 7

Discontinued operations – 15

Total expense recognised (all equity settled) 66 102

Costs of associated social security obligations:

Included in Benchmark PBT 4 3

Excluded from Benchmark PBT 6 1

Total expense recognised in Group income statement 3 76 106

1. The costs of associated social security obligations include the costs of derivatives entered into in connection with such obligations.

2. The charge for the year ended 31 March 2007 comprised US$15m on the early vesting of certain GUS awards at demerger and, as indicated in note (c) above, a

charge of US$8m for the incremental fair value of modifications.

3. The charge for the year ended 31 March 2008 is in respect of continuing operations. The charge for the year ended 31 March 2007 comprised US$91m in respect

of continuing operations and US$15m in respect of discontinued operations.