Experian 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.80 Experian Annual Report 2008

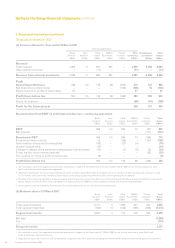

2. Basis of preparation and significant accounting policies (continued)

Recent accounting developments

The following accounting standards, amendments and interpretations issued by the International Accounting Standards Board

and the International Financial Reporting Interpretations Committee are effective for the Group’s accounting periods beginning

on or after 1 April 2008:

IFRS 3 (Revised) ‘Business Combinations’ (*);

l

IFRS 8 ‘Operating segments’; l

IAS 23 ‘Amendment to IAS 23 ‘Borrowing Costs’’ (*); l

IAS 27 (Revised) ‘Cost of an Investment in a Subsidiary, Jointly Controlled Entity or Associate’ (*); l

IFRIC 12 ‘Service Concession Arrangements’ (*); l

IFRIC 13 ‘Customer Loyalty Programmes’ (*); l

IFRIC 14 ‘IAS 19 – The Limit on a Defined Benefit Asset, Minimum Funding Requirements and their Interaction’ (*). l

(*) These standards are still subject to adoption by the EU.

IFRS 3 (Revised) ‘Business Combinations’ proposes amendments to accounting for business combinations and the

treatment of associated transaction costs and accordingly will impact on the treatment of future acquisitions in the financial

statements. With that exception, these accounting standards, amendments and interpretations are not expected to have a

material effect on the results and net assets of the Group. A number of the developments will lead to additional disclosures.

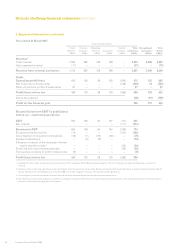

Use of non-GAAP measures

The Group has identified certain measures that it believes will assist understanding of the performance of the business. The

measures are not defined under IFRS and they may not be directly comparable with other companies’ adjusted measures.

The non-GAAP measures are not intended to be a substitute for, or superior to, any IFRS measures of performance but

management has included them as they consider them to be important comparables and key measures used within the

business for assessing performance.

The following are the key non-GAAP measures identified by the Group:

Benchmark profit before tax (‘Benchmark PBT’)

Benchmark PBT is defined as profit before amortisation of acquisition intangibles, goodwill impairments, charges in respect

of the demerger-related equity incentive plans, exceptional items, financing fair value remeasurements and taxation. It

includes the Group’s share of associates’ pre-tax profit.

Earnings before interest and tax (‘EBIT’)

EBIT is defined as profit before amortisation of acquisition intangibles, goodwill impairments, charges in respect of the

demerger-related equity incentive plans, exceptional items, net financing costs and taxation. It includes the Group’s share of

associates’ pre-tax profit.

Benchmark earnings per share (‘Benchmark EPS’)

Benchmark EPS represents Benchmark PBT less attributable taxation and minority interests divided by the weighted

average number of shares in issue, and is disclosed to indicate the underlying profitability of the Group.

Exceptional items

The separate reporting of non-recurring exceptional items gives an indication of the Group’s underlying performance.

Exceptional items are those arising from the profit or loss on disposal of businesses, closure costs of major business units

or costs of significant restructuring programmes. All other restructuring costs are charged against EBIT in the segments in

which they are incurred.

Net debt

Net debt is calculated as total debt less cash and cash equivalents. Total debt includes loans and borrowings (and the fair

value of derivatives hedging loans and borrowings), overdrafts and obligations under finance leases. Interest payable on

borrowings is excluded from net debt.

Notes to the Group financial statements continued