Experian 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 Experian Annual Report 2008

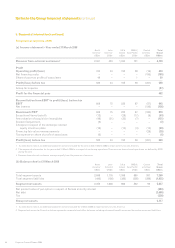

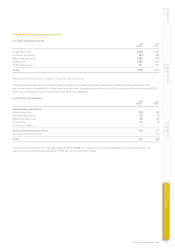

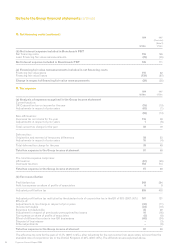

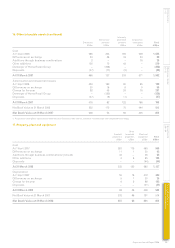

10. Net financing costs (continued)

2008 2007

(Restated)

(Note 2)

US$m US$m

(b) Net interest expense included in Benchmark PBT

Net financing costs 155 146

Less: Financing fair value remeasurements (29) (35)

Net interest expense included in Benchmark PBT 126 111

(c) Financing fair value remeasurements included in net financing costs

Financing fair value gains 110 62

Financing fair value losses (139) (97)

Charge in respect of financing fair value remeasurements (29) (35)

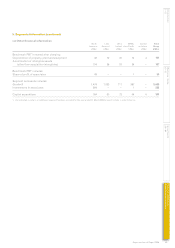

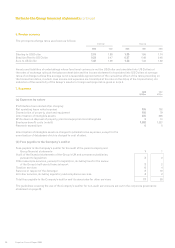

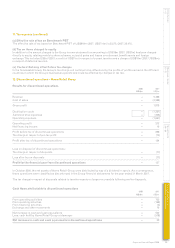

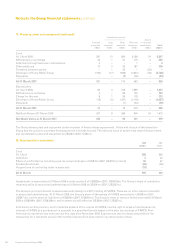

11. Tax expense

2008 2007

US$m US$m

(a) Analysis of expense recognised in the Group income statement

Current taxation:

UK Corporation tax on income for the year (15) (13)

Adjustments in respect of prior years (43) (1)

(58) (14)

Non-UK taxation:

Overseas tax on income for the year 116 39

Adjustments in respect of prior years 1 (6)

Total current tax charge for the year 59 19

Deferred tax:

Origination and reversal of temporary differences 28 53

Adjustments in respect of prior years 10 (4)

Total deferred tax charge for the year 38 49

Total tax expense in the Group income statement 97 68

The total tax expense comprises:

UK taxation (67) (45)

Overseas taxation 164 113

Total tax expense in the Group income statement 97 68

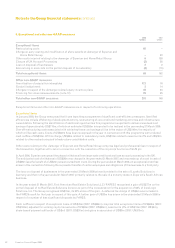

(b) Tax reconciliation

Profit before tax 549 394

Add: tax expense on share of profits of associates 6 9

Adjusted profit before tax 555 403

Adjusted profit before tax multiplied by the standard rate of corporation tax in the UK of 30% (2007: 30%) 167 121

Effects of:

Adjustments to tax charge in respect of prior years (32) (11)

Income not taxable (24) (10)

Expenses not deductible 45 39

Adjustment in respect of previously unrecognised tax losses 10 (16)

Tax expense on share of profits of associates (6) (9)

Effect of different tax rates in non-UK businesses (63) (34)

Disposal of businesses – (3)

Other adjustments – (9)

Total tax expense in the Group income statement 97 68

The effective tax rate for the year of 17.7% (2007: 17.3%), after adjusting for the net income from associates, is lower than the

standard rate of corporation tax in the United Kingdom of 30% (2007: 30%). The differences are explained above.

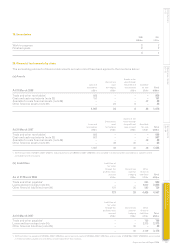

Notes to the Group financial statements continued