Experian 2008 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124 Experian Annual Report 2008

35. Share-based payment arrangements (continued)

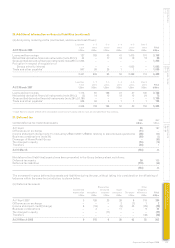

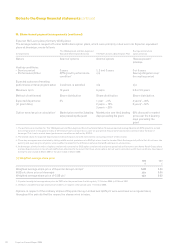

(iv) Weighted average estimated fair values and the inputs into the Black-Scholes models – Experian plans

Experian

Arrangements Experian Share Option Plan Sharesave Plans

2008 2007 2008

Share price on grant date (£) 5.30 5.63 5.83

Exercise price (£) 5.22 5.61 4.72

Expected volatility 29.5% 28.0% 26.7%

Expected dividend yield 3.6% 3.3% 3.8%

Risk-free rate 5.2% 4.9% 5.7%

Expected option life to exercise 3.6 years 4.4 years 3.3 years

Fair value (£) 1.08 1.26 1.58

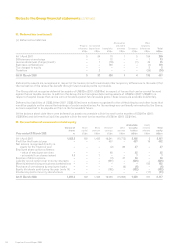

(v) Weighted average estimated fair values and the inputs into the Black-Scholes models – former GUS plans

The 1998

Approved and

Non-Approved

Executive The North

Share Option America Stock

Arrangements Schemes Option Plan

Share price on grant date (£) 9.35 9.35

Exercise price (£) 9.26 9.26

Expected volatility 29.4% 29.1%

Expected dividend yield 3.5% 3.5%

Risk-free rate 4.7% 4.7%

Expected option life to exercise 4 years 3.75 years

Fair value (£) 2.06 2.00

The weighted average estimated fair values and the inputs into the Black-Scholes model for these plans are in respect of the

period from 1 April 2006 to the date of demerger. Options over GUS plc shares granted in that period had a weighted average

fair value of £2.03. There were no options granted in respect of savings related share option schemes in that period.

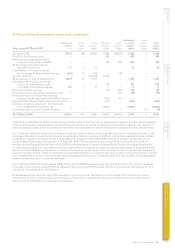

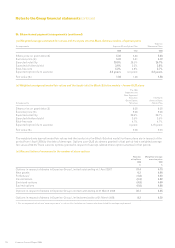

(vi) Reconciliation of movement in the number of share options

Number Weighted average

of options exercise price

2008 2008

m £

Options in respect of shares in Experian Group Limited outstanding at 1 April 2007 31.4 4.73

New grants 6.3 4.96

Forfeitures1 (1.8) 5.20

Cancellations (0.3) 4.52

Exercised options (4.9) 4.09

Expired options (0.6) 4.88

Options in respect of shares in Experian Group Limited outstanding at 31 March 2008 30.1 4.85

Options in respect of shares in Experian Group Limited exercisable at 31 March 2008 8.3 4.20

1. For arrangements which are ‘save as you earn’ in nature, this includes non-leavers who have failed the savings requirement.

Notes to the Group financial statements continued