Experian 2008 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25Experian Annual Report 2008

Financial statements

65 – 144

Governance

38 – 64

Introduction

2 – 5

Business review

Financial review

Business review

Financial review

Net financing costs

At US$127m, net financing costs

excluding financing fair value

remeasurements were US$16m higher

than last year. The net interest expense

for the year ended 31 March 2008 reflects

the funding cost of the significant

acquisitions in the year.

That factor together with the changes

in capital structure resulting from the

settling of intra-group lending prior to

the demerger, the demerger itself and the

IPO mean that the prior year’s interest

expense is not directly comparable with

that for the current year. The reported net

interest expense benefits from a credit to

interest of US$23m relating to the excess

of the expected return on pension assets

over the interest on pension liabilities

(2007: US$16m).

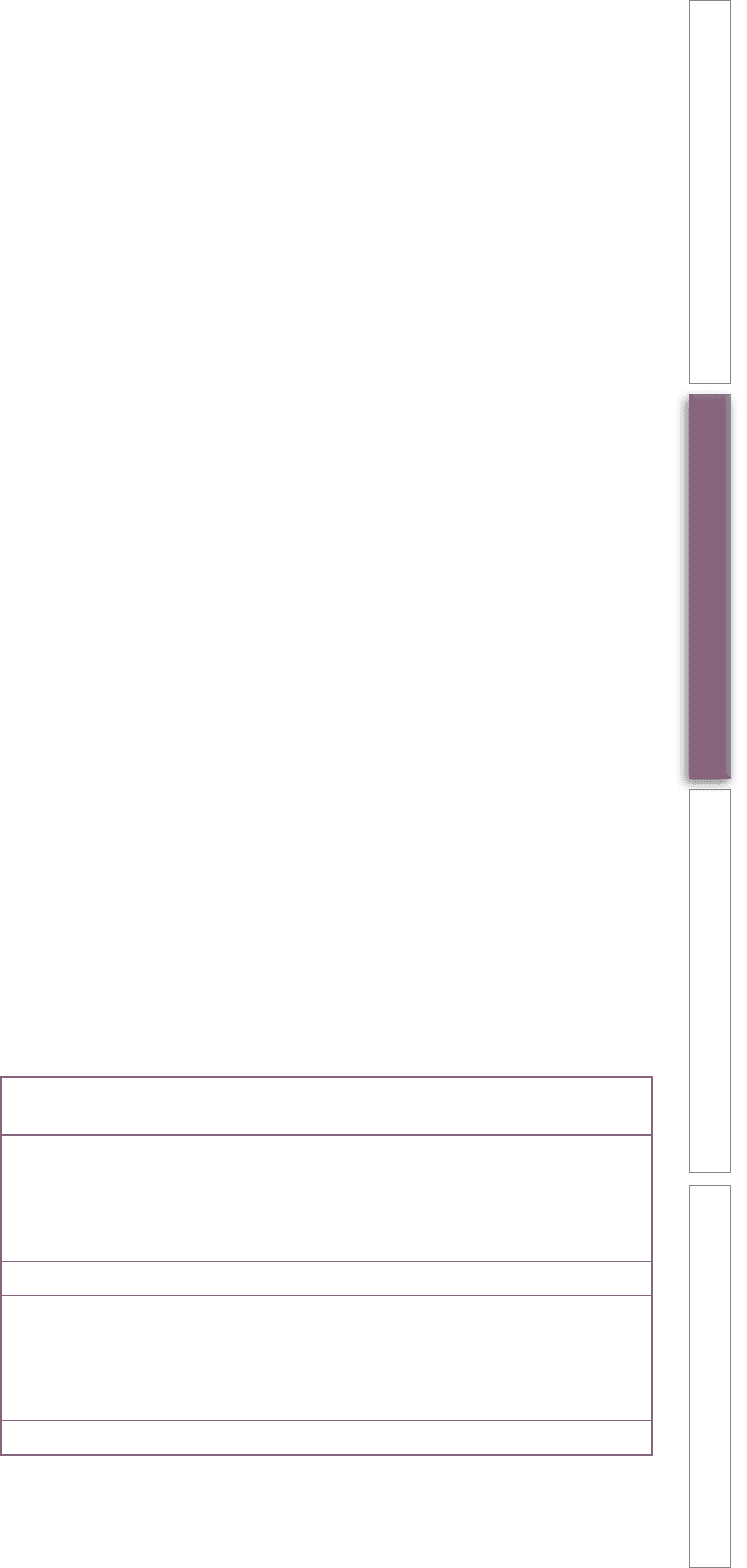

Exceptional items

In January 2008, the Group

announced that it was launching

a programme of significant cost-

efficiency measures. Identified

efficiencies include offshoring of

development activity, restructuring of

core credit and marketing activities

and infrastructure consolidation.

Following the identification of

additional opportunities this

programme is expected to deliver

annualised cost savings in the region

of US$110m, of which approximately

US$50m is expected to be realised in

the year ending 31 March 2009. One-off

restructuring costs associated with

achieving these cost savings will be in

the region of US$140m, the majority

of which will be cash costs. Costs

of US$60m have been recognised

in the year in connection with this

programme with a related cash

outflow of US$18m. Of this charge,

US$36m related to redundancy

costs, US$12m related to asset

write-offs, and US$12m related to

other restructuring and infrastructure

consolidation costs.

Costs relating to the demerger of

Experian and Home Retail Group

comprise legal and professional fees in

respect of the transaction, together with

costs in connection with the cessation

of the corporate functions of GUS plc

and, in the year ended 31 March 2007, a

charge of US$23m on the early vesting

and modification of share awards.

Other exceptional items are those

arising from the profit or loss on

disposal of businesses or closure of

material business units.

Other non-GAAP measures

IFRS requires that, on acquisition, specific

intangible assets are identified and

recognised separately from goodwill and

then amortised over their useful economic

lives. These include items such as brand

names and customer lists, to which value

is first attributed at the time of acquisition.

The Group has excluded amortisation

of these acquisition intangibles from its

definition of Benchmark PBT because

such a charge is based on uncertain

judgements about their value and

economic life.

A goodwill adjustment of US$2m

arose in accordance with IFRS 3

‘Business Combinations’ following

the recognition of a benefit in respect

of previously unrecognised tax losses

relating to prior year acquisitions. The

corresponding tax benefit reduced the

tax charge in the year by US$2m. The

equivalent adjustment in the prior year

was US$14m.

Charges in respect of demerger-

related equity incentive plans relate

to one-off grants made to senior

management and all other staff

levels at the time of demerger under

a number of equity incentive plans.

The cost of these one-off grants is

being charged to the Group income

statement over the five years following

the demerger, but excluded from the

definition of Benchmark PBT. The cost

of all other grants is being charged

to the Group income statement

and included in the definition of

Benchmark PBT.

Exceptional and other non-GAAP measures 2008 2007

US$m US$m

Exceptional items

Restructuring costs 60 –

Demerger related costs 6 149

Closure of UK account processing (2) 26

Net gain on disposal of businesses (1) (13)

Total exceptional items 63 162

Other non-GAAP measures

Amortisation of acquisition intangibles 121 76

Goodwill adjustment 2 14

Charges in respect of the demerger-related equity incentive plans 49 24

Financing fair value remeasurements 29 35

Total other non-GAAP measures 201 149