Experian 2008 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114 Experian Annual Report 2008

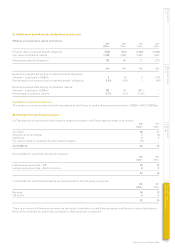

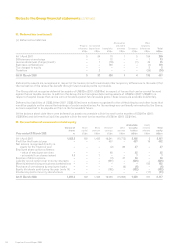

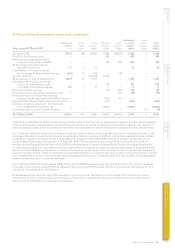

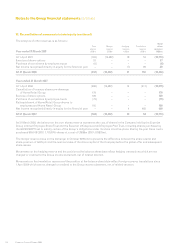

30. Additional information on financial liabilities (continued)

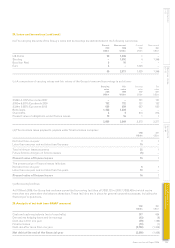

(b) Analysis of financial liabilities by currency:

Brazilian

Sterling US Dollar Real Euro Other To t a l

At 31 March 2008 US$m US$m US$m US$m US$m US$m

Loans and borrowings

£350m 6.375% Eurobonds 2009 732 – – – – 732

£334m 5.625% Euronotes 2013 660 – – – – 660

Bank loans – 1,438 – – – 1,438

Overdrafts – – – 4 – 4

Present value of obligations under finance leases – – 16 – – 16

Effect of forward foreign exchange contracts1 (900) 611 – 222 67 –

Other derivative financial liabilities 84 55 – 2 – 141

Put option in respect of acquisition of

Serasa minority interest – – 583 – – 583

Trade and other payables2 343 376 76 145 53 993

919 2,480 675 373 120 4,567

Sterling US Dollar Euro Other To t a l

At 31 March 2007 US$m US$m US$m US$m US$m

Loans and borrowings

€548m 4.125% Euronotes 2007 – – 751 – 751

£350m 6.375% Eurobonds 2009 721 – – – 721

£334m 5.625% Euronotes 2013 627 – – – 627

Overdrafts 4 – 269 – 273

Present value of obligations under finance leases 1 – – – 1

Effect of forward foreign exchange contracts

and cross currency swap1 (1,065) 1,513 (516) 68 –

Other derivative financial liabilities 40 – – – 40

Trade and other payables2 207 409 120 30 766

535 1,922 624 98 3,179

1. These represent the gross notional values of foreign exchange contracts and, at 31 March 2007, a cross currency swap.

2. VAT and other tax payable of US$52m (2007: US$42m), social security costs of US$95m (2007: US$75m) and accruals of US$196m (2007: US$200m) are included

in trade and other payables in note 23 but are excluded from this analysis.

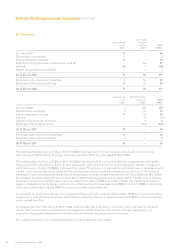

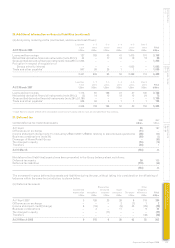

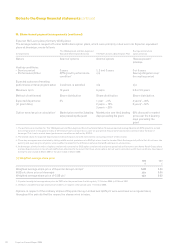

(c) Analysis of financial liabilities by interest rate profile:

Non-

interest

Floating Fixed bearing To t a l

At 31 March 2008 US$m US$m US$m US$m

Loans and borrowings 1,443 1,407 – 2,850

Effect of interest rate swaps1 (note 30(a)) (185) 185 – –

Other derivative financial liabilities 141 – – 141

Put option in respect of acquisition of

Serasa minority interest – – 583 583

Trade and other payables2 33 70 890 993

1,432 1,662 1,473 4,567

Non-

interest

Floating Fixed bearing To t a l

At 31 March 2007 US$m US$m US$m US$m

Loans and borrowings 1,024 1,349 – 2,373

Effect of interest rate swaps1 (note 30(a)) 130 (130) – –

Other derivative financial liabilities 40 – – 40

Trade and other payables2 – – 766 766

1,194 1,219 766 3,179

1. These represent the effect of interest rate swaps on the interest rate profile.

2. VAT and other tax payable of US$52m (2007: US$42m), social security costs of US$95m (2007: US$75m) and accruals of US$196m (2007: US$200m) are included

in trade and other payables in note 23 but are excluded from this analysis.

Notes to the Group financial statements continued